Hog prices remain volatile

The disappointing prices have been due mostly to smaller-than-expected exports rather than excess supply.

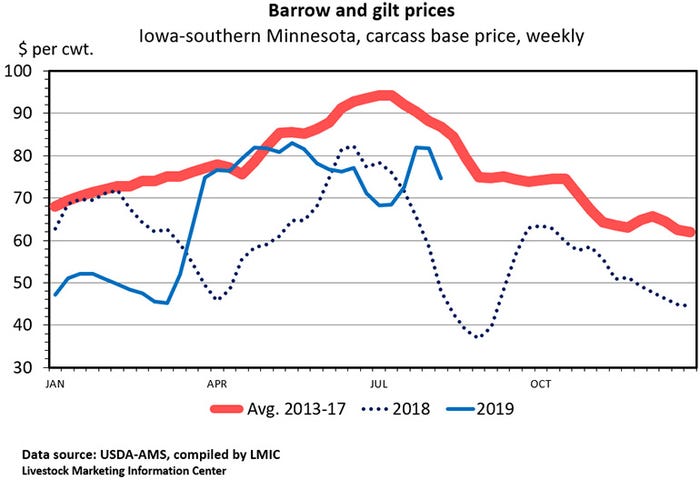

Cash hog prices peaked in mid-May with negotiated carcass prices slightly over $80 per hundredweight. Prices declined through June to the mid-$60s in early July, then rebounded to the low-$80s by late-July, only to dip to the $60s again in August. Last week, prices increased modestly.

Summer hog prices have been disappointing compared to what was expected during the spring. In mid-April, the June, July and August lean hog futures contracts were each trading above $98 per hundredweight. The three summer hog contracts each expired below $80 per hundredweight. In mid-April, the October and December hog futures contracts were each above $87 per hundredweight. October and December contracts are currently trading in the low-$60s.

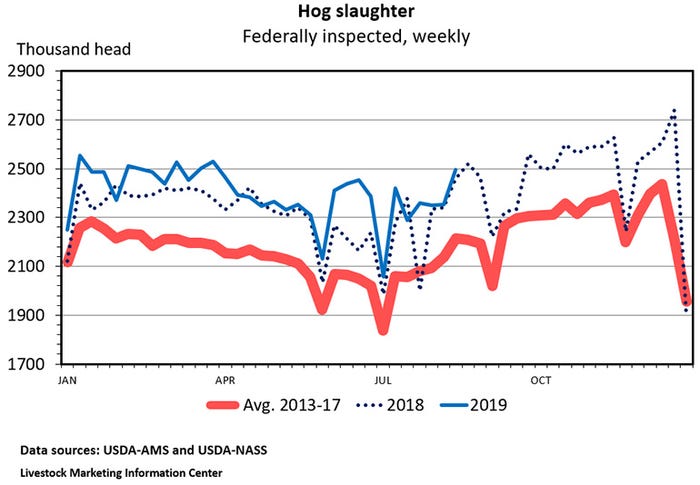

The disappointing prices have been due mostly to smaller-than-expected exports rather than excess supply. Since June 1, hog slaughter has been only 0.5% higher than implied by the market hog inventory in the June hogs and pigs survey.

