How many hogs are backed up?

Two items of good news for the future: Sow slaughter has been above the year-ago level each week of 2020 and 2020 calf crop predicted to be down 0.7%.

Hog slaughter has been far below the level expected based on the latest quarterly hog inventory survey. Just how many hogs are backed up on farms because of coronavirus? A lot.

Weekly hog slaughter has not been above the level indicated by the USDA's June market hog survey since the week ending on March 28. During the last 17 weeks, federally inspected hog slaughter has totaled 38.7062 million head. That is 1.186 million (2.97%) fewer than the same period last year and 4.2448 million (9.88%) fewer than indicated by the last quarterly inventory survey.

The reason for the low slaughter was too many packing plant workers with COVID-19. Although the number of sick workers has dropped, several plants continue to operate below capacity.

The record for daily hog slaughter is 502,843 head processed on March 25, 2020. There have been two weeks with slaughter over 2.8 million head. Since the end of March, only one week has seen slaughter above 2.6 million head. Packers are trying to keep their workforce healthy.

There are several options for thinking about the missing hogs.

The survey numbers are right, and we've got 4.2 million hogs backed-up on farms awaiting slaughter.

The survey numbers are right, but a good share of those 4.2 million missing hogs have either died on the farm or have been euthanized.

The survey was wrong, and the hogs aren't there.

A combination of the above.

Option 4 is an obvious and unsatisfying choice. Option 3 would be an easy choice if USDA's track record with their market hog inventory estimates wasn't so outstanding. Option 2, there probably has been an increase in the number of hogs dying on farms. Some euthanasia has occurred, especially with young pigs.

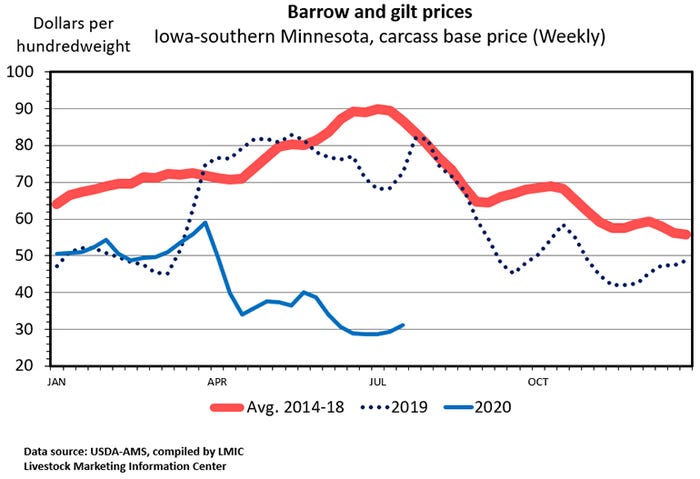

Given all the red ink in raising hogs this year, increased death loss is not the costly problem it normally would be. Losses were estimated by Lee Schulz at Iowa State University to be $23.30 per head marketed in June. June was the eighth loss in the last 10 months. Option 1 leaves us with a problem that can't be solved anytime soon — 4.2 million backed-up hogs are a huge challenge. If we are 4.2 million behind in hog slaughter, when will we be able to get back to even? Not this year.

Slaughter outlook for the next five weeks (i.e. now through August)? During this period last year, federally inspected hog slaughter averaged only 2.437 million per week. Packers should be able to easily beat that this year. But they will need to do so just to hold even. The June Hogs and Pigs Report implied that during this period slaughter of hogs will average 2.641 million per week. Hog slaughter hasn't reached 2.641 million any week since March 28. Thus, the number of backed-up hogs is more likely to increase during the next five weeks than decrease.

How about after August? During the last 17 weeks of 2019 hog slaughter averaged 2.62 million per week. Unless COVID worries are eliminated we aren't likely to average more this year. The good news is that the inventory of market hogs weighing under 50 pounds was down 0.23% on June 1 and the farrowing intentions for June-August was down 4.6%.

It looks like the best opportunity for working through the 4.2 million head backlog will be when hog production falls off.

