A lot at play for the hog sector

Very strong prices could be in the cards if demand holds.

November 15, 2021

A few comments about several things.

First, USDA finally took action to restore the pork packing capacity lost when a Minnesota judge set aside the increased line speed feature of the New Swine Inspection System (NSIS). USDA announced a “one-year trial” for the nine plants that had been approved under NSIS and solicited plans from each plant on how they would implement the higher speeds. The plans have to include programs to assure worker health and safety that will meet OSHA scrutiny and must include input from the plant’s union or Work Safety Committee.

I understand that two of the plants might submit their plans as early as this week and that USDA has promised to review the plans quickly. No one will address a start-up date, but those statements lead me to believe that those two plants may get the go-ahead before the end of the year. That doesn’t mean they will be able to speed up by then as labor availability could still be an issue. But it is progress, and I have to compliment USDA on progress.

What does this mean? The slowdowns cost the industry about 85,000 head per week in throughput potential. Remember that the sector lost and additional 50,000-54,000 per week when Smithfield ceased slaughter operations at Gwaltney, Virginia. The Gwaltney plant is not coming back, but the restoration of the 85,000 head per week would push 5.4 days/week capacity back above 2.71 million head. If it could be operational tomorrow, it would allow packers to comfortably handle this year’s peak supplies.

But the big impact may be next fall. While nothing has been easy in the production segment since the beginning of 2020, ISU’s estimated costs and returns indicate that profits have been strong. The potential for strong profits next year (see below) and some cash in hand suggest expansion can’t be far away. Sow slaughter levels support that conclusion, but higher hog numbers will not likely come until Q3 2022. My calculations say we’ll need more capacity next fall, and the only way to get it is to speed up the plants. Will the “one-year trial” be successful? I’d bet on yes as everyone gains if they are. And we may not gain just the 85,000/week back but may gain more as two plants (Ottumwa, Iowa and Madison, Nebraska) that had not actually operated at enhanced speeds before the court ruling may do so by next fall.

This is all good news. I wish it had happened quicker, but I’m thankful it is happening now!

Our friend Dennis Smith argued last week for explosive prices in 2022 based on tight world supplies. His logic is sound as China has been a mess and has caused the EU to be a mess. And when things are a mess, supplies often decline. The question is one of degree and whether U.S. producers will stay where they are or expand. You know from above that I expect some expansion – primarily due to a return to robust productivity growth.

The bigger question in my mind is what happens to demand. It has been pretty unbelievable this year and is, in my opinion, the primary reason for the high pork and hog prices that have benefitted packers and producers this year.

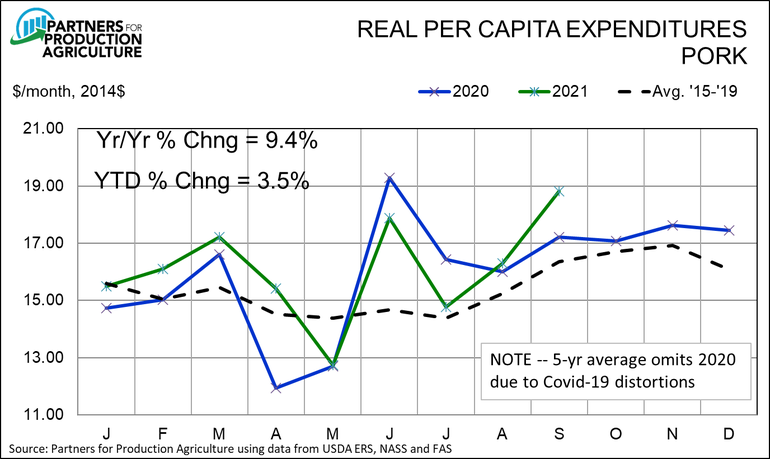

Figure 1 shows monthly real per capita expenditures on pork for the past two years. While comparisons to 2020 have frequently been difficult, we have been since August in a period when reasonable comparisons can be made – and they have been good, especially in September when pork RPCE was 9.4% higher than last year – and the second highest EVER.