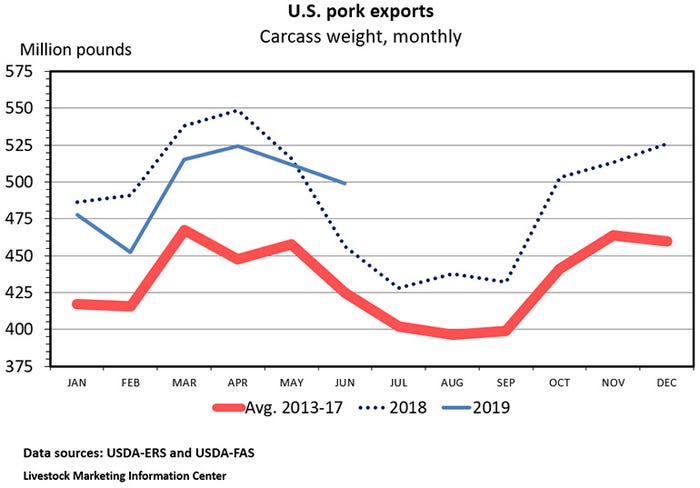

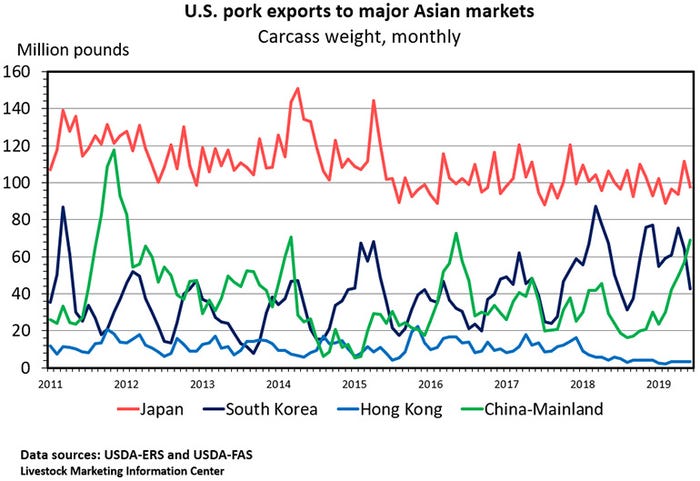

The optimism of spring was based on the expectation that rapidly spreading African swine fever in China was about to cause a boom in U.S. pork exports. ASF continues to spread, but U.S. pork exports are far from booming. U.S. pork exports were down 1.8% in the first half of 2019. Only one month (June) had exports that were above the year-earlier level.

Pork shipments to China during the first half of 2019 were up 27.7%, but the 58.8-million-pound increase in exports to China was less than one-third of the decline in pork shipments to Mexico. China took less than 10% of U.S. January-June pork exports and only 2% of first half U.S. pork production. U.S. pork exports to China during June totaled 69 million pounds, the most since May 2016. The record Chinese purchases for a month is 117.8 million pounds, shipped in November 2011.

During the first half of 2019, U.S. pork production was up 3.7%, pork imports were down 11.5%, and pork exports were down 1.8%. During January-June of 2019 pork imports equaled 3.6% of production and exports equaled 22.2%.

For hog prices to move higher, a rally in the pork cutout value is needed. Larger pork exports remain the key to a spike in the cutout value.

Hope springs eternal. December 2019 lean hog futures contract prices are the lowest on the board and the July 2020 contract is the highest. Given the seasonal price pattern, that is not surprising. What’s unusual is the premium the 2020 contracts carry over the 2019 contracts. The October 2020 contract is $10 per hundredweight above the October 2019. December 2020 is up $9 per hundredweight compared to December 2019. Current futures contract prices imply next year’s hog prices will average nearly $6 per hundredweight above this year.

That wouldn’t be unexpected if production was declining, but year-to-date pork production is up more than 3% year and a similar increase is expected in 2020. The per capita pork supply for 2020 is expected to be 52.3 pounds, the most since 1999. Next year’s total red meat and poultry consumption (222.7 pounds per person) is expected to be a record.

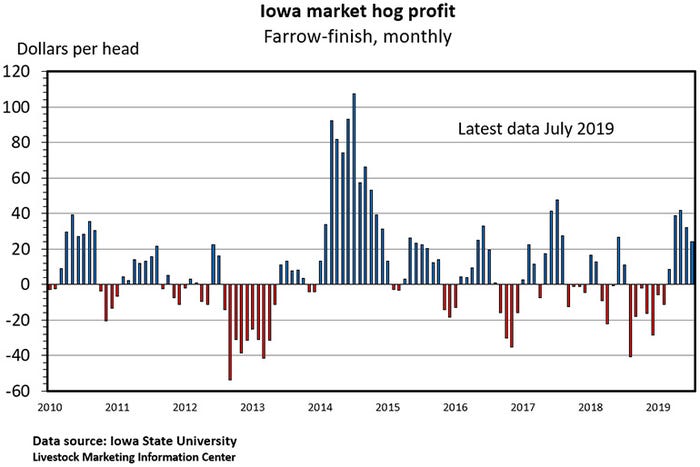

Calculations by Lee Schulz at Iowa State University estimate the typical profit for market hogs sold during July at $24.07 per head. That makes July the fifth consecutive profitable month this year. The breakeven carcass price was estimated at $63.23 per hundredweight, the highest since June of last year.

The futures market implies that profits will increase this month, then decline to near zero by year’s end.

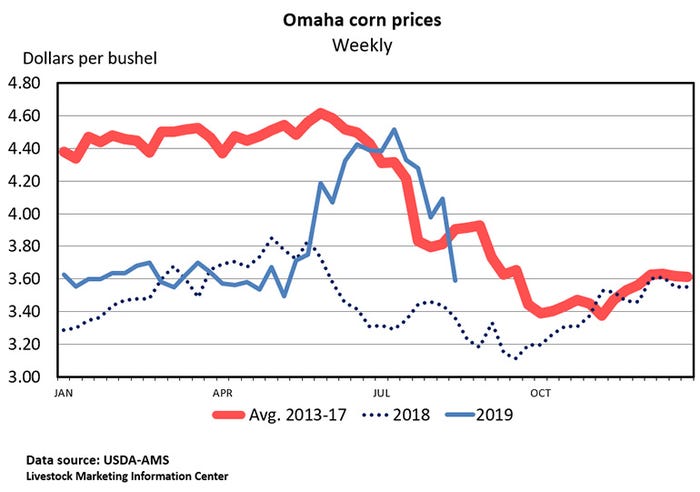

Compared to last month, the August World Agricultural Supply and Demand Estimates reduced corn acres planted by 1.7 million, but increased yield by 3.5 bushels per acre. That resulted in a slight (0.2%) increase in corn production causing USDA to lower by 10 cents per bushel their forecast for 2019-20 seasonal average corn price to $3.60 per bushel.

