Contract growing evolves as swine industry transitions to a new normal

With three new packing plants and the sow expansion that took place last year, along with additional sows being added this year, the barns will be built, but at what cost?

It’s been about 25 years since contract growing hogs overcame the stigma of working for someone else and not having that “ownership” component. Contract growing has become a great way for individuals to build equity. It keeps young, beginning farmers on the farm and provides supplemental income for their cropping operations. In some cases, it even provides full-time jobs for individuals using it as their entry into the hog business. From what I’ve seen, I would call it one of the best young, beginning farmer programs ever.

Changing over time

Much has changed since those early days of simply building barns and caring for someone else’s pigs. Along the way, growers discovered the true value of the nutrients readily available in the manure to reduce fertilizer costs and increase yields for their cropping operations. In many cases, the original growers leveraged this opportunity and kept adding barns and growing that segment of their business. This would not have happened if the business model wasn’t sound

In the 1990s, contract growing construction costs were approximately $160 to $170 per space to build a barn. The loans were set up to be fully amortized over 10 years and interest rates around that timeframe ranged between 7.5% and 10%. The cash flow generated covered all expenses, provided the manure value and returned about $4 to $5 per pig space for labor.

As contract growing continued to evolve, along with the consolidation of the swine industry, construction costs rose each year. Looking back at an old cash flow on a projection I received, construction costs were $165 per space. Construction costs today are around $340 per space, meaning there has been a steady 3.5% annualized increase in facility costs over the past 20 years. Granted, this is not all increased costs, but a combination of higher-quality barns being built, increased material costs and labor expense. Keep in mind; this is prior to any increased costs due to recent tariffs placed on incoming raw materials from China.

Cash flow

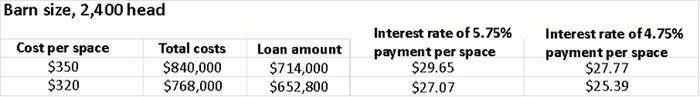

As an offset to the increased costs, interest rates continued to drop and loan amortizations increased from 10 years to 15 years, keeping the cash flows unchanged. In 1997 for analysis purposes, I used 9.5% as the interest rate. As recent as a year ago, we would use 4.5% to 5% as a range for the cash flow analysis. Now, you would need to add about 1% to that rate with the Federal Reserve indicating it will continue to raise rates in the new term. What does this mean to the cash flow if you were to construct a barn today? Let’s take a look at these examples.

(Remember these numbers are for illustration purposes only. Actual barn costs vary based on type of barn and materials built, geographic locations and current interest rate environment.)

With a loan amount of 85% of costs/appraised value, the principal and interest payments with added costs, along with a 1% increase in interest rate, will add $4.26 per pig space demands on cash flow. To keep the same cash flow under current barn cost and interest rate environment the loan amount would need to be at 73% of cost/appraised value or an additional down payment of $100,800 more per 2,400-head barn.

Below is the current May Lumber Futures contract from the CME. Since Jan. 1, there has been a 50% increase in lumber prices driven by several factors such as forest fires, economic growth increasing demand in the United States and uneasiness with the North American Free Trade Agreement discussions with Canada and Mexico.

What led to the continued inflation and costs of barns? Looking back 20 years ago, dramatic improvements have been made to grower barns. Initially, all barns were finish barns and most were curtain-sided. Today, the majority of barns have tunnel ventilation with very sophisticated controllers, LED lighting, larger office and shower areas, permanent load-out chutes, etc. One thing to do when considering building a new barn is to look at scaling back on some of the premium materials. If it doesn’t increase performance or lower production costs is it really needed? Will a Chevy suffice instead of a Cadillac?

This will be driven by the economic costs of building and continued need for facilities. Depending on your financial situation, building barns today could look more like a long-term equity investment and gaining value from the nutrients for the cropping operations. With three new packing plants and the sow expansion that took place last year, along with additional sows being added this year, the barns will be built, but at what cost?

Malakowsky is a senior swine lending specialist, with more than 20 years of experience at Compeer. For more insights from Malakowsky and the Compeer Swine Team, visit Compeer.com.

About the Author(s)

You May Also Like