Hog slaughter slowly recovering

Limited slaughter capacity is the bad-news pork industry story of 2020 and international trade is the good-news story.

Under ideal conditions, U.S. hog packers can slaughter roughly 500,000 hogs in a day or 2.8 million head in a week. Current conditions are far from ideal. Too many workers with COVID-19 have forced some plants to temporarily close and others to operate at a reduced pace.

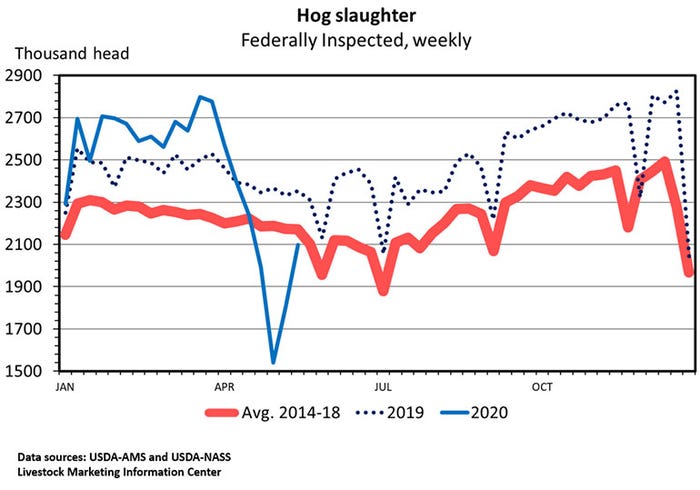

Daily hog slaughter hit bottom on April 29 when only 267,367 hogs were slaughtered. This was roughly 53% of slaughter capacity under ideal conditions. That week slaughter totaled 1.54 million head or 55% of capacity. Hog slaughter has increased each week since.

In order to handle this year's anticipated hog marketings, slaughter plants will need to operate at an average of 90% of capacity. That will be an average of 450,000 per day or 2.52 million hogs per week.

Hog slaughter is increasing, but is still too low. Thursday's hog slaughter was 398,000, the most since April 17. That was 80% of capacity and 52,000 head short of the needed average of 450,000 per day.

Things may appear to be getting better for hog producers, but they are just getting worse more slowly. Because daily slaughter is running below the market hog supply a serious backlog of hogs is piling up on farms.

On the first day of March, the market hog inventory was 4.3% larger than a year earlier. Since then hog slaughter has been 4.5% lower than last year. Spring slaughter has been 1.31 million head fewer than last year and 2.75 million head fewer than indicated by the March Hogs and Pigs Report. The industry will need to eliminate this backlog of hogs during the summer months when marketings are usually lower. After Labor Day, there will be little excess capacity to work with.

When hog marketings are delayed, hogs get bigger. Slaughter weights have skyrocketed in recent weeks. Last week's average live weight for Iowa-Minnesota-South Dakota slaughter was 294.1 pounds, down 1 pound from the week before, but up 9 pounds from a year ago.

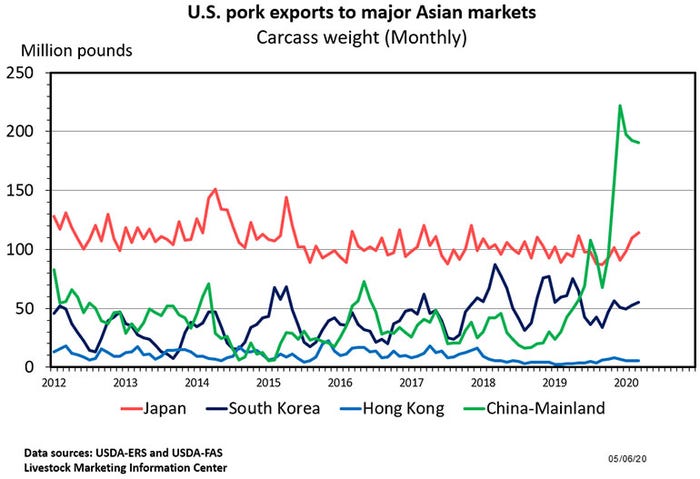

Limited slaughter capacity is the bad-news pork industry story of 2020 and international trade is the good-news story. In the first quarter of the year, pork imports were down 20.2% (52.4 million pounds) and pork exports were up 39.9% (577.4 million pounds). During January-March, exports equaled 27.2% of U.S. pork production up from 21.1% a year ago, with 7.8% of production going to China.

First quarter U.S. pork exports saw 28.7% go to China, 21.5% to Mexico and 15.9% to Japan.

The decline in pork imports was due to a sharp drop in imports from European Union countries, especially Poland. The increase in exports was due to China; 84% of the increase in exports was shipments to China.

First quarter pork production was up 8.6% year-over-year (587.8 million pounds). Adjusted for imports and exports, the domestic pork supply was down 0.6% (42.0 million pounds).

