Hog profits disappointing two months running

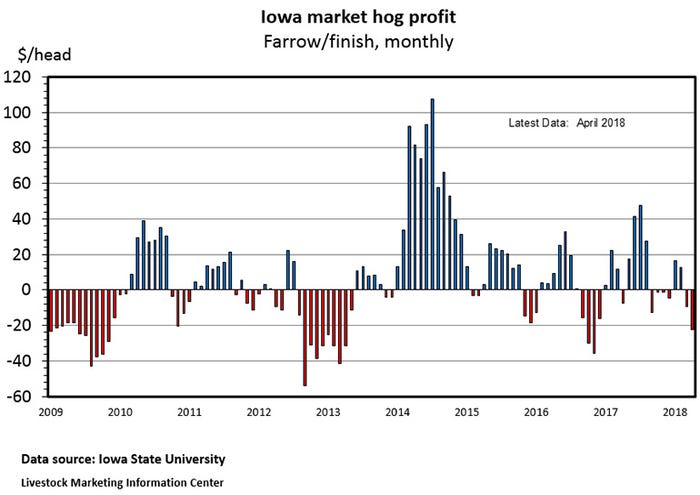

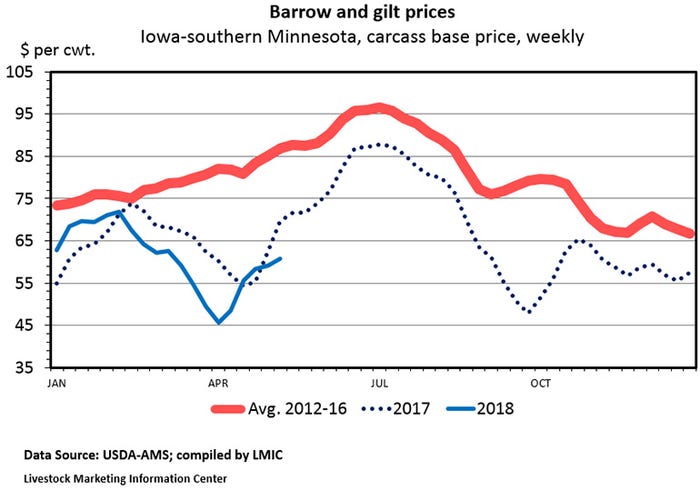

The typical Iowa farrow-to-finish operation lost $22.17 per head marketed during April by ISU calculations. April net returns were the worst since November 2016.

Profits for hogs marketed in April were negative for the second month in a row, according to calculations by Lee Schulz, economist at Iowa State University. The typical Iowa farrow-to-finish operation lost $22.17 per head marketed during April by Schulz’s calculations. April net returns were the worst since November 2016.

ISU estimates the cost of production for April marketings at $45.97 per hundredweight (live) or $62.35 per hundredweight (carcass), the highest monthly cost since August 2016.

Friday’s futures closes imply profits for all of 2018 will come in around $3.50 per hog with May close to breakeven, June-to-September net returns in the black and October-to-December in the red.

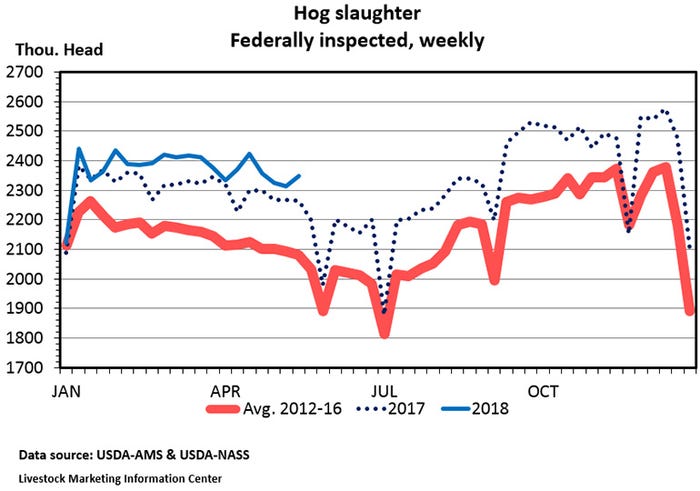

Hog slaughter has been up 3.3% during the 11 weeks since the start of March. That is only a small fraction below the 3.4% increase implied by the heavy weight market hog inventory in USDA’s March inventory survey. Market hog slaughter during June-to-August should be up 3.1%, if the March 1 light weight hog inventory was also correct.

