Hog hedging is not all fun and games

Basis risk, especially in an environment of rosy expectations, is large and likely to stay.

November 4, 2019

Hog hedgers have had no fun at all this year. That statement is not meant to insinuate that hog hedgers are sit-at-home-in-the-dark curmudgeons who listen to the Statler Brothers sing “Flowers On The Wall” over and over. (OK, that’s an old reference so call it up on YouTube and you’ll see the comparison is correct!) I think they are actually a pretty fun-loving and lively lot. At least the ones I know are.

But their day jobs this year have been a challenge to say the least. It’s not that they didn’t have opportunities to price hogs well. But the “irrational exuberance” that drove Lean Hogs Futures prices sharply higher earlier this year has stayed in place, keeping the deferred contracts higher even as cash markets have disappointed. And “deferred” here doesn’t necessarily mean a few months into the future. The nature of the LH contract means it might just be a few weeks.

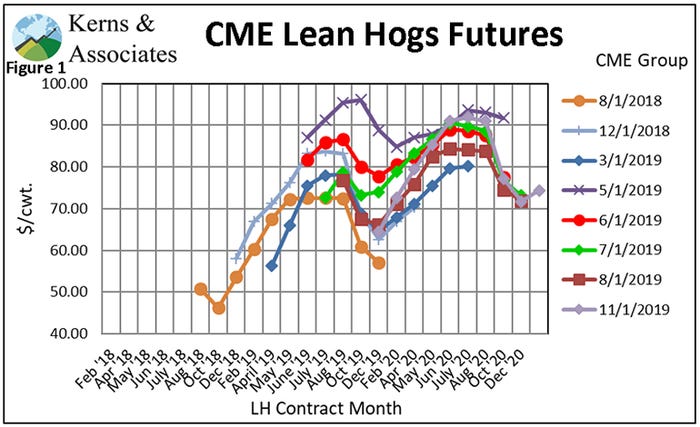

To the point of “there were chances,” we refer to Figure 1. Now the chart is busy but just walk through it date-by-date to see what this market has done since Aug. 1, 2018, just a few days before the first case of African swine fever was acknowledged in China.

You may recall that July and August of 2018 had been unmitigated disasters for the hog markets. Producers had held some hogs in the spring, pushing weights higher. The rush to sell and get those weights put more hogs on the market than was anticipated, sending prices lower. Then, we believe, pigs that lived to market weight due to the low incidence of porcine reproductive and respiratory syndrome in the winter of 2017-18 piled on to that supply, completely destroying the normal seasonal rally and leaving cash negotiated base prices at $37 and net prices at $39 by the end of the month. Those prices across all pricing methods were $48.67 and $50.93. None were commensurate with a golden opportunity to supply pork to 1.3 billion pork-loving consumers.

But by December, the scope of China’s situation started to become apparent. December futures were still under $60, but summer 2019 contracts had pushed to the mid-$80s, over $10 higher than they were in August.

Disappointment No. 1 set in with the new year. Expectations of burgeoning exports fizzled. Hog supplies were ample, and the April contract fell from $70-plus to $56 on March 1. June futures dropped by more than $6 per hundredweight.

China Euphoria No. 2 was kindled the week of April 4 when China booked over 78,000 tons of U.S. pork for shipment sometime before the end of the calendar year. Now, an export sales booking might be worth no more than the paper it once would have been printed on, but it was enough to set off an “expectant” futures market that saw summer contracts eclipse $95 by May 1. Cash prices were in the low-$80s for both negotiated and all-method averages and the futures promised higher prices. There was no need to hurry pigs to market, and slaughter fell back to year-earlier levels from mid-April to the end of May. The trouble is that there were indeed more hogs on farms and matching last year’s slaughter just backed them up. Instead of declining seasonally, market weights stayed constant into June, slaughter totals averaged over 9% higher than the year before and cash markets began to slide.

Enter China Disappointment No. 2. Soft cash prices and more disappointment with the level of shipments to China once again pushed futures lower and this move downward can be seen in the lines for June, July and August in Figure 1. Even the Nov. 1 line reflects that sell-off in the front months.

But China Expectation No. 3 still exists for next summer. Note that those contracts — and the ones beyond them — have moved little since the big April rally. The trade still expects Chinese business to be robust next year. We think the trade is correct in its expectation of big exports. Whether prices go that high is an open question.

So, what does this mean for hedgers? Disappointment. They get hedges placed at good levels and, considering a long-term average basis, those strong hedges establish strong expectations for realized price when the hogs go to market. But all hedgers know that you get the expected price only if the basis (cash hog price - futures price) at the time of selling the hogs is equal to the expected basis back when the hedge was placed. And it is here that hedgers’ jobs have been wholly unfulfilling in 2019.

Is it because some market — cash or futures — is “broken,” as many like to say when things don’t go as expected? Or is it because the expectations for the future are constantly running into the disappointment of the present? The answer is “both.”

The Lean Hogs Futures contract has always had a “convergence” problem. Cash settlement guarantees only that cash and futures will converge on the last two days of trading — the days whose cash markets determine the final CME Lean Hog Index. While the basis has been generally manageable in the four weeks preceding the eight listed contracts, it has been notoriously large in the off months. Everyone needs to realize that there is a tradeoff here, though. The convergence difficulties of a cash-settled contract are the flipside to the attractiveness of a cash-settled contract to outside investors. Cash settlement is one reason that the volume of Lean Hogs contracts is much higher than trade volumes for the old Live Hogs contract. That volume provides producers with more opportunities to hedge hogs. There are more investors willing to take the price risk if they don’t have to accept delivery risk.

Even this reasonably good historical basis behavior has declined this year. I think there are two reasons. First, the futures market has held on to hope even into the spot month since May and then fallen to the cash market. May futures fell $5.92 in their final month. June fell $7.30 and July fell $12.76. August rose $0.29 and October fell by $3.55. What that means is that hedges could not be lifted at enough of a profit (if any!) to offset the decline in cash hog prices. If hogs are falling, hedgers want futures to fall with them. Or better yet, before cash declines. Such declines allow profits on futures positions to offset the lower cash price and get hedgers at least close to their expected price level. A deliverable contract would likely have pushed those futures prices lower earlier, but producers may have had to sell the futures contracts perhaps $2 lower to entice someone to buy them in the first place. It’s a trade-off.

The other problem is that reported prices don’t mean the same things. “What’s the price of hogs today?” someone asked. “Which hogs?” the other correctly responded.

The critical basis for any hedger is the difference between the futures prices and his/her cash market. All that matters is whether the futures and his/her specific cash market move together. But the futures moves to the CME LH Index. That index is the weighted average of the net negotiated price and the net swine/pork market formula price. If your market price doesn’t move closely with those two — and, in truth, the SPMF price since it represents far more hogs than does the negotiated — then your basis is different. The inclusion of more and more hogs tied to the cutout value makes this difference between the SPMF price and the negotiated prices even larger. And this is a trend that is not going away.

And that has been the case for anyone tied to any negotiated base price, especially this fall as slaughter runs have increased and left less and less value for those extra few loads of hogs offered on the spot market. Packers simply don’t need them and, it appears, are taking them only if they can buy them cheap. The basis for these “minority” marginal prices is huge, but it represents the basis for only a small percentage of the hogs sold on any day.

Some structural changes may be needed, but those won’t happen quickly. Basis risk, especially in an environment of rosy expectations, is large and likely to stay.

Source: Steve Meyer, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like