Allocating capital for hedging as risk management

Hedging strategies, such as trading futures and options, require maintaining performance bonds, and these positions can become quite capital intensive. Moreover, longer-term positions can tie up capital for an extended period of time.

For most agriculture producers, capital is an asset in limited supply. Hedging strategies, such as trading futures and options, require maintaining performance bonds, and these positions can become quite capital intensive. Moreover, longer-term positions can tie up capital for an extended period of time. Even strategies that are less capital-intensive require producers to deposit and maintain funds in a brokerage account until the positions are closed out and converted to purchases and sales in the local cash market. That’s why successful, competitive agriculture operations make it a priority to ensure they are using their capital efficiently. With that in mind, we examine how producers can optimize their capital and take these considerations into account as part of their risk management plans.

Some producers may avoid futures and options altogether out of fear that margin calls could drain capital reserves, relying exclusively on the cash market for their risk management. But the futures and options market offers valuable tools for capturing attractive forward margins, and most lenders are willing to extend capital to fund a client’s hedging activities, particularly when they know it is part of a thoughtful plan aimed at securing an operation’s profitability. In some cases, these lines of credit can be in addition to – and distinct from – operational lines of credit, so they don’t inhibit the operation’s ability to address basic expenses like salaries and input costs.

Regardless of how your credit lines are structured, if you rely on a lender to gain access to the liquidity you need to fund your hedging activities, it is important that both of you understand the impact of those hedges on your net profitability. For example, you might be short on hogs in the futures market, while simultaneously long on corn and soybean meal contracts as a way to secure an attractive feeding margin. As a borrower, you should be able to demonstrate to your lender the value of those positions as the market moves, by connecting them to the resulting change in your projected forward margins relative to the open market.

Get more INSIGHT: Download 6 Ways to Manage Risk on your Hog Farm now!

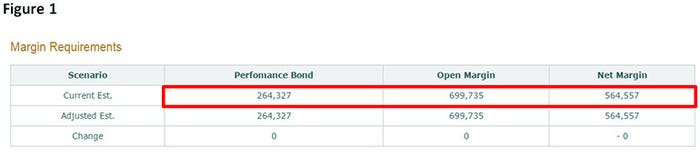

We can illustrate this connection by looking at hypothetical scenarios using a capital stress testing tool, such as CIH’s capital monitor. Figure 1 shows a hypothetical hog operation that finishes around 89,000 head annually. They are projecting and actively managing profit margins for the current spot Q2 period, as well as for deferred marketing periods through Q2 of 2018. About 30% to 40% of their risk exposure is currently offset through hedge strategies made up of a combination of futures and options positions. The operation is projecting that these positions will generate an effective net profit margin over the next year of $564,557. We can subtract the open market margin of $699,735 from that net margin to determine the present value of the positions, which is negative $135,178. In addition, we can see that $264,327 of capital is currently tied up in performance bond requirements.

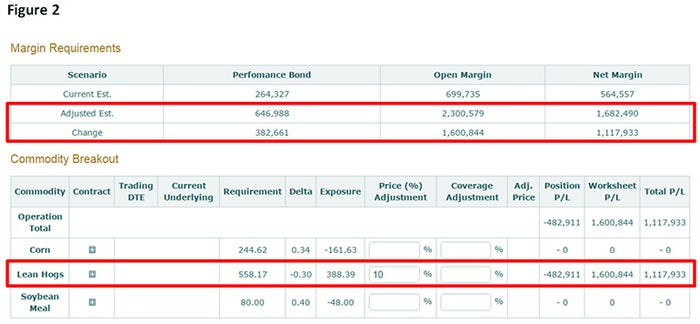

As the market moves over time, the projected profitability, as well as performance bond requirements, will change. Let’s say hog prices rise 10% across all contracts that are currently hedged. This scenario is illustrated in Figure 2. The net margin almost triples to $1,682,490. Since the open market value has also risen, to $2,300,579, we know that the value of the open hedges has dropped by a further $482,911 and is now negative $618,089. At the same time, the performance bond requirement has also increased by $382,661 to $646,988.

If prices remain at current levels, the hog operation will be able to secure margins of $1,682,490 over the following year. Although the hedge position loses value as hog market prices rise, the operation participates in 70% of those increases. This improvement can be seen by the change in the operation’s net margin, which increased by $1,117,933 as the open market margin rose by $1,600,844.