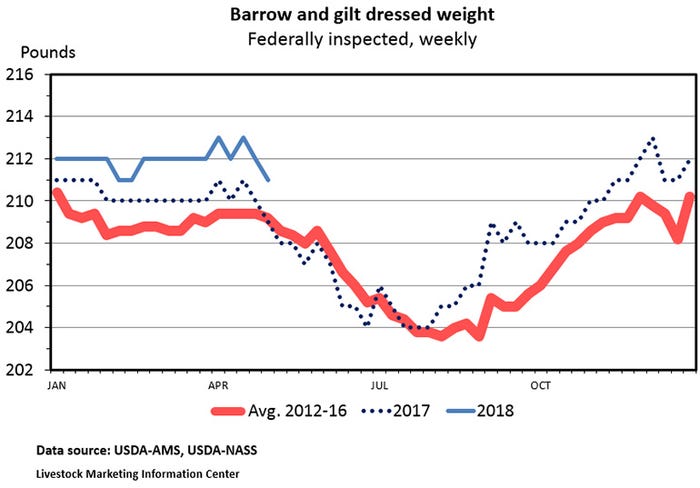

Year-to-date hog slaughter is up 2.8%, but pork production is up 3.6% due to heavier slaughter weights. Iowa-Minnesota market weights through early May averaged 285.6 pounds, up 3.2 pounds from same period last year.

If weights continue to run above the year-ago level, then summer pork production could be up in the range of 3.5% to 3.8%, year-over-year. Friday’s average closing price for the June, July and August 2018 lean hog futures contracts averaged 4.3% lower than the June, July and August 2017 contracts were a year ago. Only having a 4.3% decline in hog price for a 3.5% to 3.8% increase in pork production would imply very strong demand.

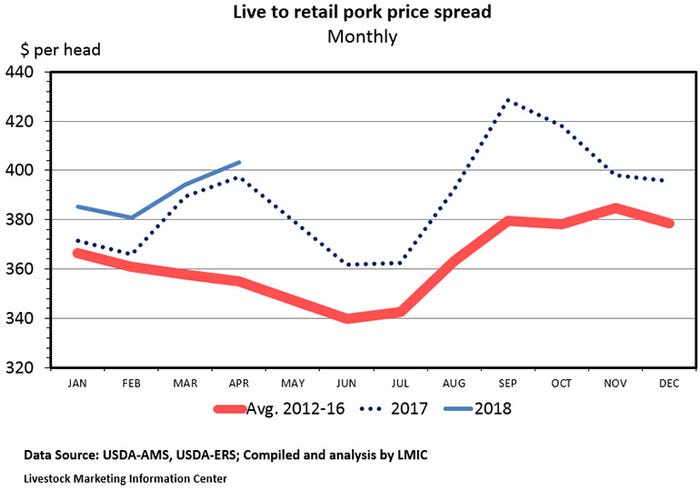

The average retail pork price in April was $3.752 per pound, down 0.1 cents from the month before, but up 0.5 cents from April 2017. Hog prices were sharply lower. The average price for 51-52% lean live hogs in April was down $4.16 per hundredweight from a year earlier and down 5.59 from the month before. Packer margins were down 27.0 cents per pound in April, but the wholesale-retail price spread was up 35.8 cents per pound compared to April 2017.

