Farmageddon will give way to silver linings

We still have the wall of too-many-pigs-relative-to-shackle-space coming at us in the fourth quarter.

March 23, 2020

If you had one market to follow to gauge the forward curve of how/if/when we resume to "normal," my choice would not be the Dow Jones or S&P index. It would be crude oil. There are a lot of moving parts, of course, in all markets, the oil market had the OPEC disagreements and behavior in conjunction with economic slowdown from the Wuhan virus influencing values. I believe there are some hints amidst the turbulence and there are more clouds in the overall (and the ag) economy prior to seeing the silver lining.

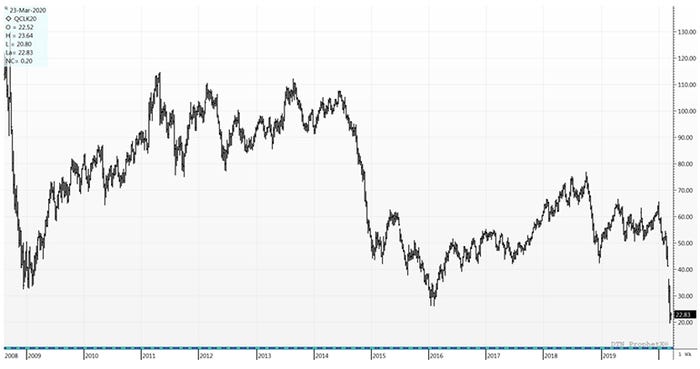

As a backdrop, here is a chart of nearby crude. Note, we recently eclipsed the lows that were a result of the 2008 recession — we are back to $20 per barrel crude, nobody is making money in the energy sector. The problem I see is that the forward curve has a premium, but nothing breaking above $30 for the foreseeable future.

This has at least a couple of implications for those of us in ag. The first is "good" as it leads to favorable consumer values for gasoline and diesel, and propane and natural gas. The other is good for some and not-so-good for others as it will have a direct impact on the price of ethanol and, hence, corn. As a review, recall that the United States instituted the first iteration of what we have as an ethanol policy back in the mid-'90s under the Bush administration. It got into full swing in the mid-2000s and had a pronounced impact on corn values.

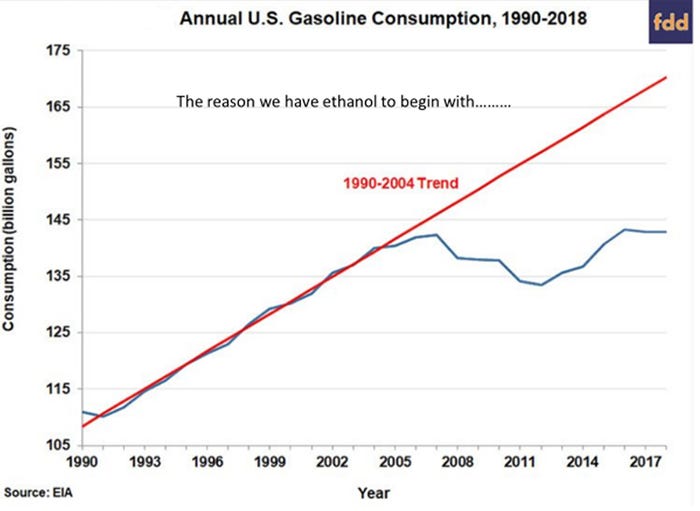

Attached is a graph from the U.S. Energy Information Administration that depicts the gasoline consumption assumptions that the administration used to base their decision (red line) with what actually occurred (blue line).

Note, the correlation was reasonably tight for several years and then fell completely apart right about the time we ramped up ethanol production. In rough terms, we have used 140 billion gallons of gasoline each year, a 10% blend with ethanol equates to 14 billion gallons of usage — which is reasonably close to the 14.5-billion-gallon mandate. Right now, we produce about 16 billion gallons per year and export the balance after accounting for waivers.

So far, ethanol has not had much of an immediate impact on the consumer as ethanol and unleaded gasoline traded at roughly the same value which has not led to a discrepancy at the pump. (Note: ethanol only has two-thirds of the Btus of genuine gasoline so there really is a cost to society in the form of reduced fuel economy with ethanol blends) This situation is changing rapidly.

As of this writing, ethanol is trading at $0.87 per gallon wholesale while unleaded gasoline is $0.56 per gallon. Ergo, there is zero economic incentive to blend beyond the values mandated in addition to the yet-unknown long-term impact of reduced economic activity (social distancing equates to fewer miles driven).

