3 reasons why Cuba will not bring a tsunami for U.S. pork exports

March 21, 2016

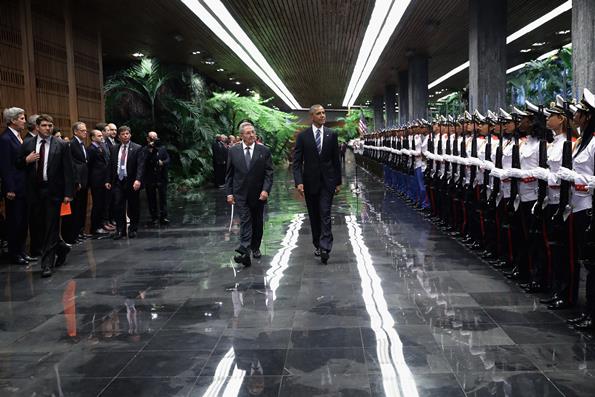

The news of President Barack Obama and his family’s historical trip to Cuba fills the headlines. There is no question his trip is significant, attempting to mend the diplomatic bridge. After the announcement by Cuba president Raúl Castro in December 2014 a willingness to restore the nations’ relationships, calming patterns have surfaced — lifting the travel embargo, reopening of embassies in Havana and Washington, D.C., and removing it from the list of nations that sponsor terrorism.

The minute Obama landed in Cuba, many hope that his visit will embark a wave of change and part a sea of economic opportunity for U.S. businesses, especially agriculture, by lifting the end of a decades-long U.S. trade embargo.

While no one would turn down a chance to sell its product in a new marketplace, it is important to acknowledge that Cuba will not bring a tsunami for U.S. pork and here is why:

1. Cuba is approximately the same size as Ohio

No matter how you measure it Cuba is a small country at 42, 426 square miles. Its islands are the home to 11.03 million people. Keeping it in perspective, Cuba is very close in size and population as Ohio. In comparison, Ohio has more people on less land (11.59 million people, 40,948 sq. miles).

2. Follow the money

The gross national income per person of Cuba is $5,880 with the take-home salary for the majority of Cubans around $20 a month or an average hourly wage of 12-15 cents per hour based on a seven-hour work day. This is about one-tenth of the average U.S. income.

Furthermore, the long-term economic growth could be hindered by Cuba’s aging population. The dependency ratio — the ratio of those not in the labor force (people younger than 15 or older than 60) to the working population — of the Cuban population will increase from 54.7 today to 67.7 in 2025.

Juan Triana Cordoví and Ricardo Torres Pérez note that “most growth in developing countries in the last 50 years has been the exact opposite, spurred by a growing youth population and workforce. Together, these elements coupled with the current economic model make setting Cuba on a sustainable long-term growth path an immense challenge.”

3. The Cuban economy is in rough waters

According to the U.S. Central Intelligence Agency, the estimated size of the Cuban economy is $121 billion. For years, the country has remained isolated, refusing relationships with the International Monetary Fund and World Bank. It owes large sums of money to Venezuela, Russia, China and other countries.

There is no denying a political wave of change is occurring in Cuba. However, the government structure is socialist and their economy is a Marxixt-Leninist state controlled by the Castro family. The government still remains the top employer.

In April 2011, the government did hold its first Cuban Communist Party Congress, which approved wide-ranging economic changes. While this policy shift ignited a cut to state government sector jobs, only 8.6% of the Cubans are classified as self-employed. This is an improvement from the 2.8% of Cubans in 2009.

Currently, the Cuban government only authorizes 201 categories of self-employment activities. Ted Piccone, senior fellow in the Project on International Order and Strategy and Latin America Initiative in the Foreign Policy program at the Brookings Institution, says “this creates a problem in forging economic ties since “U.S. importers can only engage in transactions with independent Cuban entrepreneurs” while Cuba fails to expand the list, excluding “huge swaths of Cuba’s human capital” from trade with the United States.

Still, Ernesto Hernandez-Cata, in his paper the Association for the Study of the Cuban Economy, estimates Cuba’s private and cooperative sector only accounted for 25% of gross domestic product in 2012. In addition, government investment has dropped 5% since 1989. Hernandez-Cata says a government investment of 9.1% “reveals one of the most disturbing aspects of Cuba’s recent economic history.” This investment is extremely low by international standards.

In reality, it makes more sense to focus on a new market adventure that will return on investment and move more U.S. pork quicker.

“Everybody is talking about Cuba, which is great. There is change happening but look at the per capita income and the population in Cuba compared to Argentina and Venezuela,” says Nick Giordano, National Pork Producers Council vice president and counsel of global government affairs.

Comparing the two countries, Argentina per capita income is $13,480 and political atmosphere is more favorable.

“Don’t get me wrong, we want it all but we are going to sell a lot more pork to Argentina than Cuba,” concludes Giordano.

You May Also Like