Hitting the reset button

Hog industry has a lot of moving parts to watch as it heads into 2021.

December 21, 2020

The turning of the calendar is the traditional time to take an inventory of your personal situation and commit to steering in another direction, if you so choose. Statistics show, however, that you will probably revert back to the same old habits before February. Change can be hard. There is nothing inherently wrong with New Year’s resolutions if they are bends in behavior and not wholesale changes unlikely to stick.

I bring up the New Year’s resolution concept, because before you can pledge to a change, you have to understand your current situation and realize there is a better solution than what you are currently experiencing. For instance, before you can embark on a path to lose 40 pounds, you have to realize you are 40 pounds overweight. It is the same way in the markets. We can either be surprised by what happens (gee, my pants don’t fit right), or anticipate change and take action prior to a negative scenario (maybe I should back off on the holiday cookies before it is too late). We have a few key markers in the market, both current and upcoming, that should serve as guideposts for your risk management decisions both now and in the New Year.

First, the upcoming “Hogs and Pigs” report should be incredibly revealing. The understandable errors in the June report when we were in the throes of the COVID plant closures and the subsequent miss in the September report that indicated way too many heavy-weight hogs at that time should settle into calmer waters for the USDA to navigate and provide us insight. I am fully anticipating a friendly report based on space available, wean pig values and the recent chatter of porcine reproductive and respiratory syndrome (PRRS) incidents. The latter one is admittedly subjective and has not evidenced itself in any objective data thus far. Conversations with veterinarians and bankers provide an anecdotal lean to the “more incidents than last year and a naïve sow herd” concept. The other two have a bit of substantiation behind them in the way of economics not having a bias – barns are trending to the “available” side of the ledger and wean pig values have been moving higher, both hinting at a smaller numbers on feed. This December report should also shed some light on the North Carolina situation, the last region to deal with too many heavy hogs.

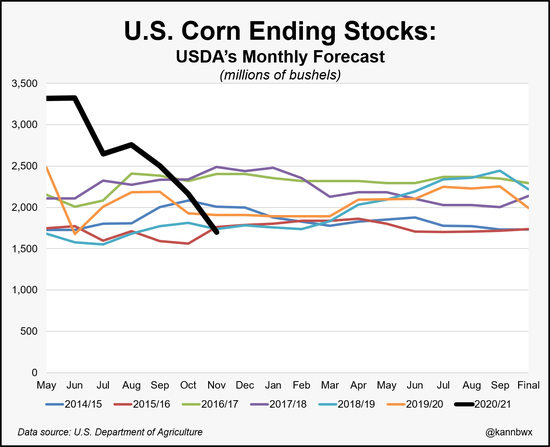

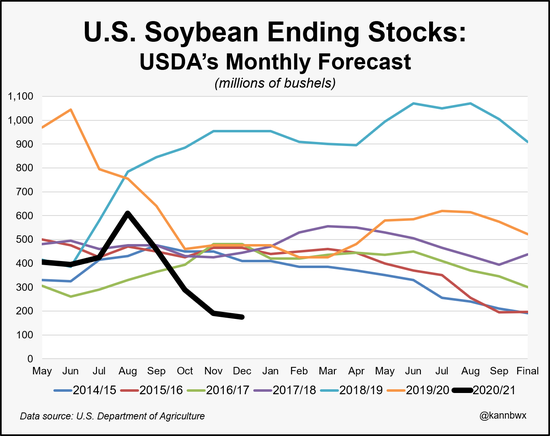

The second item on your radar should be the upcoming USDA “World Agricultural Supply and Demand Estimates” report, to be released on January 12. This will be our final – subject to future revision if needed – look at the 2020 U.S. crop size and an adjusted demand number. Recall, the December report did not have any production changes and only had a modest shift in soy demand, with the corn balance sheet was completely unchanged from the November figures. Similar to my opinion on the “Hogs and Pigs” report, I think this one could have some juice to it, too. The two below charts depict the carryout projections of corn and beans over the past few months. Notice a trend? We are moving from a scenario characterized by the expectations of gracious surpluses to one of a precariously tight balance sheet.