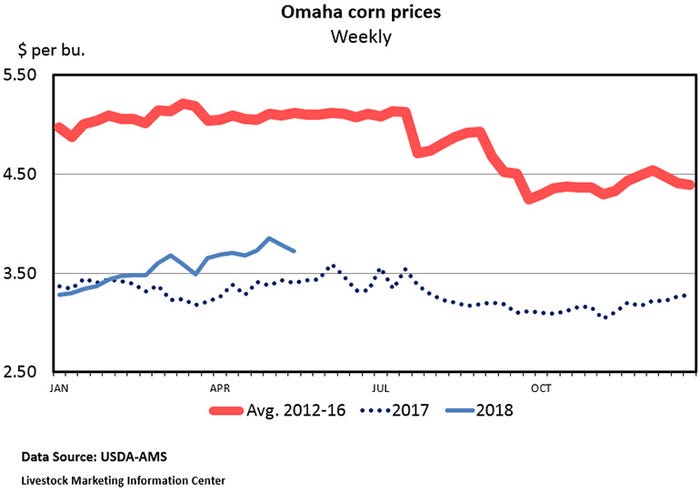

USDA’s May World Ag Supply and Demand Estimates included their first estimate for the 2018 fall harvest. They projected 2018 corn production at 14.04 billion bushels, down 3.9% from last year. The 2018 soybean harvest is forecast to be 4.28 billion bushels, down 2.6% from last year. Fewer acres and lower yield per acre combine to explain the expected decline in production. The smaller crop should mean higher prices. USDA expects corn to average 40 cents (give or take) per bushel higher during the upcoming marketing year. They are forecasting a 75-cent, more or less, per bushel hike in soybean prices.

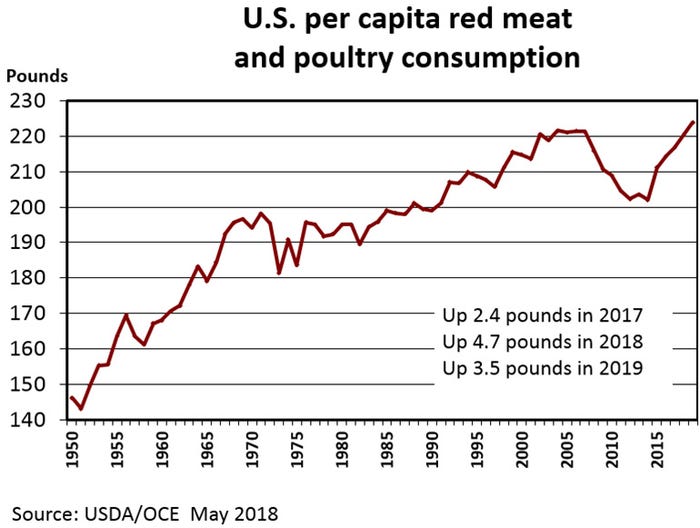

The WASDE’s first estimate of 2019 pork production for 2019 is 27.61 billion pounds, up 3.1% from this year which is expected to total 26.770 billion pounds up 4.6% from 2017’s 25.584 billion pounds. The long-term growth rate for pork production has been 1.5% per year. It looks like 2019 will be the fifth consecutive year with growth faster than the 1.5% trend. Although USDA expects 2019 pork production to be up 3.1%, they expect 2019 prices to be more or less even with this year. It will take strong demand to make that happen.

USDA is forecasting 2019 U.S. pork consumption at 53.1 pounds per person (retail weight), up 1.2 pounds from 2018, up 3 pounds from 2017, and the highest since 54.2 pounds in 1981.

The supply of competing meats is also high. Per capita beef consumption for 2019 is forecast to be 58.8 pounds, the highest since 59.6 pounds in 2010. Per capita broiler consumption in 2019 is projected at 93.2 pounds which would be record high for the fifth consecutive year. Total red meat and poultry consumption at 223.9 pounds per American in 2019 would break the old record set in 2004. Given this quantity of meat, it is hard not to expect pressure on meat prices. Obviously, USDA is expecting meat demand to stay strong.

USDA is forecasting U.S. pork exports will be up this year, up again in 2019, and thus be record high for the third consecutive year. They expect little change in U.S. pork imports.

Tuesday afternoon USDA-National Agricultural Statistics Service will release its monthly Cold Storage report. Stocks of frozen pork have been above the year-earlier level at the end of each month since December and is likely to be up again on April 30.

On Thursday afternoon, USDA will release their monthly Livestock Slaughter report. Preliminary data indicate April hog slaughter was up 7.0% largely because of one more slaughter day than last year. On an equal day basis, last month’s hog slaughter was up roughly 2.4% compared to April 2017.

The May Cattle on Feed report will be released on Friday afternoon.

About the Author(s)

You May Also Like