‘Black Monday’ impact on pork demand

August 31, 2015

How will the most recent version of “Black Monday” for equity markets impact consumer behavior and, more importantly, pork demand? That is a question on many producers’ minds this week and so it should be. The decline in stock markets around the world threatens to damage consumer wealth and attitudes. Both are important factors in demand.

Economic theory tells us that consumers optimize their well-being by purchasing alternative goods and services subject to their budget constraints – i.e.: the amount of money they have to spend. That budget constraint is driven primarily by income levels, but it can also be affected by borrowing or repaying debt and by the amount of wealth held by the consumer. That wealth can be in the form of cash or various assets including real estate, equities and debt instruments.

When the value of those assets falls, current incomes are impacted by the decline in dividends and other income, and by the impact of the valuation decline on future needs. An example would be consumers with retirement fund holdings changing their current spending because of a decline in retirement fund balance and a) the uncertainty that causes about the future and b) the potential need to increase current savings to make up for those losses.

A tale of the attitudes

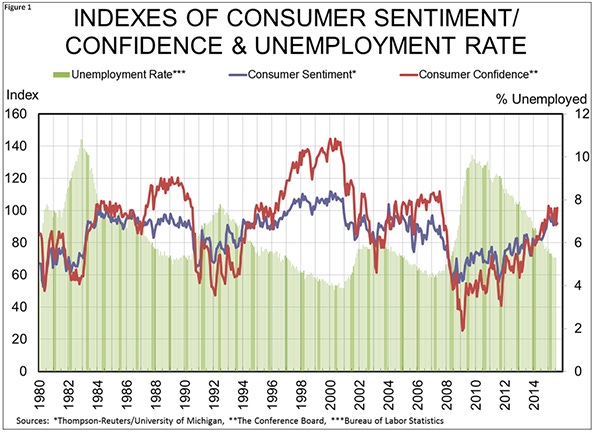

We monitor two indexes of consumer attitudes: The Conference Board’s Consumer Confidence Index and the University of Michigan’s Index of Consumer Sentiment. A long-term chart of the two indexes appears in Figure 1. We also include the monthly civilian unemployment rate just to demonstrate the clear negative correlation between attitudes and this measure of the health of the economy – or at least the labor market.

The negative relationship makes perfect sense, of course, since one would expect higher numbers of unemployed people to have more negative views of the economy and thus more negative attitudes.

It is clear that both attitude indexes have been on a roll since late last year. The current uptrend, of course, began in early 2009 when the Great Recession hit rock bottom and there was little way for consumer thinking to go but upward. Monthly index figures for both have been at their highest levels since 2007 for most of this year but have bounced around significantly in recent months. The 10-point swings for the Consumer Confidence Index are no surprise as it is clearly more volatile than the Index of Consumer Sentiment. It appears that both are in a “consolidation range” at present. Where might they go given this month’s macroeconomic challenges?

The University of Michigan’s discussion of this month’s Sentiment Index contains some interesting information about its linkage to equity values. The report states that 61% of all households own stock. In addition, 85% of those households in the upper half of income distribution and 91% of those in the top one-fifth of the income distribution hold stocks. The bottom line is that a broad swath of consumers is directly impacted by the stock market. Its impact on current behavior, however, is muted by the fact that many of the stock holdings are in retirement accounts.

UM claims that the stock market has a much smaller impact on spending than does the primary store of most consumers’ wealth – the value of their houses.

Recent break similar to '87

The report also points out that last Monday’s (actually Aug. 20-24) break is similar to the previous Black Monday selloff of Oct. 17, 1987. It notes that the impact was relatively short-lived. Note the sharp downward spike for both indexes in late-1987. Those points are for November. Both indexes bounced back nicely in December and were back to pre-crash levels by March 1988. They remained relatively strong until the 1990 recession associated with Iraq’s invasion of Kuwait and the resulting first Gulf War.

Do not be surprised to see a negative reaction of the indexes when September data are released. That becomes more likely if news regarding China’s economy continues to be negative. Equity markets have rebounded significantly from their post-crash levels of last Monday, and the September surveys will not be completed for at least a couple of weeks.

Only time will tell the impact of this latest round of international financial roiling, but we can definitely be thankful for one thing: Any deterioration of consumer attitude is beginning at a very high level. The past five years of improvements might come in very handy.

About the Author(s)

You May Also Like