Hog markets could use a little good news

March 16, 2015

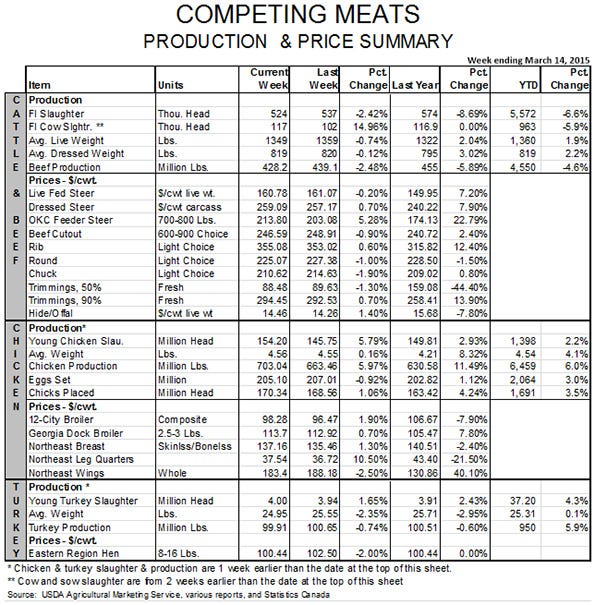

It was another tough week for hog and pork markets even though hogs held relatively steady in the face of continuing large slaughter totals. The news of avian influenza was not good either. Anne Murray once sang “could use a little good news today” and I know the feeling!

Let’s start with the situation in the U.S. poultry industry. It took an ominous turn early last week when a case of highly pathogenic avian influenza was confirmed in a turkey flock in northern Arkansas. While the cases in the Pacific Northwest were worrisome and those in Minnesota and Missouri were ominous, this one is absolutely threatening. Arkansas ranked fourth among states in 2014 for both chicken and turkey production. No other state impacted so far ranks near that high in the chicken business which exported about 19% of its total output last year.

Several countries, including the European Union and Mexico (our largest chicken export market) moved to ban poultry products from Arkansas last week. We heard rumors today that Mexico would change its ban to cover only Boone County, Ark., the home of the infected flock, but have seen no confirmation of that rumor. Limiting the ban to a smaller area would certainly reduce the impact on the U.S. business and is certainly not unusual for HPAI outbreaks. The rumor is also reflective of the important role that U.S. poultry products – and especially chicken – play in the food commerce of Mexico. The country certainly doesn’t want any additional HPAI problems but it needs the food.

State-wide or county-wide bans leave plants in other areas able to supply the export needs of our customers. That reduces the impact of these targeted shutdowns but plants are not perfectly interchangeable as suppliers. A tray-pack plant can probably switch to shipping combos of dark meat only slowly, if at all.

