Fourth quarter fear of taxing packer capacity

All eyes on the Chinese market.

February 10, 2020

"Forecast often!" is the mantra for all market forecasters. While it sounds like — and usually is — a monumental copout, the admonition is based on sound economics and decision making. Virtually all economic analysis aims at stating an expected outcome ceteris paribus or "other things held constant."

The rub, of course, comes in that other things are never constant. The environment we work in is always changing thus necessitating another run at the forecasting methods to see what the new result is under new ceteris paribus conditions. I'm not likely to garner any sympathy from non-economists with that explanation but weather forecasters know exactly what I am talking about. They and we are a miserable lot at times.

Last week was maybe the best and most maddening example I've seen in a long time of how things can change on a dime. Consider:

The week of Jan. 24 brought more news on the growing threat of novel coronavirus and how it was exploding in China. Travel bans were imposed on some large population centers, the government extended the new year celebration to keep people at home, factory output declined, shipments of products within, into and out of China slowed. Chinese pork importers told U.S. suppliers to send what was on the way but stop further shipments. Most U.S. suppliers responded to those orders. Several stopped boxing frozen carcasses and put those carcasses into their fabrication lines where the products were likely headed for the domestic market. Agony and despair won the day.

Last Thursday the importers said, "Never mind — send it on." Included in that message was Tyson Foods and its now company-wide supply of ractopamine-free pork. Tyson has been selling to China, but the presumption is that they will do a lot more volume now and their CEO confirmed that in comments last week. June Lean Hogs futures recovered from the $9.55 six-day beating it had taken and by Friday afternoon, five-days later, has recovered $3.275 of that decline.

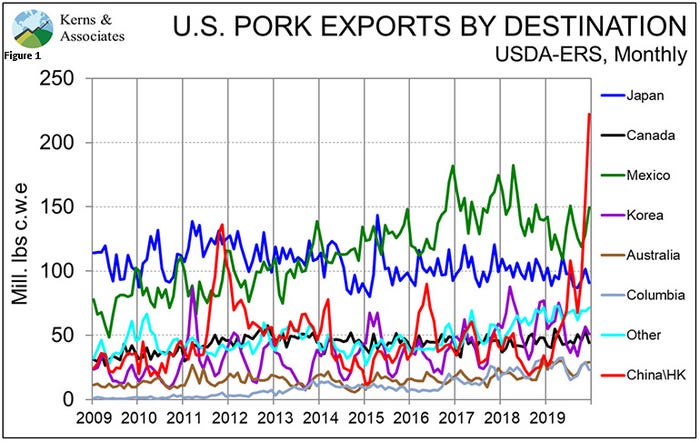

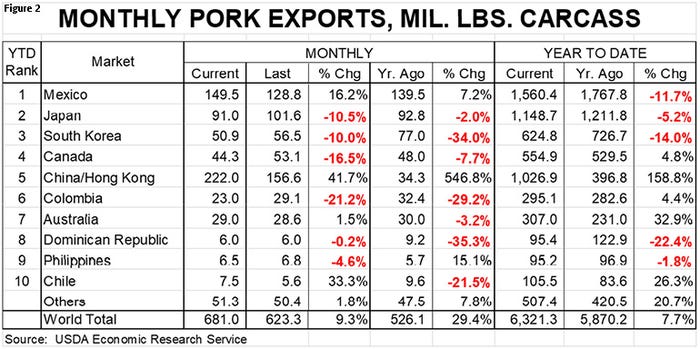

Newly published export data for December confirmed what we believed: China bought more pork than ever from the United States. December shipments of 222 million pounds carcass weight equivalent broke the previous month's record and dwarfed historic levels of pork trade with China (see Figure 1). December's shipments to China/Hong Kong were up 546.8% from last year and left annual exports at 1.027 billion pounds carcass weight, 160% larger than in 2018. Shipments to other markets except for Canada, Columbia and Chile were lower for the year (see Figure 2). Total U.S. shipments hit 6.321 billion pounds carcass weight in 2019. That figure is record large at 7.7% larger than one year before and represents 22.9% of total U.S. pork production.