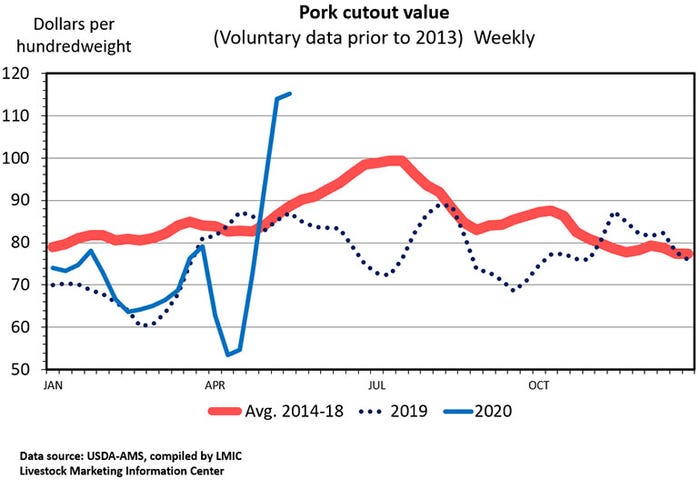

The average price of a pound of pork in grocery stores during April was $3.893 per pound. That was up 4.7 cents from March and up 10.6 cents from April 2019. It was the highest month since October.

Reduced hog slaughter means less pork on the market, which impacts the cutout value more than the hog price. In recent weeks pork cutout value has been both high and volatile.

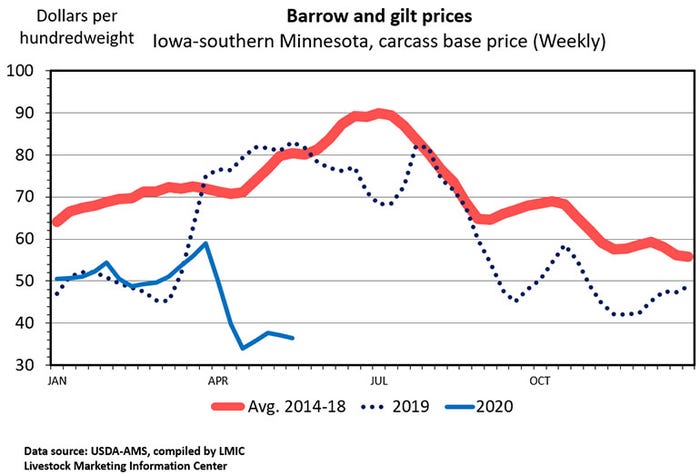

The average live price for 51-52% lean hogs was $36.09 in April, down $7.47 from March, down $21.59 from April 2019 and the lowest for any month since November 2016. Prices rebounded in May, but the futures market expects hog prices to trend lower until the fourth quarter. It is predicting higher prices in 2021.

Not only have pork plants struggled to keep operating in the face of the coronavirus pandemic, so have cattle and poultry processing facilities. Compared to the April forecast, USDA's May forecast for 2020 beef production is down 6.1%, 2020 pork production down 5.5%, 2020 broiler production down 3.1%, and 2020 turkey production down 1.3%. There are three primary causes for this sharp drop in 30 days. Low hog prices are removing the incentive for production; the expectation that many animals will be euthanized rather than marketed; and the slaughter of others will be pushed back into 2021. The amount of euthanizing which is occurring is difficult to quantify.

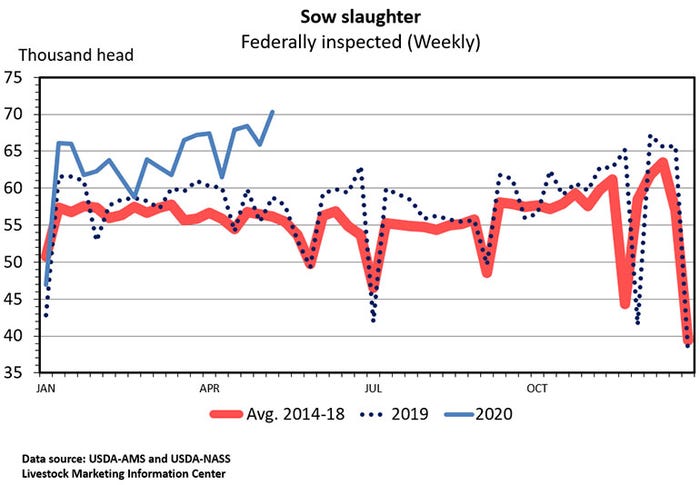

Hog production is extremely unprofitable and sow slaughter is rising. Sow slaughter has been consistently above last year's level thus far in 2020. Over the last eight, weeks sow slaughter has averaged up 14% year-over-year.

Last Monday's Crop Progress report put corn acres planted at 80% of the expected total, up from 44% a year ago. The five-year average is 71% planted by May 17. Crop Progress put soybean plantings at 53% completed, up from 16% last year. The five-year average is 38% planted by May 17.

The outlook for feed cost is encouraging. USDA's May corn forecast is for acres planted to be up, yield per acre up, and price per bushel to be 40 cents lower than for the 2019-20 marketing year. Soybeans have a similar forecast: acres up, yield up, and price per bushel 30 cents lower than for 2019-20.

USDA will start their June hogs and pigs survey next week. Results will be released on June 25.

Source: Ron Plain, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset. The opinions of this writer are not necessarily those of Farm Progress/Informa.

About the Author(s)

You May Also Like