COVID-19 impact on finishing pig growth

Pandemic virus had a direct impact across the pork industry, especially on pig performance.

June 1, 2021

In 2020, the COVID-19 pandemic virus had a direct impact across the pork industry. This article will focus on two main areas: What was the 2020 performance when compared to prior years and what was the performance impact of slowing down pig growth?

Finishing closed group analysis was performed utilizing the MetaFarms Ag Platform with specific focus on the U.S. customers only. In the calendar year 2020, the U.S. MetaFarms customers had slightly more than 10,000 closeouts (10,122) with total pigs started of nearly 17,500,000. A finish group consists of pigs that will be on feed for 115 days, consume 5 pounds of feed per day, average 50 pounds as a starting weight and end weighing around 285 pounds.

In 2020, the COVID-19 pandemic virus had a direct impact across the pork industry when, in March 2020, packing plants started closing due to employee health concerns. The effect was immediately felt as cancellations of market loads created bottlenecks within the industry. Market hogs that were supposed to be sold were put on hold, which meant that sites that should be empty for new arrivals, still had occupancy. Pork producers scrambled to adapt to the unknown of when “normal” would return but knew that time was not on their side and actions had to be well thought out. As dock time availability became scarce, producers honed in on three main criteria: selling the heaviest hogs, maximizing capacities and slowing down the pig growth.

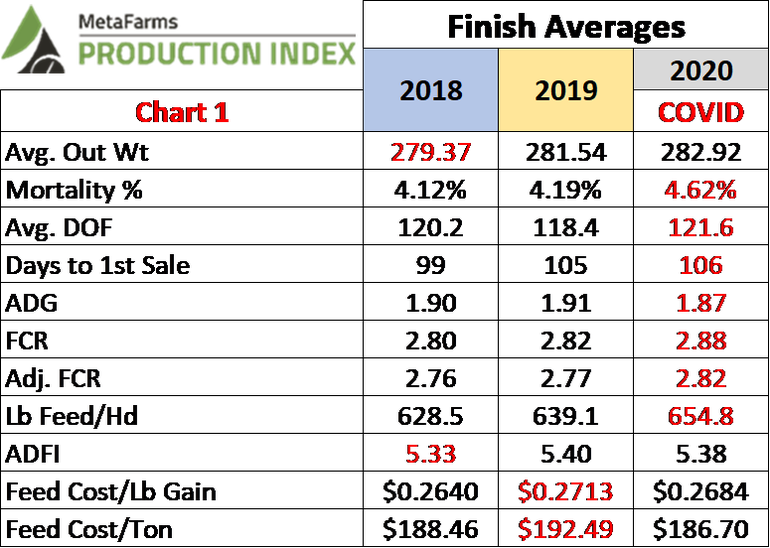

Chart 1 represents a three-year look at finishing closeout averages. As pig growth was slowed, the performance was felt in almost every metric. When comparing 2020 to 2019, pigs were on feed for 3.2 days longer which led to a heavier average out weight of nearly 1.5 pounds (1.38). A slower growth rate (ADG) of 0.4 and a worsening feed efficiency (FCR) by from 2.82 to 2.88 were also analyzed amongst the closeout data.

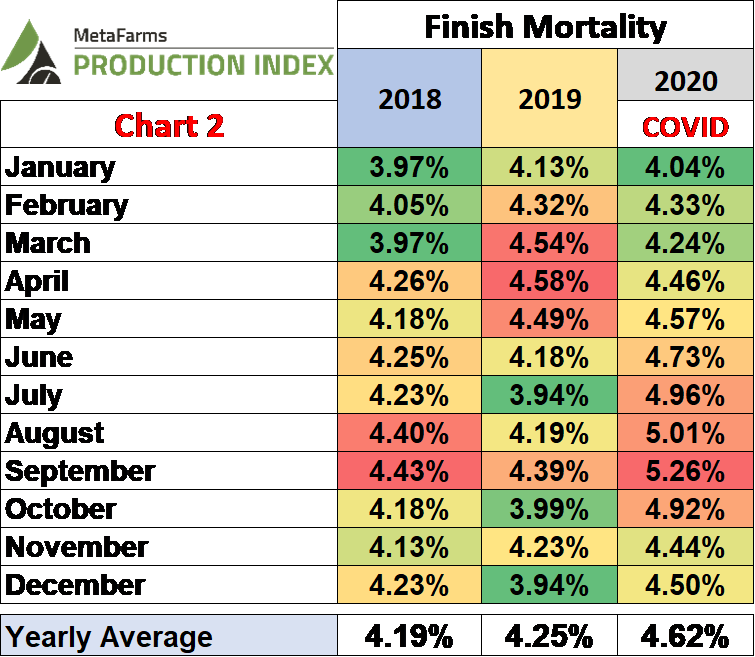

Chart 2 shows the monthly mortality percentage average from 2018 to 2020. When looking at the monthly breakdown, note that finishing groups are on feed for four months. So, with the plant closures occurring in late March 2020, the first closeout groups that would have been affected for more than half of the time on feed would be starting in June. All three years tell a different story of when mortality spiked. In 2018, the difference between the highest month and lowest month was 0.46% (11.5% change) whereas in 2020 the difference between the highest and lowest months was 1.22% (30.2% change). September 2020 mortality (5.26%) was the highest monthly finishing average since June 2015 (5.31%).