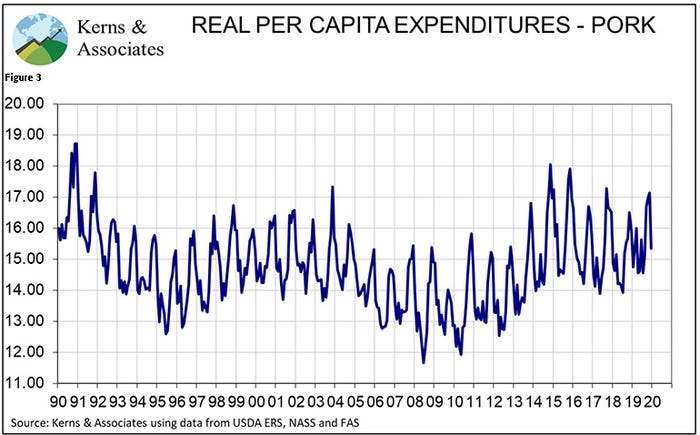

Those same export figures provided the last data we needed to determine how pork demand fared in 2019, and the answer is "Stellar!" Real per capita expenditures on pork finished the year on a bit of a downer, coming 3.3% short of last December's figure. But total RPCE for the year finished at plus-4.5% (compared to plus-1.2% for beef and plus-0.3% for chicken) putting annual RPCE for 2019 at $186.70 (2014 dollars), the fourth largest ever. (See Figure 3). U.S. per capita pork consumption was up 3% in 2019 while the nominal retail pork price gained 2.7% and the real (deflated) pork price gained 0.8%. Higher quantity and higher price equal higher demand.

Chinese hog prices recovered to over 36 Chinese yuan per kilogram last week and have risen further since. Many think they are headed back to their previous record near 42 yuan per kilogram. Chinese chicken prices have tanked since January as consumers have apparently agreed with this author that chicken is a poor substitute for pork. While an outbreak of avian influenza may have confused the coronavirus issue, it did not likely influence the chicken price decline since that started before the avian influenza outbreak.

So what do I think after all of this?

First, demand both at home and abroad is terrific. If Phase 2 of the China trade deal can officially roll the retaliatory tariffs back, it could get even better. I put the word "officially" in there because is it widely believed that Chinese importers are paying few retaliatory tariffs on U.S. pork. That's primarily because state-owned entities such as COFCO are, we think, doing most of the buying. But getting that hurdle out of the way could open up China's vast market to even more companies and more U.S. products.

Second, in spite of all of the difficulties, China has been a huge customer and our world in the United States would have been much worse had they not been so active in our market. December U.S. pork output was 9.45% larger than last year while the cutout value was more than 10% higher than one year ago. Those figures for all of 2019: plus-5.0% and plus-2.6%, respectively.

Third, hog prices didn't fare as well as the cutout, but they did remarkably well for the year given a 5% increase in annual pork supply. National net prices across all purchase methods fell just $0.04 per hundredweight (less than 1%) to $69.43. The average price of producer-sold barrows and gilts increased 4.1% for the year while the national net negotiated price, though $8 less than the previous two prices, also gained 4% on its 2018 level. Even the Iowa-Minnesota negotiated base price grew by 2.1% last year.

But the past is the past so what about the present? Lean Hog futures prices aren't what they once were, but they are still offering profits for 2020. In fact, as of last week, the producers represented by Iowa State University's costs and returns estimates (we think those are the low-cost 25% or so) could lock-in roughly $20 per head for the year. Average producers would be closer to $10 per head. Those figures are good enough to be in a horse race for the fifth best year ever, trailing 2015, 2004, 2005 and 2010 and, at present in a dead heat with 2017.

I'll keep saying it until hopefully proven wrong: I am still scared about fourth quarter 2020 as it appears at present that breeding herd growth, productivity growth and high pig survival rates will severely tax packing capacity. Strong demand helps but you have to get them in a box first. And that could be a huge challenge.

I would say I'm sorry to sound like a broken record but hardly any readers would know what that means. So, I'm sorry to keep repeating myself. See you young'uns learned something today.

Source: Steve Meyer, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like