USDA cut soybean production but also lowered exports and ending stocks, and left soybean prices unchanged at $8.40 per bushel and soy meal steady at $300 per ton.

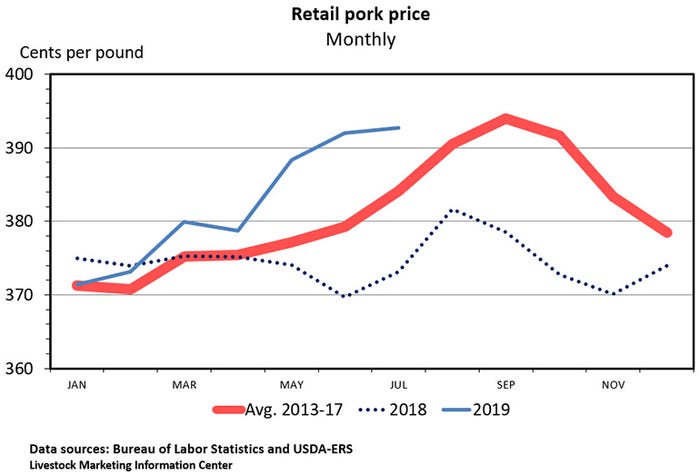

Domestic pork demand remains strong. Retail pork prices averaged $3.927 per pound in July. This was up 0.7 cents from June, up 19.6 cents from July 2018 and the highest pork price for any month since September 2017.

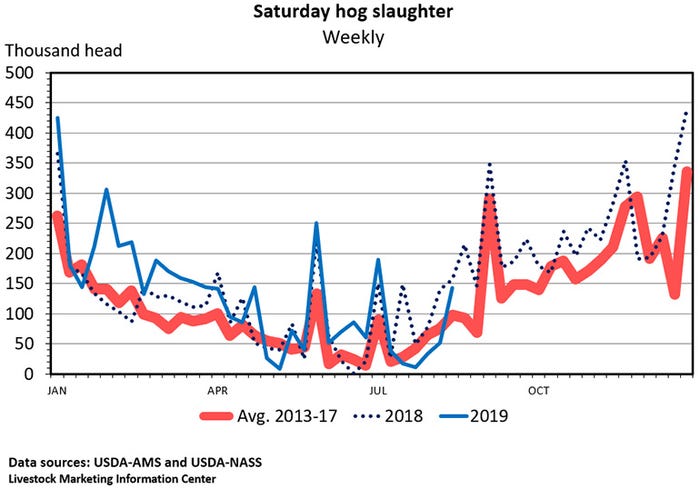

For 15 of the last 16 weeks, hog slaughter has been above the year-earlier level. But, for the last five weeks, Saturday hog slaughter has been below the year-ago level. The lower Saturday slaughter has been caused in part by tight packer margins. Gross packer margins during June and July dipped below $20 per head, removing incentive to slaughter extra hogs. This led to low Saturday slaughter levels.

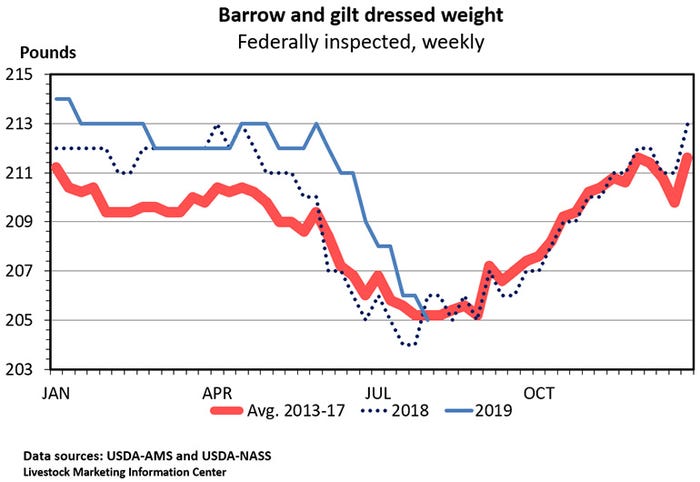

Slaughter weights usually decline during the summer. This year is no exception. Slaughter weight of market hogs has dropped fast as summer temperatures have climbed. Average dressed weights are down seven pounds from seven weeks ago. We are at the time of year when slaughter weights are likely to trend higher until winter.

This afternoon, USDA will release their weekly crop progress report. The monthly Cold Storage report and the monthly Livestock Slaughter report both come out Aug. 22. Preliminary data indicate July hog slaughter was up 10.2% year-over-year, due mostly to one additional slaughter day this July than last. That means daily hog slaughter was up about 5.2% which is 0.6% more than implied by the June Hogs and Pigs Report. USDA will release the August Cattle on Feed report on Friday afternoon.

Source: Ron Plain, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like