Hurricane Matthew made a mess

It is far from clear that producers will be able to market their hogs on a schedule of their choosing this fall. If they can’t, then the low in hog prices could be both memorable and painful.

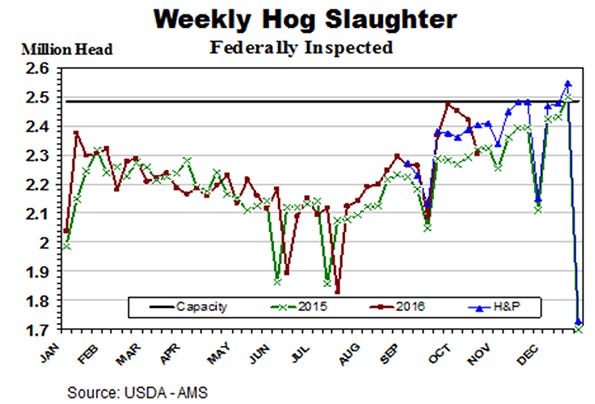

Hog slaughter plants have been running close to capacity in recent weeks. Earlier this year Steve Meyer calculated hog slaughter capacity at roughly 452,000 head per day. If you figure 5.5 slaughter days in a week, you get a weekly capacity of 2.486 million hogs.

The largest weekly slaughter ever was 2.499 million hogs during the week ending on Dec. 19, 2015. Three of the next seven largest slaughter weeks were in the past 30 days: 2.473 million head during the week ending Sept. 24; 2.453 million during the week ending Oct. 1; and 2.422 million during the week ending Oct. 8.

Modern hog production systems do not have a lot of flexibility on marketing date. Barns need to be emptied to make room for the next batch of hogs. Hog prices can approach zero if large numbers of hogs can’t be slaughtered on a timely basis. See price data for December 1998 as an example.

At a time like this, with marketings pushing up against slaughter capacity, what hog producers really don’t want is anything that disrupts packers’ ability to process hogs, such as a hurricane along the coast of North Carolina.

Hurricane Matthew dumped a foot of rain in North Carolina, flooding roads and disrupting the movement of people and hogs. Smithfield’s Tar Heel slaughter plant, the world’s largest, was idle for several days this past week. Last week’s hog slaughter was 2.304 million, down 118,000 from the week before and down 145,000 from the average of the prior three weeks.

USDA’s last Hogs and Pigs report indicated that there was a record number of market hogs on farms on Sept. 1. The survey indicated the number of market hogs weighing 180 pounds or more on Sept. 1 was 4.1% greater than a year ago; the number weighing 120 to 179 pounds was up 3.7%; the number weighing 50 to 119 pounds was up 1.9%; and the number weighing less than 50 pounds was up 1.7%.

The chart shows weekly federally inspected hog slaughter for 2015 (green line); slaughter thus far in 2016 (red line); the slaughter level implied by the September Hogs and Pigs survey (blue line); and the 2.486 million head estimated slaughter capacity for non-holiday weeks (black line).

During the first half of 2016, daily hog slaughter averaged less than 1% above the year-ago level. Third quarter slaughter was up nearly 3%. The Hogs and Pigs report implied fourth quarter daily hog slaughter will be 2.9% greater than last year.

Looking ahead, the important question is how long will packers need to work through this week’s apparent backlog of 100,000-plus hog caused by Hurricane Matthew.

Slaughter is low, of course, during weeks that include one of the six major holidays – New Years, Memorial Day, Independence Day, Labor Day, Thanksgiving and Christmas. Half of those six holidays will occur in the next 80 days. The September market hog inventory weight groups imply weekly hog slaughter will be close to the capacity limit for a five week period before and after Thanksgiving. If packers can’t eliminate any backlog by mid-November, things are likely to get really bad in December.

On the plus side, there is the possibility that there are not 100,000 hogs backed up on farms. A few hogs, less than 3,000 head, perished in the flooding. Producers may have been pulling ahead on sales. Certainly, hog slaughter in late-September and early October was well above the level implied by the September inventory report. In addition, the September hog survey may have overestimated the market hog inventory.

There are three weeks left until the blue line of predicted hog slaughter reaches the black line of slaughter capacity. If hog slaughter averages 2.432 million during the next three weeks, then it will be 100,000 head above the level implied by the Hogs and Pigs Report. That is a doable number as it is less than both weeks of Sept. 24 and Oct. 1.

It is far from clear that producers will be able to market their hogs on a schedule of their choosing this fall. If they can’t, then the low in hog prices could be both memorable and painful.

About the Author(s)

You May Also Like