This tightening grain scenario has a couple of implications. The first is our export pace of soybeans, combined with a record-high crush rate, which means that any rationing we institute in the old crop will occur late in the season, if at all. I am genuinely concerned that pork producers may have a difficult time sourcing soybean meal in the summer, unless something changes radically in the South American weather forecast. The developing La Niña (cooling temps in the Pacific Ocean) is strengthening and, with it, so do the odds that yields will be compromised in South America. If the U.S. is asked to supply more of the world’s soybeans than we currently project, there is little remaining buffer, and we risk a repeat of the 2013-14 experience, wherein we witnessed the highest price of soybean meal in history ($600+/ton in the spot market during the height of the supply compression). Those that have beans to deliver to the processor will be first in line to receive soybean meal. If you have beans in the bin, consider selling them commensurate with your meal purchases.

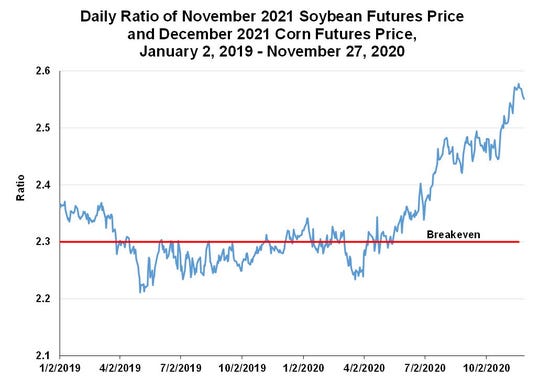

The second item is an acreage battle that is brewing as we come into the spring. Per the graph, corn needs to rally to compete for acres. Several firms will be out with their acreage guesses. We are using a nearly identical 50/50 split between corn and soybeans, roughly 90.5 million acres each. Those type of planting dynamics will not be comfortable as the weather moderates in the spring. I suspect corn will have to work to garner the acres by making new crop values more attractive relative to soy economics.

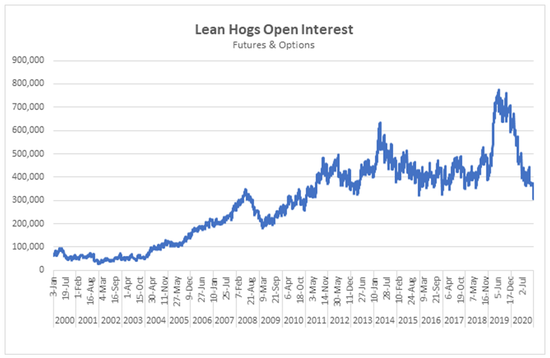

I also want to address an ominous situation in the hog futures: The case of the shrinking open interest. You may remember that the Chicago Mercantile Exchange is a perfect offset, with each transaction having a buyer and a seller. The amalgamation of all of these transactions is termed “open interest.” This is of vital importance for the pork production community as we need buyers to take the other side of our hedge transactions. We have recently seen a sharp decline lower in open interest, with it reaching its lowest level in the past 10 years. The “why” behind the “what” likely has several factors.

One obvious one can be seen on the chart – the spike in speculative interest in our markets in early 2019 corresponding with African swine fever (ASF) in China. Prognostications abounded about the unparalleled impact of this event on our markets, money flooded in to profit from what would most certainly be new record highs. Oops! Those lessons and wounds have not yet been forgotten, and the faith – rightly or wrongly – in the hog market’s ability to deliver on the promise has been tainted. This is in conjunction with positive returns in the grain, metals and equity markets. Whose idea were those losing hog trades?

Another concern that I have, although it is yet to be proven, is the potential dilution of participation because of the new pork cutout contract. I have been a proponent of the contract for pork producers, but we need to garner the faith of the speculative community for this contract to catch fire. Let’s hope that occurs soon.

The bottom line is that we have a lot of moving parts, many of which can be identified and addressed before they become a crisis. Doing the diligent work now will save us from having to work harder later.

Comments in this column are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals.

Source: Joseph Kerns, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset. The opinions of this writer are not necessarily those of Farm Progress/Informa.

About the Author(s)

You May Also Like