Consumer demand critical to keep hog farms in black

Will consumer level demand strengthen again and allow a rally for wholesale and hog demand?

February 13, 2023

For any of you that have noticed that my turn at the weekly National Hog Farmer market column has more-or-less devolved into a monthly update on demand, I apologize for the monotony. But the reason I harp on the subject every month is that it has been critical to keeping most hog farms in the black over the past two years.

I have warned since last fall that there were signs that this tremendous wave might be ebbing and I'm more concerned about that now than I was then, especially in the face of average hog production costs approaching and possibly exceeding $1 per pound carcass weight. Let's consider the most recent information.

December U.S. pork exports were better relative to last year but still low from a longer-term historical perspective. Total U.S. shipments for December were 561.3 million pounds, carcass weight. That's 5.6% more than last year and brings total 2022 exports to 6.337 billion pounds, carcass weight, 9.9% less than last year. The 2022 total represents 23.5% of total carcass-weight pork production, down from 25.4% in 2021. The record for share of pork production exported was set in 2020 at 25.7%. Note that none of these figures are adjusted for pork by-product shipments.

The reason that exports are important for considerations of domestic demand is, of course, that U.S. consumers will purchase whatever is not exported. With relatively small adjustments for the amount of product in cold storage, this "availability" will be taken off the market at some price. The price level, of course, depends on the relatively strength or weakness of demand.

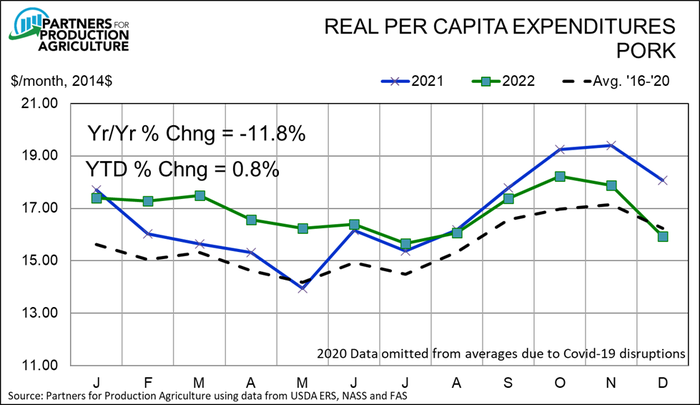

There has been little apparent weakness in pork demand beginning in 2019. Real per capita expenditures (RPCE) for pork, a measure of demand, increased by 3.7% that year followed by gains of 2.7% and 5.4% in 2020 and 2021. 2021 marked an all-time high for pork RPCE, breaking the previous record set in 2015.

And 2022 began with six out of seven months higher than their 2021 predecessors (see Figure 1). Then some cracks in the armor began to appear. Pork RPCE fell slightly short of its year-ago level in August and each month's year-on-year decline since then has been larger, culminating in a nearly 12% reduction in December. The 2023 total will still set another record but will do so by a scant 0.8%.

Readers need to realize that the 2021 comparison months for October through December aren't exactly chopped liver. In fact, those months from 2021 are the three highest pork RPCE months on record so a shortfall may be akin to comparing a very good game by the Eagles to a very good game PLUS by the Chiefs.

My problem is the progressively larger year-on-year reductions and the clear softening of demand at the wholesale and farm levels (more in a moment) that have accompanied them and, I think, continued past the Dec. 31 cutoff of the data you see in Figure 1.

What is the culprit? Or are there culprits? Front and center on my list is inflation. I have talked for some time that the impact of inflation would be cumulative, draining more and more spending power from consumers and likely reducing demand for all goods at some point unless wage growth could keep up. It has not and I think we are seeing the impact. Consider that the demand for beef, the most expensive meat protein, was down 2.1% in 2022 while demand for chicken, the least expensive meat protein, gained more than 10% for the year. Do you reckon real income levels may have played a role?

In addition, the shift in behavior that was forced on consumers by the COVID-19 disruptions may have worn off. I never really expected that the forced change from foodservice to home preparation would remain in its entirety so I believe some slackening is behind this softening of beef and pork demand. The question now is whether we can hold any of those gains and, if we can, just how much.

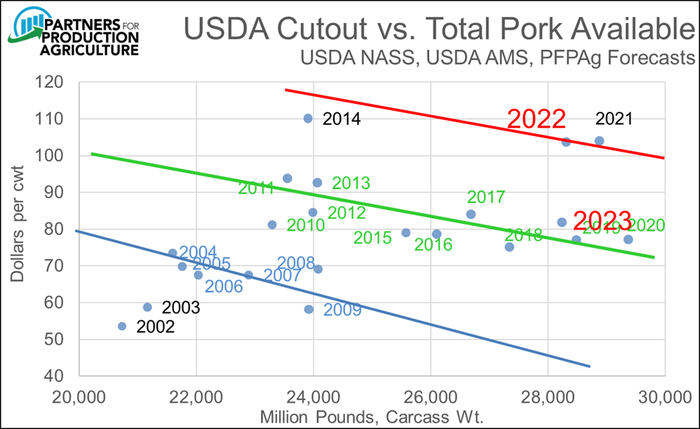

Softness of wholesale prices has suggested some challenges at the consumer level for a few months but has become more severe since the beginning of 2023 (see Figure 2). Figure 2 is a scatter of historical pairings of USDA's estimated pork cutout vale and total pork availability. That quantity is used because both export and domestic wholesale buyers compete for the total supply of carcass weight pork produced each year. Each dot in Figure 2 would represent the intersection of a supply curve and demand curve for the respective year. You can see that clusters of past years fall near negatively sloped lines that would represent shifting demand relationships.

The strength of wholesale demand in 2021 and 2022 is clear as both years lie well above and to the right of past relationships. But look at where my forecast for 2023 lies based on January wholesale prices, my forecast of 2023 total pork availability and historic wholesale value -quantity relationships. Current wholesale pricing suggests that wholesale demand – at least for the moment – is back to pre-2021 levels.

Readers must realize that this downward shift is not set in stone for 2023. Far from it! It simply says "If current conditions remain, this is what will happen." The key is "current conditions." They can indeed change and we witnessed a dramatic rally just one year ago. Wholesale demand was weak in early 2022 but came back strong and gave us strong prices through the summer months.

The question is: Will consumer level demand strengthen again and allow a rally for wholesale and hog demand? How big will that rally be? Or, will the relative weakness we've seen in Q4 continue into the new year?

Current lean hogs futures prices for contracts from April forward are significantly higher than the 2023 scatter observation in Figure 2 would suggest. I know those futures prices offer little if any profit at present, but I've heard that a small loss beats a big loss every day. It's worth thinking about, especially with products and strategies available that will allow for higher prices to be realized should a 2022-esque rally materialize.

About the Author(s)

You May Also Like