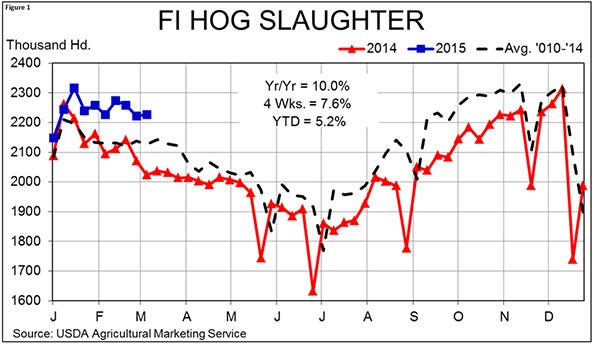

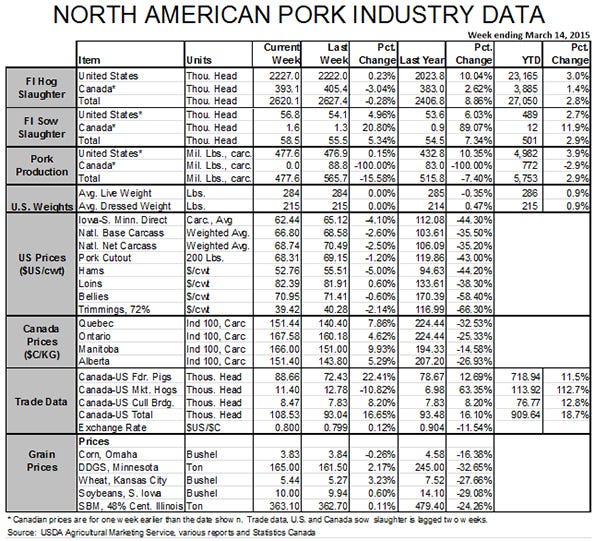

While we sweat a bit about chicken demand, hog numbers run merrily along. Last week’s slaughter is estimated to be 2.227 million head, 10% larger than one year ago (see Figure 1). We need to realize that the immediate past two weeks marked the point last year where hog numbers began to plummet as the previous summer’s pig losses began to take hold and producers began to delay marketings to take advantage of rapidly rising prices.

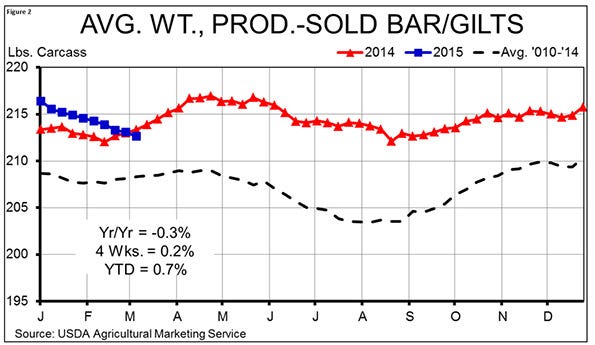

Just the opposite is true this year, of course, as hog prices have fallen and producers are trying desperately to reduce weights, and they are succeeding. Producer-sold Mandatory Price Reporting barrow and gilts weighed, on average 212.6 pounds last week, down 0.5 lbs. from the previous week and finally dropping below 2014 weights – but only by 0.3% (See Figure 2).

Higher year-on-year slaughter and lower year-on-year weights still left pork production 10% higher than last year – the largest year-on-year increase so far this year.

This tonnage pressured the cutout value lower by $1 per hundredweight to $68.15 last week. That was the seventh straight week in which the pork cutout value was down from one week to the next. Hog prices were roughly 2.5% lower and are now 35 to 45% lower than one year ago, depending on which one you look at.

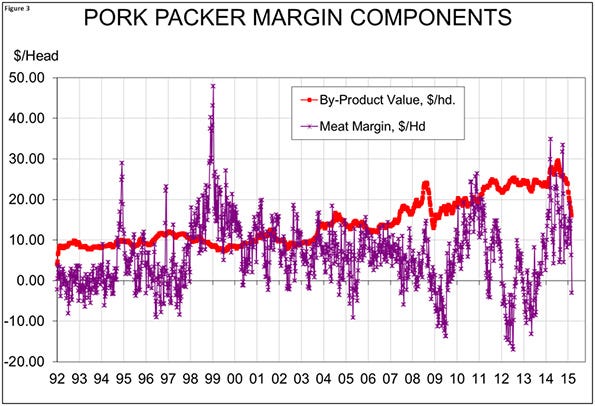

Estimated packer margins fell to their lowest weekly level since May 2013 the week of March 7. The gross margin between total carcass and byproduct revenue and the cost of a market hog fell to just $13.05 that week. That figure spent 10 weeks last year above $50/head. A major reason for the weakness is a collapse in the value of variety meats and other byproducts from nearly $30 last summer to just $14.79 the week of March 7. See Figure 3.

These products are very dependent on exports so the port slowdown and rising dollar have hit them disproportionately hard. Remember, packers don’t really care where they make their margin just as long as they make one. That lower byproduct value is a major reason for tight packer margins and lower hog bids.

About the Author(s)

You May Also Like