COOL ruling brings economic consequences

June 15, 2015

The World Trade Organization Appellate Body has delivered its final decision on the U.S. mandatory country-of-origin labeling requirements for meat. For the fourth time, the WTO has found mandatory COOL to be non- compliant — a decision that was not a big shock to the meat industry.

The United States appealed the WTO October 2014 decision that found the U.S. COOL law discriminates against Canadian cattle and pigs and Mexican cattle. Under the mandatory COOL program, all meat sold in the United States must be labeled with the country where the animal from which it was derived was born, raised and harvested.

The final answer from the WTO paves the way for Canada and Mexico to place retaliatory tariffs on U.S. food, agriculture and manufactured goods. During the debate of the 2002 Farm Bill, the National Pork Producers Council and correlated U.S. food, agriculture and manufacturing organizations and companies warned the meat labeling law was not consistent with WTO rules and other countries would challenge it. It provides an open invitation for retaliation, an invitation accepted by Canada and Mexico.

“The amended COOL measure, which causes Canadian and Mexican livestock and meat to be segregated from those of U.S. origin, is damaging to North America’s supply chain and is harmful to producers and processors in all three countries,” said Canadian Minster of International Trade Ed Fast and Agriculture Minister Gerry Ritz, along with Mexico’s Secretary of Economy Ildefonso Guajardo Villarreal and Secretary of Agriculture, Livestock, Rural Development, Fisheries and Food Enrique Martinez y Martinez in a joint statement. “In light of the WTO’s final decision, and due to the fact that this discriminatory measure remains in place, our governments will be seeking authorization from the WTO to take retaliatory measures against U.S. exports.”

In 2013, Canada issued a preliminary list targeting an extensive range of commodities and manufactured products that would affect every state in the United States. On the lengthy list that ranges from bakery goods to furniture is live swine and fresh pork.

On the other hand, Mexico, beyond the media statement, has not officially organized its retaliation tariff agenda. However, based on the cross-border trucking dispute of 2011, the country is not timid to impose such actions. Chad Russell, U.S. Meat Export Federation regional director for Mexico, Central America and the Dominican Republic, sat down with Mexican trade officials prior to the final WTO decision. “Mexicans reserve the right to retaliate if that right is given to them from the WTO,” Russell said.

Consumer perspective

Originally, the requirement for the origin of fresh fruits and vegetables, fish, shellfish, peanuts, pecans, macadamia nuts, ginseng, meat and poultry to be disclosed on labels in the United States was stipulated in the 2002 Farm Bill as amended by the 2008 Farm Bill. Supporters of mandatory COOL claimed that consumers have the “right to know.” Despite the challenge from Mexico and Canada less than one year after the rule took effect, the proponents of COOL did not back down, even though industries impacted asked repeatedly for a correction.

Interestingly, since the mandatory COOL rule went into effect, consumers really have not noticed the change in meat labels. Last November, Oklahoma State University’s Food Demand Survey (FooDS) asked Americans about information on the meat label that is required by the government. Only 22% of the consumers surveyed thought that it was required to label where an animal was born, whereas 28% thought the country the animal was raised needed to be disclosed, and 24% thought the country where the animal was slaughtered needed to be printed on the label.

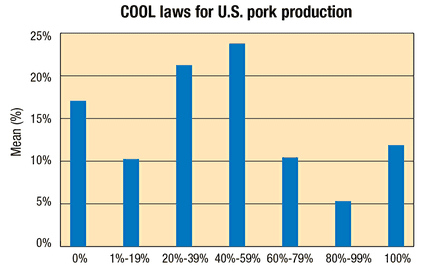

Going a step further, the survey asks participants: “What portion of pork products consumed in the United States is covered by current mandatory country-of-origin labeling laws?” Only 12% of American consumers answered that all pork products were required to be labeled. In contrast, 17% thought no pork products were required. The remainder fell in between as indicated in the chart on Page 24.

mandatory country-of-origin labeling laws?” Only 12% of American consumers answered that all pork products were required to be labeled. In contrast, 17% thought no pork products were required. The remainder fell in between as indicated in the chart on Page 24.

The final question tackles the one answer all pork producers want to hear — the willingness to pay according to country-of-origin labeling. Although the question was centered on a 12-ounce boneless rib-eye steak, the consumers’ response does give a glimpse into meat purchasing motivation based on label claims. As stated in the FooDS results, consumers were willing to pay 89 cents more for beef born in the U.S. and $1.05 more for beef born and raised in the U.S. than for beef born and raised in Canada.

Still, the fact is mandatory COOL does not provide beneficial health or safety information to consumers and leads to net economic costs. Agricultural economists Glynn Tonsor and Ted Schroeder from Kansas State University and Joe Parcell from the University of Missouri conducted a study commissioned by the USDA on the market impacts of COOL.

The team of researchers note that consumers desiring the COOL information receive some value. However, there was not sufficient evidence to conclude that benefits translate into a measurable increase in consumer demand for meat. Moreover, mandatory COOL implementation increases the cost of production throughout the entire supply chain.

Utilizing economic models, the researchers quantified prices and meat quantity estimates over the next 10 years based on the 2009 and 2013 rulings. Since some meat products are sold in restaurants, only 16% of the pork is covered by mandatory COOL.

A closer look at the 2009 economic impact shows economic loss of $1.31 billion to the pork industry. In fact, Tonsor notes that pork demand must grow by 5.6% to avoid an adverse economic impact. Over the 10 years, higher retail prices and lower quantities each year will result in net losses of $1.79 billion to pork consumers.

