ASF-driven rebound makes marketing difficult

At March 1, by our calculations, the average producer was losing about $30 per head. As of last week, that same producer was making $28 per head.

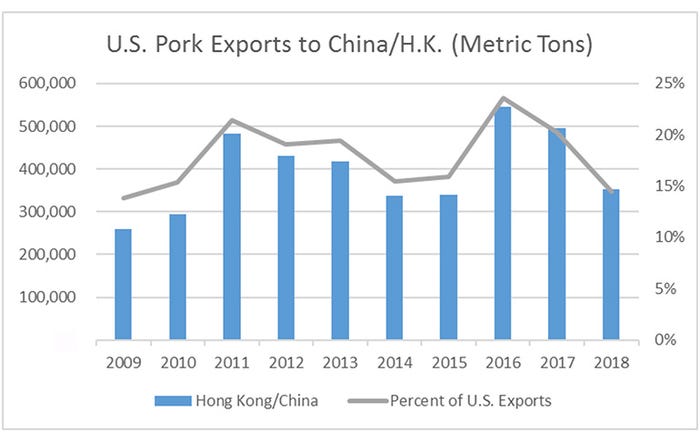

The impact following the spread of African swine fever to southeast Asia is the most significant event in the history of the global pork sector. The losses of pigs and herds in China, and now in Vietnam, are becoming staggering numbers as the disease continues to spread in that area of the world. By year-end, losses in China are expected to result in a 30-40% reduction in pork production. To put that in perspective, China produced 53.4 million metric tons of pork in 2017, about 48% of the world’s total pork supply. If the reduction in Chinese production reaches 40%, reduction in the world’s pork supply would amounts to 19%. The loss in global meat supply would be close to 8%.

This is going to have a profound impact on global protein. We have seen the impact in our pork markets over the past six weeks as the impacts of speculation, staging and sales of pork abroad start to escalate. The realization that global pork exports from all countries is about 8.5 mmt compared to reduction in pork supply in China alone expected to be over 20 mmt. This void in filling protein demand in Asia will not be filled by pork alone and will impact beef and poultry as well.

U.S. pork producers have experienced an increase in market price over the past six weeks that we haven’t seen before. Even in 2014 when piglet losses drove our markets to record highs, the market didn’t run as fast as it has over the past six weeks. At March 1, by our calculations, the average producer was losing about $30 per head. As of last week, that same producer was making $28 per head.

The rapid increase in futures prices and the dynamics of the future perspectives make marketing decisions very difficult. On one hand, you could easily build a case for much higher pig prices, based on the potential demand for pork globally. On the other hand, risk of an export-interrupting disease entering the United States would be devastating.

I believe that laying some of that risk off is a prudent thing to do given the extreme downside risk and the belief that this is a long-term issue in countries that have ASF and lack the biosecurity to successfully rebuild the industry.

Weekly pork exports to China were reported at over 77,000 metric tons in the first week of April alone.

Source: Kent Bang, Compeer Financial, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like