Hog market is steady as she goes

First big check on the accuracy of these herd size and price predictions will come Friday when the USDA releases the next Hogs and Pigs Report.

As is typical in the summer, hog prices are up. The futures market is predicting that this year’s high in hog prices will come in August, a bit later than normal.

The USDA’s June price and production forecasts predict 2016 pork production will be 1.9% higher than last year’s record, and that 2017 production will be 2.6% higher than this year. Growth in pork production comes partially from heavier weights, but mostly from increased hog slaughter.

The first big check on the accuracy of these predictions will come this Friday when USDA will release the next Hogs and Pigs Report. This quarterly survey of the nation’s swine herd is the best predictor of future hog slaughter. The report’s inventory of market hogs weighing 120 pounds and up has been within 2.0% of subsequent barrow and gilt slaughter in 11 of the last 13 quarters and within 0.2% of slaughter five of those quarters.

Breeding herd holding steady

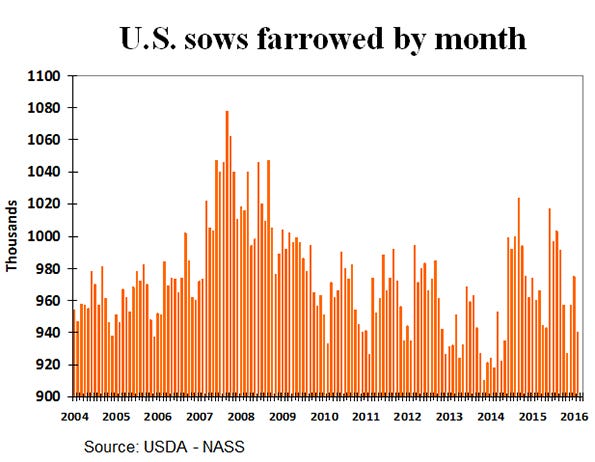

The swine breeding herd appears to be holding steady. In the first 22 weeks of 2016, barrow and gilt slaughter was up 0.7% and sow slaughter, net of imports from Canada, was up 0.5%. The gilt slaughter data shows a higher percent of gilts in the slaughter mix this year than last. Combined sow and gilt slaughter is up more than male slaughter implying a slower growth rate for the breeding herd than we had a year ago.

The breeding herd inventory is less accurate at predicting future hog slaughter than are farrowing intentions. The March producer survey predicted a surprisingly large 3.5% decline in summer farrowings. It will be interesting to see if the June survey confirms this number.

Litter size lags

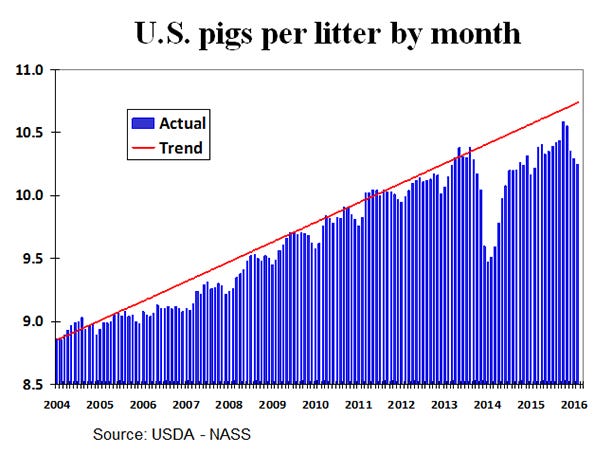

Prior to the arrival of the porcine epidemic diarrhea virus in the United States, the national average number for pigs per litter was fairly steady and predictable. There was a strong seasonal trend (fewer pigs per litter during the winter) and a steady growth rate that averaged about 0.15 more pigs per litter each year.

Prior to PED, large changes in the pig crop were almost always due to changes in the number of litters farrowed. That has changed with PED. The pig crop from October 2013 through September 2014 was down 3.3% year-over-year even though the number of sows farrowed was down only 0.3%. When PED arrived in 2013, pigs per litter took a huge drop followed by a partial rebound. The seasonal pattern remains, but litter size lags well below the old trend line.