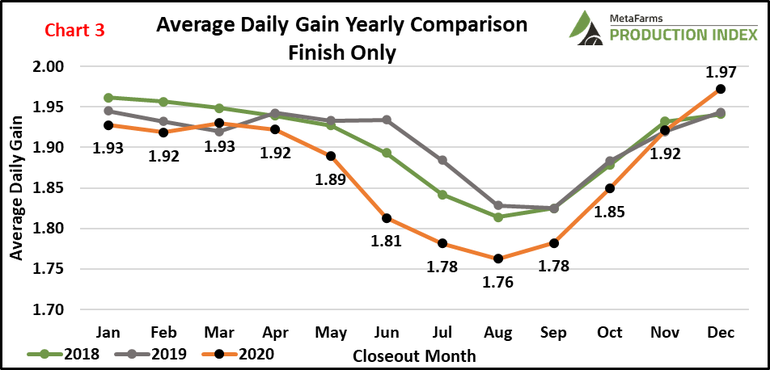

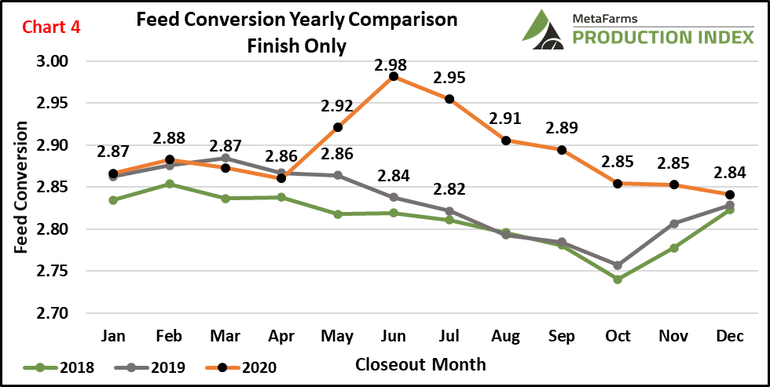

Charts 3 and 4 represent a three-year comparison analysis on the direct impact decisions to slow down pig growth. Summertime temperatures lead to the slower pig growth, as shown in chart 3. This is typically when finishing closeout average daily gains start to decline. June 2020 ADG dropped to 1.81, 0.12 (6.4% change) from the same period in 2019. Chart 4 shows how 2020 was impacted by feed diet changes along with a higher average mortality (see chart 2). Like ADG, June was the biggest outlier in comparison between 2020 and 2019, where in 2020 FCR increased by 0.14 (4.8% change) from 2019 (2.98 vs 2.84).

Feed expense is known as the biggest expense to produce a pig, with an estimated total expense ranging between 55-65%. For a finishing pig to grow 235 pounds (50-285 lbs) with the 2020 average feed cost per pound gain of $0.2684 (as noted in Chart 1), $63 would be the feed cost for that animal. Another way to look at the feed cost would be to take that $63 and divide it by the number of days on feed, 121 days. The cost per day to feed that animal is $0.52. That may not seem that expensive, but now take that daily rate and multiply it by 100,000 pigs. The cost and thus important focus on feed costs are imperative. Nutritionists constantly balance between lowering feed costs and balancing the proper diet for the age of the pig while also meeting or exceeding expected growth and efficiencies.

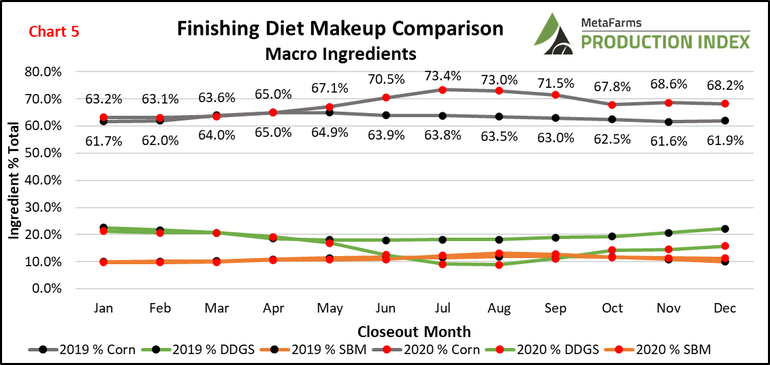

With the need to buy time for packing plants to open more shackle space, it seemed all but necessary to slow down the pig growth. Chart 5 depicts the yearly comparison between 2020 and 2019 for the three main feed ingredients, corn, soybean meal (SBM) and distiller’s dried grains with solubles (DDGS). It should be noted that while finishing diet adjustments started to occur as soon as the plant closures started, the closeout analysis would not be shown until the May/June timeframe. Corn had the largest adjustment increase from 2019, where June through September accounted for over 70% of the diet. The largest percentage difference was in July when 2020 saw 9.6% increase (15.6% change). To accommodate the increase in corn, nutritionists decreased the usage of DDGS, most notable in July 2020 where percent DDGS was down to 8.8% from 2019’s 11.9% (26% change). Soybean meal fluctuated in 2020 starting off the year with a 9.7% usage to the high point in August at 13.1% (35% change).

Can you think of a time where a nutritionist was given the task to slow down the growth of a pig? How crazy that concept would have been perceived before last year? But then how crazy would it have been able to not be able sell your pigs? An ancient Greek physician is believed to have first said, “desperate times call for desperate measures.” Desperate times we were a havin’. For the pork industry, 2020 will be remembered as a time to expect the unexpected, to think outside the box and to preserve in good times and bad.

MetaFarms Analytic Insights were used to provide the context and trends for this article. If you would like to see an analysis of how COVID-19 impacted your marketing & finish mortality, or if you have suggestions on production areas to write articles about, please e-mail or call us.

If you have questions or comments about these columns, or if you have a specific performance measurement that you would like us to write about, please contact Bradley Eckberg or Ron Ketchem.

Sources: Bradley Eckberg, MetaFarms, who are solely responsible for the information provided, and wholly own the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

You May Also Like