Fact versus feeling in the current hog market

The positive momentum of pork values combined with plentiful supplies of grains and oilseeds are a recipe for success.

October 8, 2018

Most of us in agriculture are not exactly creative poets. Our prose is found in planting in a straight line across the field and our clever ingenuity can be witnessed in fixing things with minimalistic tools. Duct tape and baling wire can work miracles in a pinch. It is against the backdrop of our affinity to facts and science that I am encouraging a different approach to understanding our current markets — feel.

Consider this: the USDA just told us that there are roughly 3.5% more pigs coming to market compared to this time last year, yet marketings are closer to 1% higher. What is up with that? The hurricane can explain some of the disruption, but not all.

We took the August contract off the board near $55 while the October currently stands closer to $68 — more than $25 per pig rally into October? Something else is at play that our traditional supply-demand mentality cannot explain, and I think this is where successful negotiation of the environment will require some reliance on market feel. If you think the September USDA report was “wrong,” the December report uses a higher sample size for its computation and may tease out discrepancy.

Our cash-connected sources indicate the tight supplies are likely to be with us for a bit before numbers increase sharply. This too-good-to-be-true situation is augmented by a couple other phenomena that I believe are contributing to the positive price movement. First, forward product sales on the domestic side appear to be robust as the meat guys were reading the same tea leaves and were appropriately aggressive on forward sales, even to the point where we may be moving product out of the freezer in October. Wow.

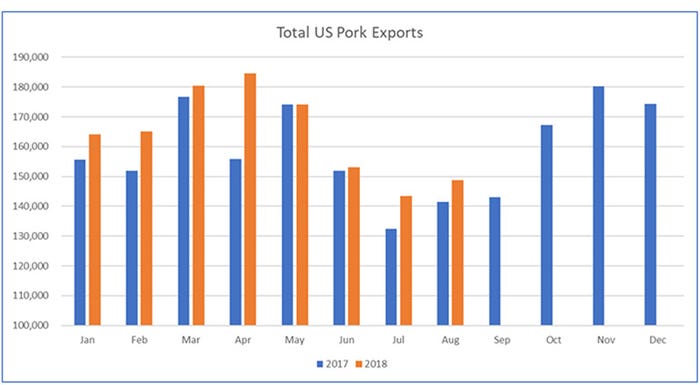

Second, export shipments have been running a robust 6% above year-ago levels and do not appear to be backing off. In fact, forward sales that have not shipped are running roughly 9% above year-ago values providing the impression that the trend is fully intact. This will be important as we approach the end of the year and will compare ourselves to the big export numbers in the fourth quarter of 2017.

Third, recall that the USDA has committed over $500 million to pork purchases, the initial solicitation is in October. These are all items that are friendly to the market and are influencing price action.

Mini summary

There are a lot of factors at play just below the surface that are making their presence known. This is before any material impact that African swine fever may have in our price discovery. If we can keep this dreaded disease off our shores, there is reason to be optimistic as we close out the fourth quarter of 2018 and roll into 2019. That seemed nearly impossible to imagine two months ago. Stay nimble my friends.

The USDA will provide us a grain report this week that will update yield projections, revise demand expectations and incorporate the September stocks data to provide a final carryout for last year (and subsequent carry-in for this year). The trade is generally expecting bean yields to get propped up as anecdotal reports have been nothing short of amazing. More production combined with a heavier stocks report will mean we have a realistic shot of posting a carryout for this year approaching 1.0 billion bushels. That is a whopper of a number. To put it in comparison, the biggest carryout in the history of the United States was in 2006 at 574 million bushels (we are on the cusp of doubling that value) and beans traded at $6.50 per bushel.

This leads me to the corn scenario. This year’s corn balance sheet should grow modestly based on the September stocks report and likely revisions (downward) to feed demand. That is not the story. The most interesting thing in the corn market is expectations for next year. Given the aforementioned huge bean inventory — and what is expected to be a bountiful South American harvest — will provide little incentive for row crop farmers to plant beans in the United States when spring arrives. A modest shift in corn acres combined with trendline yields could see corn carryout values next year approaching 3 billion bushels. That is a heavy number.

Bottom line

The prospects for animal agriculture look bright right now. The positive momentum of pork values combined with plentiful supplies of grains and oilseeds are a recipe for success. Producers are responsible for saying “yes” to favorable margins while they are availed, there are many opportunities for forward profit and the tools are at your disposal. Let’s put money in the bank and be both head smart and emotionally intelligent.

Comments in this column are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals. Joseph Kerns, 515-268-8888.

About the Author(s)

You May Also Like