Profit cycle

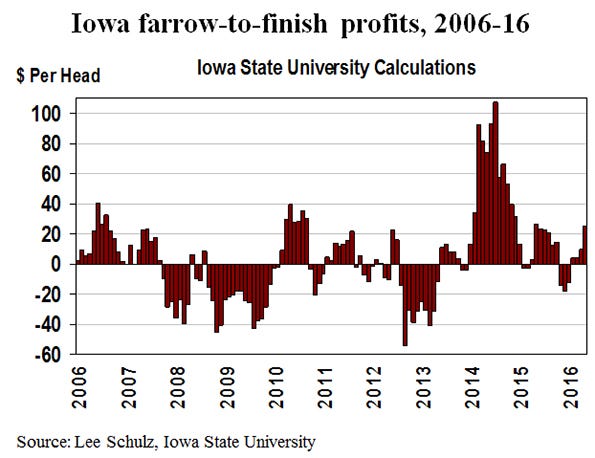

There are several reasons for USDA’s prognosticators to anticipate growth in pork production. Hog farms are enjoying a prolonged period of profits. According to Iowa State University calculations, there have been only five unprofitable months in the last 29 months for the typical Iowa farrow-to-finish operation. Profits averaged $7.93 per head in 2015. That is not outstanding, but it followed a record profit of $61.85 per head in 2014. Four of the first five months of 2016 have been profitable with a solid $25 per head profit in April. Historically, profits lead to an expansion of the swine herd. There are two big new slaughter plants scheduled to open next summer, Clemens Foods in Coldwater, Mich., and Triumph-Seaboard in Sioux City, Iowa. That is another reason to expect the sow herd to grow. Both plants are making efforts to assure themselves of hogs to slaughter.

There are two big new slaughter plants scheduled to open next summer, Clemens Foods in Coldwater, Mich., and Triumph-Seaboard in Sioux City, Iowa. That is another reason to expect the sow herd to grow. Both plants are making efforts to assure themselves of hogs to slaughter.

Along with the increase in pork production, USDA is predicting lower hog prices in 2017. Given the rise in corn prices in recent weeks, hog profits could get squeezed when fall gets here and hog prices face the usual seasonal price decline.

Lackluster domestic meat demand

Domestic meat demand has been lackluster in recent months. For the 12 months ending with April, domestic meat demand was 1.6% higher than a year earlier with both pork and beef demand up 0.5%. As unimpressive as that sounds, it is better than the export demand situation. The 12 months ending in April saw a decrease in export demand for each of the major meats — pork, beef, chicken and turkey. Slow growth in the U.S. economy is hurting domestic meat demand. Unfavorable exchange rates between the U.S. dollar and other major currencies are the likely cause of the poor export demand situation.

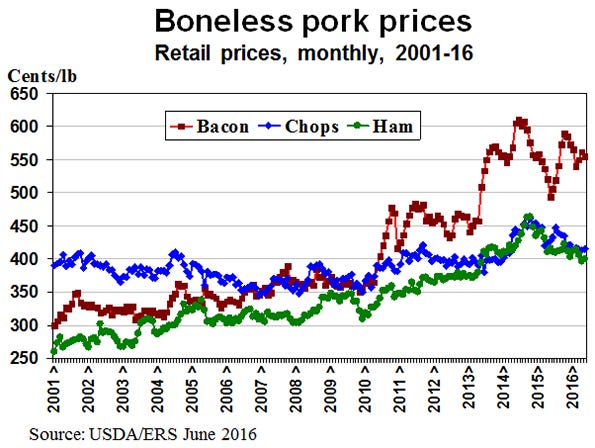

The relative price of pork cuts has changed in recent years. For the last couple of years, retail prices of boneless pork chops have been roughly the same as boneless ham. Bacon prices, which used to lag well below pork chops and pork steak, are now clearly a premium product.

About the Author(s)

You May Also Like