The 2013 policy change required meat labels to specifically state “Born in Canada, Raised and Slaughtered in the U.S.” vs. “Products of the U.S.” The researchers looked at this rule change economic bearing separately. The additional impact was a $403 million loss to the pork industry and consumer losses of $428 million for pork.

In addition, pork demand would also need to climb 1.6% over the 2009 estimates to evade harmful economic impact.

Economic cost of revenge

According to the Congressional Research Service report, it has been estimated that retaliation by both Canada and Mexico could reach between $1 billion and $2 billion in exports from the United States.

Realistically, the true economic cost will be contingent on the actual size of the tariffs and how long beef and pork remain on the list, notes Steve Meyer, Express Markets Inc. Moreover, the impact on the U.S. pork industry is different for Canada and Mexico.

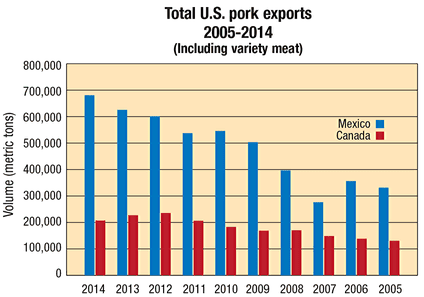

For Canada, Meyer explains the country produces more pork than the 35.2 million citizens can eat. Since tariffs will raise the price tag for U.S. pork imported into Canada, the amount of pork crossing the northern border will be reduced, and the gap will be filled by domestically raised pork. Canada was the fourth-largest market for U.S. pork in 2014 with over 207,362 metric tons ($9 billion) shipped, down 20,000 mt. On the bright side, Meyer says less available Canadian pork for export could result in an opportunity for the United States to gain those export quantities.

Furthermore, he adds, “I don’t think Canada’s tariffs will cause much damage. If they do, they will drive U.S. hog prices lower and thus drive Canadian hog prices lower, since our market determines their prices with the only differences being transport costs and the exchange rate.”

At the end of the day, the retaliation actions could actually backfire and most likely not benefit Canada’s economic position.

Meanwhile, Mexico is a different story because it has a pork deficit. Last year, the U.S. shipped 680,843 mt of pork at a value of $1.6 billion to its leading export market, Mexico. In fact, the amount of pork exported by the United States has vastly grown over the past 10 years. Looking at last year’s figures, 6% of the U.S. carcass weight production last year was exported across the southern border. For variety meats, Mexico took 31.8% of all U.S. pork variety meat exports in 2014.

While Meyer believes that a tariff will not stop the majority of the pork to be purchased by Mexico, a 2% decline could have a large influence on U.S. hog prices. He estimates that drop in volume could equal a 4% to 6% decrease in prices.

Still, Russell explains that Mexicans were in similar situation during the North American Free Trade Agreement negotiations when their trucks were not allowed to cross the U.S. border. He warns that Mexico will probably not be as tolerant as during the cross-border trucking dispute.

“The Mexicans were extremely patient in exercising that right to retaliate,” Russell says. “My sense is that they will not be as patient this time as before.”

Historically, political pressures from Mexican pork producers will most likely increase the chance of pork being on the top of the list for tariffs. Further, a tariff on U.S. pork products will only allow Canada to increase market share in Mexico due to a lower price tag. Russell says the only time U.S. pork exports to Mexico dipped since 2008 was during the cross-border trucking dispute.

A call for repeal

The NPPC, along with other members of the COOL Reform Coalition, has been urging Congress to repeal the U.S. meat labeling law, but after the final WTO ruling the voices became stronger.

“Unless Congress acts now, Canada and Mexico will put tariffs on dozens of U.S. products,” says NPPC President Ron Prestage, a veterinarian and pork producer from Camden, S.C. “That’s a death sentence for U.S. jobs and exports. I know tariffs would be financially devastating for the U.S. pork industry, and I’m sure they’ll have a negative impact on a host of other agricultural and non-agricultural sectors.”

Canada and Mexico also echo the support to repeal the meat labeling rule. Nevertheless, the countries will most likely formally request the authorization from the WTO to retaliate against U.S. products. During that process, each will have to demonstrate the damage occurred due to the United States’ policy. Russell says that process could take until September.

“WTO-authorized retaliation by two of the largest U.S. trading partners could result in very substantial tariffs affecting multiple sectors of the U.S. economy, threatening the livelihoods of American families who depend on U.S. manufacturing,” says Linda Dempsey, vice president of International Economic Affairs at the National Association of Manufacturers and co-chairwoman of the COOL Reform Coalition.

Immediately after the WTO ruling announcement, House Agriculture Chairman Michael Conaway, R-Texas, introduced H.R. 2393, a bill to repeal mandatory COOL requirements for beef, pork and chicken products. The House Agriculture Committee did pass the bipartisan bill in the first week of introduction.

“In light of the WTO’s decision and the certainty that we face significant retaliation by Canada and Mexico, we cannot afford to delay action. That’s why I was joined by 61 of my colleagues in introducing H.R. 2393, a bill to repeal mandatory COOL for beef, pork and chicken. This bill is a targeted response that will remove uncertainty, provide stability and bring us back into compliance. I appreciate the support of so many colleagues on both sides of the aisle as we work quickly to ensure our economy and a broad spectrum of U.S. industries do not suffer the economic impacts of retaliation,” Conaway says.

Granting the quick response from Conaway, the legislation still faces challenges and a long legislative journey. It is quite possible the tariffs will be implemented quicker than Congress acts.

“My worry is that the process of removing the tariffs will be as time-consuming as has been the process of imposing them,” Meyer says.

You May Also Like