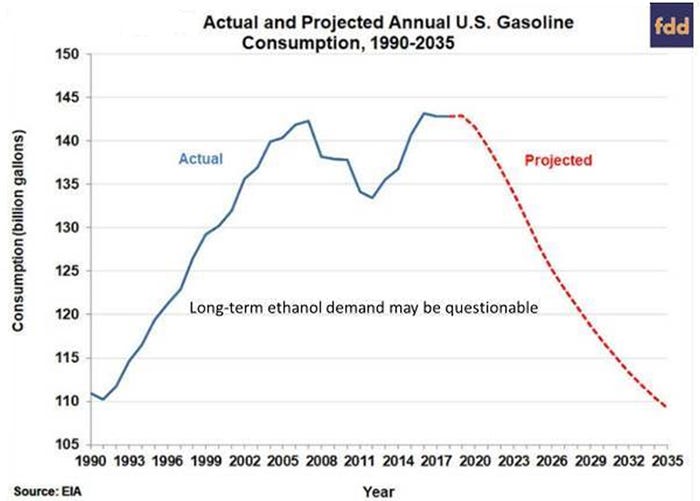

My point is this: if we back off gasoline demand by 15%+/- and corn demand falls by a similar quantity, we could easily be looking at a corn balance sheet that approaches a 4-billion-bushel carryout. Once we have the crop in the ground (which I contend we will not know the impact of macroeconomic parameters until well into the summer) there will be no incentive for the CME to encourage acres.

The last time we had a carryout in this absolute value was in the early '80s, which led to the famous -payment-in-kind program, and corn was trading at $1.50 per bushel. I am not suggesting we have to go back to those levels of prices, but the direction in this scenario is undeniable: Lower.

A return to pre-ethanol values for corn which, according to David Ricardo, circa 1809, will reduce rents which will reduce the underlying value of the land asset and cause a severe crimp in farm economics. From 2005-15, Midwest farmland fully quadrupled in value ($2,500 to over $10,000 per acre) creating a net-worth windfall to owners of land. Economists will often compare the then-current farm income year with that of 2012-13, the record year. It has been downhill from there and will almost assuredly pick up speed in the descent. Even though I think ag has a direct corollary to oil in the form of ethanol, this phenomenon takes no prisoners. Rents come down in housing units that lowers that asset value, second homes come on the market with a smaller pool of buyers, health care stocks probably do OK while luxury boat manufacturers suffer greatly.

I think we are in two-to-three year, minimum, time of economic strife. It will be a buyers' market for anything other than staples. A vaccine may halt the severity of the decline, the damage is already done in my opinion. The chart below was also generated by EIA and was run without taking the virus into consideration. We were likely going to use less corn for ethanol before the economic slowdown, the current situation will likely accelerate the process.

If this is anywhere close to right, food in the home and pork probably finds good support into the summer. We still have the wall of too-many-pigs-relative-to-shackle-space coming at us in the fourth quarter. Perhaps we get a bump in the near term to help buffer the industry for the future.

Less corn for ethanol equates to fewer dried distillers grains being produced which bumps up demand for soybean meal. SBM values have appreciated sharply in the last week or so and may be a bit aggressive with their values and inverted forward curve. Soy processing margins are expanding, you will not run out of soybean meal this year. Or the next. Or the year after that.

Anecdotal conversations regarding short-term pork demand has been outstanding with social media pictures of empty meat cases at retail making their rounds. The food industry and its ancillary components have been deemed "essential" which is important to pork producers. Relaxation of transportation rules has also been helpful in addressing key components of keeping the two most important issues we are facing right now — health care and food — from further constriction. I am in favor of using this moment in time to allow the spring/summer markets to appreciate as the sudden demand in the face of seasonally declining hog numbers should be supportive for the short term.

We can't fall asleep to the reality of the fall months. Regardless of demand, if we overwhelm packing capacity there will be price compression on the cash markets. Use this opportunity to keep your operation intact and sustain yourself for brighter days in the future.

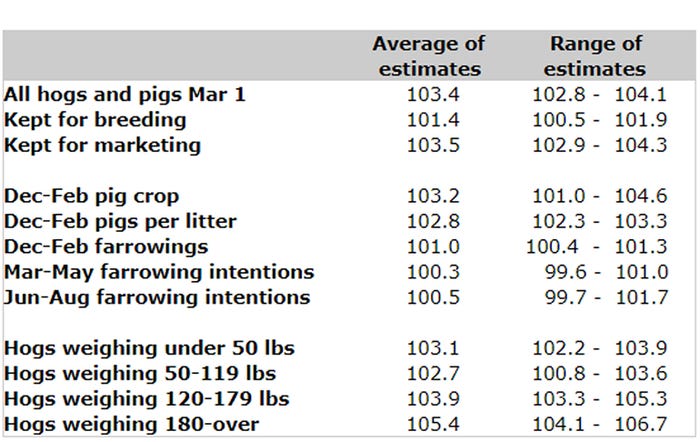

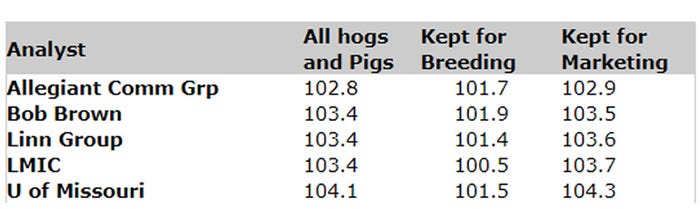

The Hogs and Pigs Report is due out Thursday. This one may have a little less sizzle compared to most quarterly reports given the acute situation. Below are the Urner Barry pre-report estimates.

Following is a breakdown of analysts' estimates for the first three categories.

Comments in this column are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals.

Source: Joseph Kerns, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset. The opinions of this writer are not necessarily those of Farm Progress/Informa.

About the Author(s)

You May Also Like