Disciplined expansion for U.S. hog industry

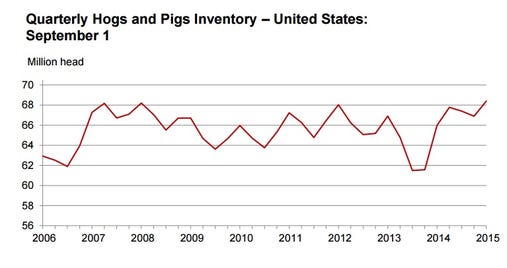

On Sept. 1, the USDA showed the largest U.S. hog inventory on record.

U.S. hog farmers are showing self-control during this expansion phase, taking cues from current economic fundamentals despite the all hogs and pigs inventory reaching a fresh new high since the quarterly U.S. estimates began in 1988. Chris Hurt, Purdue University agricultural economist, says historically high profits drive rapid expansion. Nevertheless, U.S. hog farmers recognize the excellent returns in 2014 were unusual circumstances and, therefore, they are cautious about expanding.

On Sept. 1, the U.S. herd inventory stood at 68.4 million head, up 4% from the previous year, reports the USDA National Agricultural Statistics Service. This highly anticipated report did not disappoint with figures coming in close to pre-report estimates by market analysts. Altin Kalo, market analysts for Steiner Consulting Group, says the report coming in close to expectations will most likely register as neutral tone when the markets open on Monday morning. However, the record high sow farrowings may be slightly bearish.

Breeding herd inventory

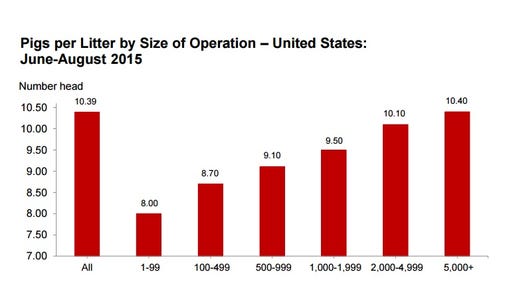

The breeding hog inventory was reported by NASS at 5.99 million head, up 1% from last year. From June to August 2015, sow farrowings penciled in at 2.94 million head, down 2% from 2014. Sows farrowed during this quarter represented 50% of the breeding herd. The average pigs saved per litter reached another all-time high at 10.39. Breaking those figures down by operation size, pigs saved per litter ranged from 8.00 for farms with 1-99 hogs and 10.40 for farms with 5,000 or more hogs (see figure below). For the June-to-August period, U.S. hog farmers weaned 30.6 million head, also an all-time high.

Looking at farrowing intentions, U.S. hog producers plan to have 2.92 million sows farrow from September to November 2015, down 2% from actual farrowings for the same time period last year. Intended farrowings for December to February 2016, at 2.87 million sows, are down 1% from 2015.

Victor Aideyan, senior analyst for Hisgrain Commodities, says the farrowing and pigs saved per litter estimates raise questions. For the last three reports, the pigs saved per litter have set new records. Also, the breeding herd has grown each quarter. Given both these factors, the report showed that hog producers are not farrowing all available sows and gilts. This is also confirmed by the relatively flat number for the under-50 pounds category.

All the same, Hurt says the pigs saved per litter illustrates that hog producers are back on the productivity train and are reaching some “victory over PEDV” for now.

Market herd inventory

Similarly, the market hog inventory at 62.4 million head also established a new high, climbing 4% over last year. Looking at the individual categories:

Under 50 pounds 20.3 million head, unchanged from 2014

50-119 pounds 18.0 million head, up 3% from 2014

120-179 pounds 13.1 million head, up 8% from 2014

180 pounds and over 11.1 million head, up 9% from 2014

Cashing in this harvest season

Although Hurt forecast 2015 profits close to breakeven for all costs (depreciation to labor), hog producers can take advantage of lower commodity prices during this harvest season. As an abundant crop of soybeans is anticipated, soybean meal should be at a more affordable price level. Hurt says late-September through the Columbus Day holiday is a good time to secure soybean meal as the price will reach its lowest price level during the harvest season. Likewise, hog producers should stockpile corn inventory as the crop is harvested. For the western Corn Belt, hog producers should take advantage of the expected large corn crop, driving basis levels lower. Hurt forecasts soybean meal to be lower in 2016, but corn prices to be in general 25 cents per bushel higher next year. As a result, Hurt estimates hog producers in 2016 to make a profit in the second and third quarters with modest losses in the first and fourth quarter.

About the Author(s)

You May Also Like