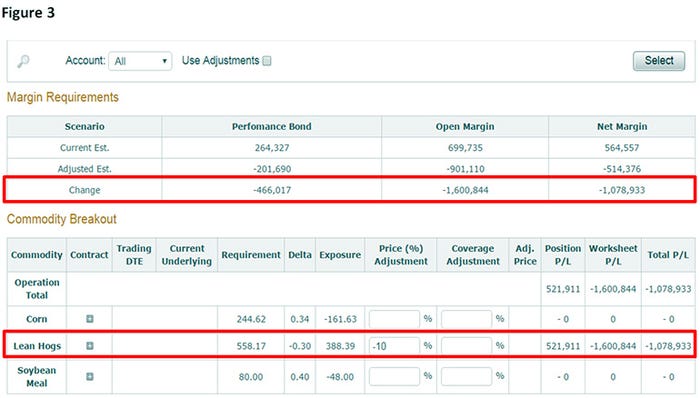

Of course, price changes can go either way. Figure 3 illustrates the scenario where hog prices go down 10%. In this case, the short hog position gains in value by $521,911, and performance bond requirements also go down, resulting in a $466,017 surplus in the brokerage account. However, the net margin deteriorates by $1,078,933 as 70% of the total hog inventory was unhedged and exposed to the lower prices.

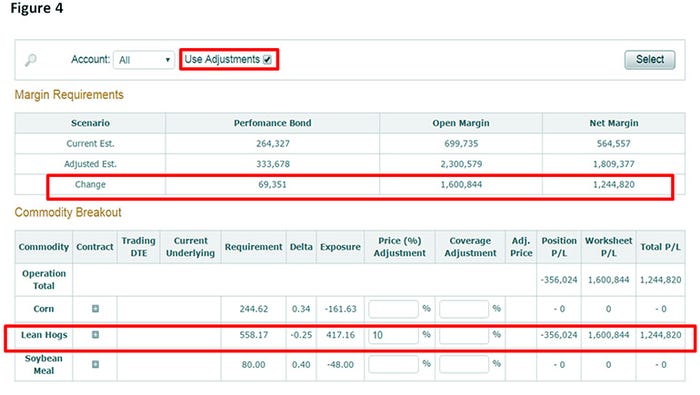

As the market moves, a lot of capital can be tied up in unrealized hedge losses and performance bond requirements. Producers can mitigate the cost of capital while still protecting margins. For example let’s look again at the scenario shown in Figure 2 where hog prices increase 10%, and the position became capital intensive. The producer could have purchased call options against some of the upside exposure on the short hog futures.

Figure 4 illustrates this adjustment. Comparing the performance bond requirements and P/L figures to those of Figure 2, we see that while the hog position will still lose money from the higher open market prices, the loss with the calls is smaller than without. An additional $356,024 of negative equity accrues to the current position value of negative $135,178, compared to an additional loss of $482,911 in the earlier scenario. Also, because the purchased call options offset much of the risk on the short futures positions, the added performance bond requirement is significantly smaller: $69,351 versus $382,661.

Some producers may not be comfortable with the performance bond exposure on hedging positions, or would rather allocate their limited capital elsewhere – such as investing in upgrades to their facilities or expanding their operations. These producers might want to consider forward contracts with packers or swap contracts with a financial intermediary, which might allow them to protect profitable margins without tying up capital. By contracting directly with a counterparty, the producer doesn’t need to address performance bond requirements to initiate the contracts or maintain capital in an account to address daily settlement procedures as prices fluctuate.

While these contracting methods can free up capital to allocate elsewhere, they are not without other costs and risks. Forward contracts with a packer make the hog producer captive to that packer’s basis upon delivery, which may or may not be competitive with other alternatives in their local market. Swap contracts typically cost more to execute than similar strategies on the exchange through the producer’s own brokerage account. Also, depending on the intermediary, there might be additional costs or limits on adjustments that can be made to an initial strategy at a later date. Moreover, with either forward contracts or swaps, there is a counterparty risk associated with the single settlement procedure upon delivery or expiration.

Despite their limitations, swaps and forward contracts can be valuable contracting tools, especially when used in conjunction with exchange-traded alternatives to create a more flexible strategy. As an example, a producer might lock-in a sale through a forward contract or swap agreement, and subsequently add price flexibility by purchasing call options in his own brokerage account. In this way, he need allocate only a limited amount of capital to address the opportunity cost of higher prices in a rising market.

As with any hedging strategy, there’s no one right way to allocate your capital. Determining the best solution for your needs will be a function of your operation’s margins and debt level, as well as a number of other considerations. But being able to quantify the impact of hedges on net forward margins can help facilitate communication with your lender and is a critical part of an effective risk management strategy.

If you have questions or would like more information about how to use your hedging capital most efficiently, contact CIH at 866-299-9333.

There is a risk of loss in futures trading. Past performance is not indicative of future results.

About the Author(s)

You May Also Like