Crimes against humanity and other noted fouls

Best bet may be the seasonal decrease in pork production that will certainly be a welcome occurrence for pricing.

April 17, 2023

Folks, things are not happy in the worlds of pork production or processing and I do not see an obvious path that leads us out of the doldrums anytime soon. In this article, we will discuss both the why and the what, neither of which is very satisfying.

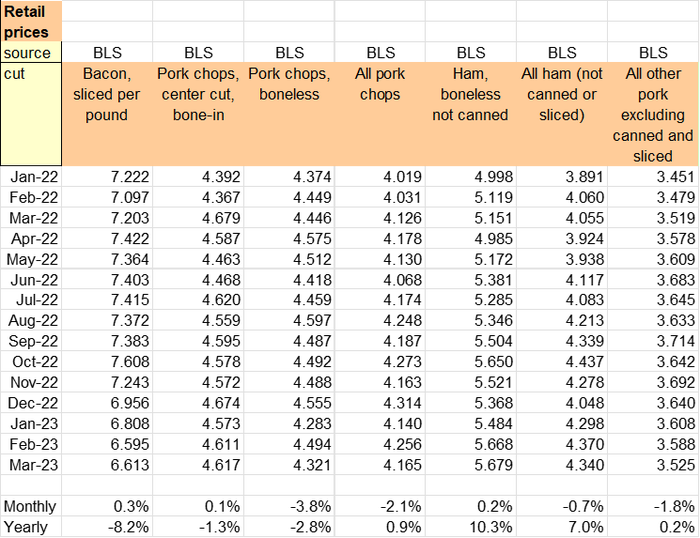

Our Dr. Meyer has raised the warning flag early and often in the disparity of the wholesale price of pork in relationship to the retail sector. Rather than repeating his words, I invite readers to review his most recent effort in this forum as a primer to where we are going today. The link is here: Pray for rain but keep on hoeing. The linked article does a good job of describing the "why" of our stagnant demand for pork at the wholesale level which portends low prices at the farmgate. To add a little fuel to this fire, attached is a table of retail prices from the Bureau of Labor Statistics.

Note that while your fortunes (and the profits of the packer) have waned, the retailer has been whistling through the proverbial graveyard without any recognition of the downstream distress. Prices at the retail level have remained historically high. This, in and of itself, is not a bad thing.

I am pleased that the consumer is willing and able to pay higher prices for our pork, I simply want some of those monies to flow to the folk that produce and process the product. I have previously embarrassed the kids that are with me in the grocery store when I have challenged the people behind the meat case with the discrepancy between the wholesale and retail price of the various pork products. I am not blaming the 18-year-old working the meat counter, he is there in a service role. We, as a consuming public, have a metaphorical voice that is represented each time we make a decision of how to spend our food dollars.

We also have an actual voice and I wonder what may happen if there are enough of us that verbalize the chasm between retail prices and wholesale values that, perhaps, that message is received and pork at the retail level becomes more attractive to consumers which allows more product to move which, in turn, allows some relief to the production and processing component? Maybe this is akin to verbalizing your displease of the driving habits of the car in front of you – they probably can't hear your mutterings while they cruise 10 mph below the speed limit in the left lane with their blinker perpetually flashing.

I think my approach may at least have more opportunity for traction if the kid in the meat counter hears from enough of us that he inquires of the manager of the case who may respond to his customer's request. Call it folly, call it exasperation, call it whatever you want if you do not agree with my approach. At least it is something of an effort to convey a message and it costs you nothing – sans, the tugging on your pantleg by the kids that want to stop embarrassing them.

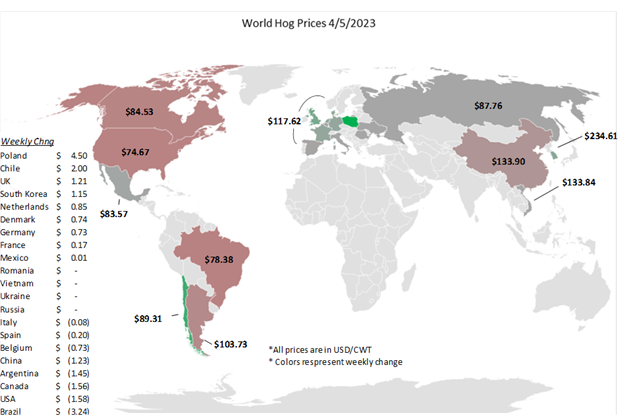

The current struggle is real and is not confined geographically or contained to the production sector. I was recently in a meeting where representatives from Asia, Europe and Latin America were also verbalizing the economic difficulty within their respective pork production sectors. The Asian market is experiencing losses in the $100/pig range, both Europe and Latin America are losing roughly $50-60 per pig. It is not just us.

The European situation may be described by a troubling statistic released from the German government that per capita consumption of all meat has fallen to the lowest levels since the government began tracking consumption in 1989. For comparison, German consumption of all meat is roughly 115 pounds per person, about 55% of what we experience in the United States. If the United States were to follow the same behavior, the fall from our current situation could be unpleasant. A recent article in The Economist (published in London) indicates that one of the most socially responsible thing we could do to "dramatically cut the carbon footprint of your diet" would be the reduction of meat, specifically beef. The struggle is real.

The table below indicates hog prices across the globe. The United States is generally a low-cost producer of pork and is poised to participate in the export trade if the economic condition of the world allows it. I am not holding my breath waiting for that to occur. Our best bet may be the seasonal decrease in pork production that will certainly be a welcome occurrence for pricing, I suspect it will not be the blessing that we are hoping for given the significant headwinds we are facing in several other facets that impact pork pricing.

The packing community is singing the blues, too. Note that north of the border, Olymel just announced the closure of their Vallee-Jonction plant citing a cumulative loss of over $400 million in the past two years. Closer to home, the HyLife facility in Windom, Minnesota is actively seeking a buyer after acquiring the plant in 2020. A press release indicated the potential closure of operations if a bonafide buyer is not identified in the near future. The financial distress is prevalent in the entire industry (excluding the retailer) up and down the pork production and processing industry, it is not contained by our borders, the world is experiencing a reset – these things generally take a long time to turn once they get a direction.

So what is a pork producer to do in the face of continuing losses and the prospect for more of the same? As unpalatable as this may sound, the opportunity to secure a small loss for your future production may be better than the financial picture when we get there. Historical spreads between summer prices and values in the fall (especially if we lose capacity of a currently running packing plant) may offer the best chance to establish a floor value while hoping for something better. We have strategies to execute in this environment, nobody is having much fun right now.

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals. Click here to contact the author.

About the Author(s)

You May Also Like