Increased crop yields result in lower hog production estimates

August 17, 2015

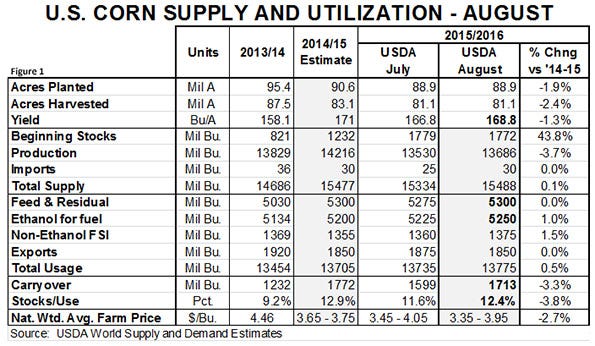

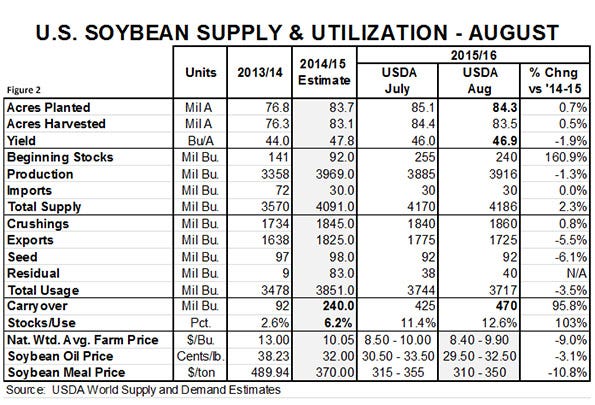

It appears that we have survived the first (and perhaps only) early killing of this year’s crop. That would be my main takeaway from last week’s Crop Production and World Agricultural Supply and Demand Estimates from the USDA. Updated balance sheets for corn and soybeans appear in Figures 1 and 2.

The biggest surprise in the report was the USDA’s raising its prediction for the national average corn yield to 168.8 bushels per acre. That is two bushels higher than the trend value that the USDA had used in the prior month and four bushels higher than the average of analysts’ pre-report estimates. The USDA has the same problem that everyone else does: Balancing the good conditions of the West with the bad conditions of the East.

Last week’s weekly Crop Progress report indicated that 83% of Iowa’s and 89% of Minnesota’s corn acres were in either good or excellent conditions, and that Wisconsin, Nebraska, North Dakota and South Dakota all had over 70% of their acres in those categories. That is a large, important portion of the corn production area with very, very good corn conditions.

On the other hand, the eastern Corn Belt is bad with less than 50% of acres rated as good or excellent in Indiana and Ohio, and less than 60% so rated in Illinois.

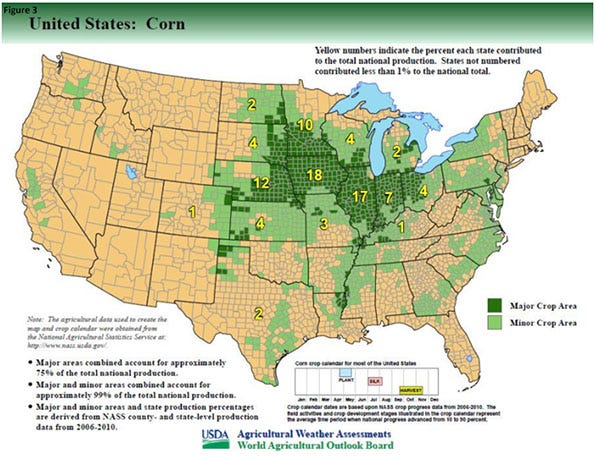

Remember where the corn is grown

We need to remember where the corn is grown. Figure 3 shows the major and minor production areas for corn and the shares of the national total that each state produced from 2006-10. Note that Indiana and Ohio only account for 11% and that Missouri, another state that has seen far too much rain this year, adds only another 3%. Throw in the eastern half of Illinois and one still has not more than 20-22% of the historical U.S. crop in the areas that are in greatest question.

I have fought my “locational bias” all year. Iowa and Minnesota could hardly look better and, based on last week’s report and several vegetative condition maps I’ve seen, both may be on their way to new record yields. But I knew that the East was another story. It appears that the USDA is comfortable with the West’s big lead at this point. Everyone could use another rain or two but it’s difficult to knock this crop much from where the USDA has it at present. I would not be surprised to see the yield get a bit larger before we are all said and done.

Look at the bottom line for the crop year in Figure 1: A carryout of 1.713 billion bushels, almost as much as this year. We hear of weakening basis levels in much of the western Corn Belt. New crop December futures have rallied a bit from the post-report selloff in which prices dipped below $3.60, but today’s $3.74 is still just over a dime higher than the contract-life low close of $3.63-1/2 back on June 15.

What about soybean meal?

As for bean meal, the USDA dropped both ends of its forecast price range in last week’s report based on a higher yield (46.9 versus a trend of 46 used in previous reports) and resulting higher output and year-end carryout (470 million bushels).