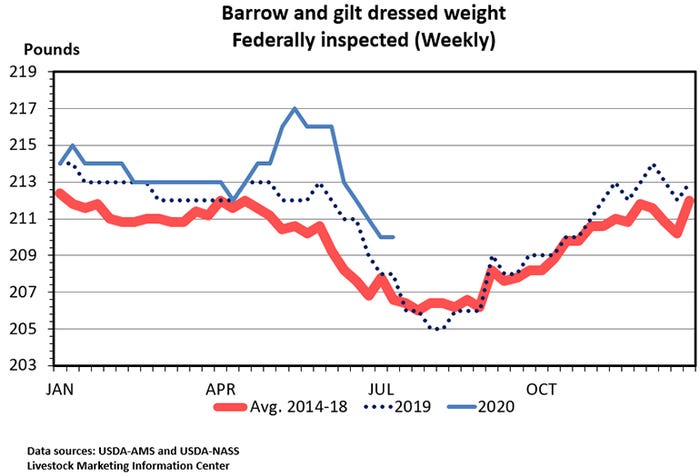

Typically, the best indicator that slaughter hogs are getting backed up is market weight. Normally, backed-up hogs are big hogs. Although slaughter weights have been above the year-ago level in recent months, the gap has been fairly small. Over the last 17 weeks while slaughter fell 4.2448 million short of expected, Iowa-Minnesota barrow and gilt slaughter weights averaged 287.3 pounds, up 3.1 pounds compared to the same weeks last year. That would imply some hogs were backed up, but fewer than 4.2 million head. Unless producers had intentionally slowed growth rates, which we know many have.

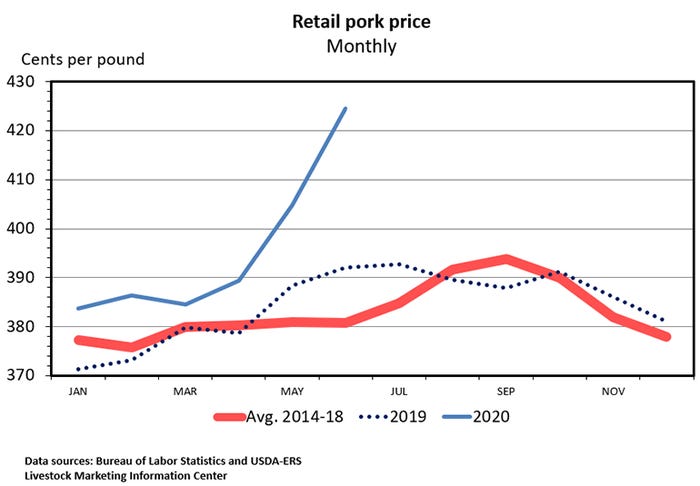

The COVID-depressed hog slaughter of April and May caused pork production during those two months to drop 12.9% below the same period last year. The average retail price of pork during June was $4.245 per pound, a new record. Fresh beef prices were also record high in June due to low cattle slaughter in April and May. Retail prices tend to lag behind events. Don't be surprised if retail pork prices decline each month in the second half of 2020.

The average live price for 51-52% lean market hogs was $34.25 per hundredweight in June. The lowest since December 2002. In early July, Iowa-Minnesota negotiated carcass prices dipped below $30 per hundredweight. In recent months the negotiated price has been far below formula prices that incorporate the cutout value.

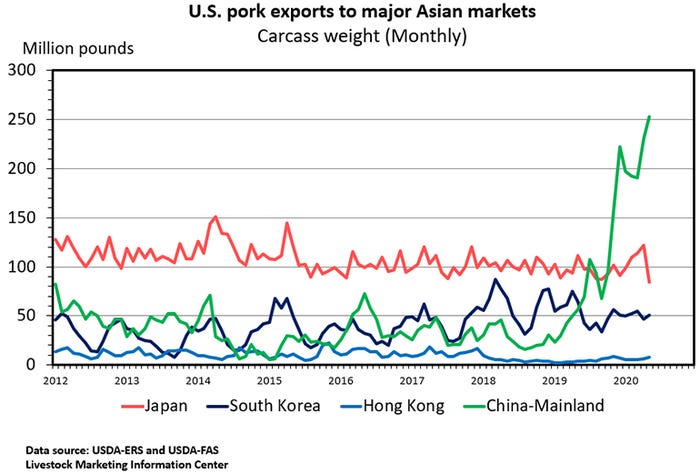

Through May, U.S. pork exports were up 32.3% (801 million pounds) compared to a year earlier. The growth was due to a 427% (862 million pounds) increase in shipments to China. U.S. pork imports were down 16.1%. During January-to-May 2020, imports equaled 3.1% of pork production and exports equaled 29.0% of production.

Two items of good news for the future. Sow slaughter has been above the year-ago level each week of 2020 and USDA's July cattle survey predicted the 2020 calf crop will be 0.7% smaller than last year.

Source: Ron Plain, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset. The opinions of this writer are not necessarily those of Farm Progress/Informa.

About the Author(s)

You May Also Like