There are still three wild cards for soybeans and soybean meal. First, the soybean crop is never “made” in early August. A lot could still go wrong. But rain in the Midwest today and forecasts of rain for much of this week will put some pressure on prices as August rains are great for beans. Second, the USDA only shaved 900,000 acres off the harvested area for soybeans and we think that number will grow. Reports indicate that over a million acres of beans did not get planted in Missouri alone.

Finally, export demand for soybeans – read that as “China’s demand for soybeans” – is not rosy at all at the moment with orders trailing last year’s level by two-thirds at this point. Factors 1 and 3 appear bearish for beans/meal while factor 2 appears bullish. How will they balance out?

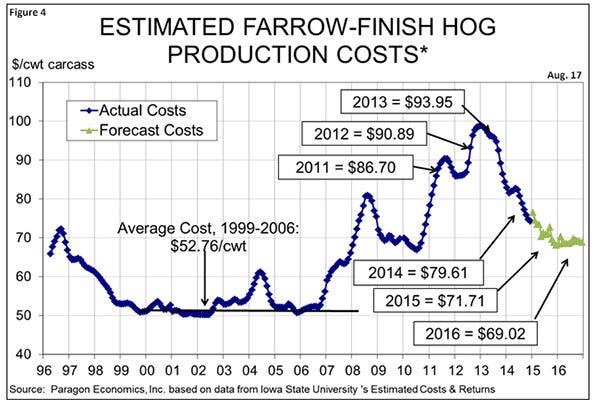

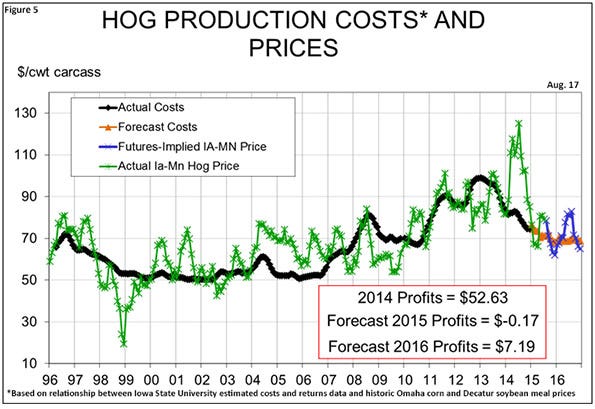

The impact of last week’s report was to drop our estimates of 2016 hog costs by over $4 per hundredweight carcass. They have been rising slightly since last Thursday, but remain well below $70 as of mid-day on Monday. That reduction and a continued rally in lean hog futures has now pushed 2015 farrow-to-finish profits back to nearly breakeven and pushed projected 2016 costs to $7.19 per head. Not great but not a loss – meaning that expansion will continue into 2016. And remember: The best producers out there are $10 per hundredweight better on the profit measure than indicated here.

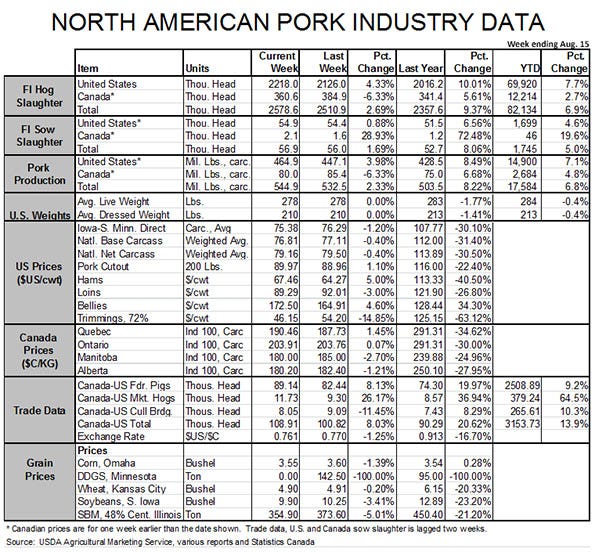

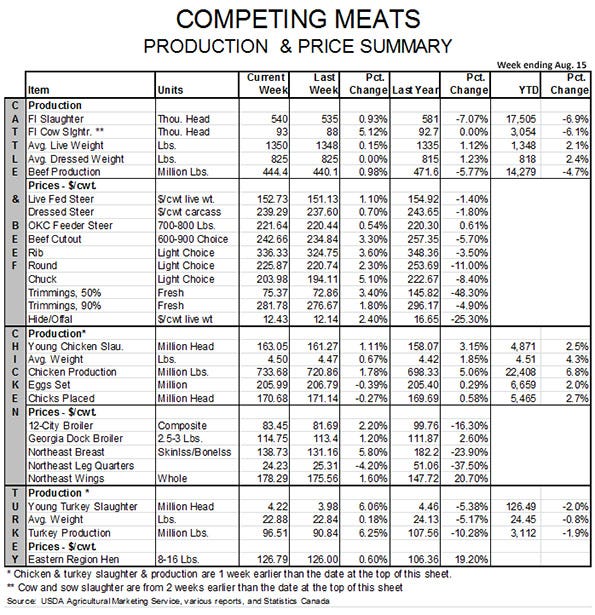

Author’s note: The Canadian price data in this week’s “North American Pork Industry Data” and “Competing Meats” tables is for the week ending July 25 as the websites from which we update our Canadian data were not operating properly today.

About the Author(s)

You May Also Like