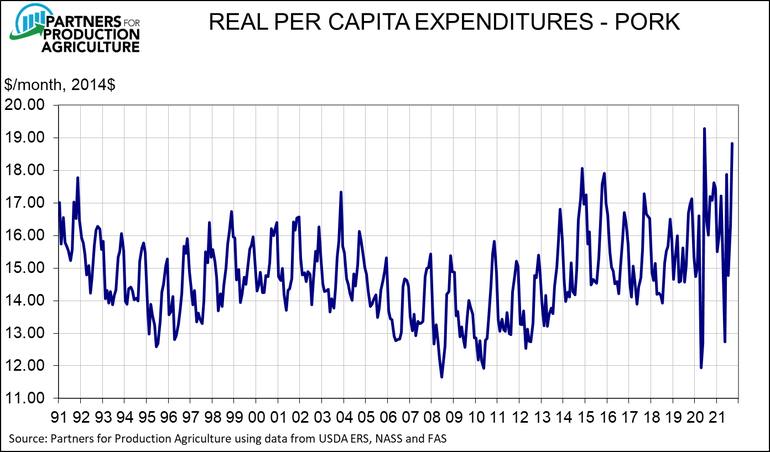

Year-to-date RPCE is up 3.5% on top of 2.5% last year. Though 2020 and 2021 have seen wild volatility, Figure 2 clearly shows that, on average, pork RPCE (which is a reasonable gauge of the status of pork demand) has been record high.

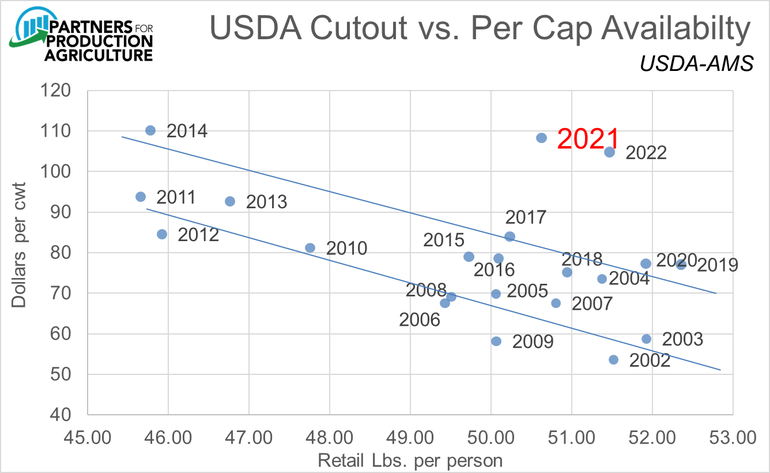

Figure 3, though, may be the clearest representation of just how strong pork demand has been this year. The chart relates the cutout value in nominal dollars to U.S. per capita availability/disappearance/con-suption. If you begin at the 2002 observation in the lower right, you can see that from 2002 to 2013, wholesale pork value increased when supplies decreased and declined when supplies increased. The only exception is 2004 when cutout values jumped roughly $13/cwt. (about 22%) on a supply reduction of just 0.5 lbs. per person (roughly 1%). That implies a surge for demand and for good reason: the Adkins high protein/low carb diet was all the rage in 2004.

Then in 2014, the PEDV supply scare drove prices to record highs. Subsequent years saw lower price but not as low as history would suggest they should have been given higher quantity offerings. Note that the price in 2017 was sharply higher than those of 2005 and 2009 even though per capita availability was about the same. The same is true of 2019 and 2020 versus 2003. It appears that pork demand shifted upwardf in 2014 and remained at that higher level.

Now look at the P-Q relationship for 2021. Off the charts—and I think the primary driver for all of the good things that happened this year. Should that new relationship hold, I would put 2022 average cutout values near $105 with per capita availability at about 51.4 pounds per person.

Can this new and higher demand relationship hold?

First, let’s get one thing clear: retail prices are high because consumers are paying them, not because they are being forced to pay them. High prices are a feature of and the result of strong demand. Costs can drive prices high over the long run since prices must cover all costs eventually. But the critical feature of cost-driven inflation is lower output. The U.S. pork sector has not lowered its output per person anywhere near enough to conclude that costs are driving these higher prices.

Second, the real world doesn’t agree with theory on a major feature of pork demand: income doesn’t drive it. Theory tells us that higher incomes mean higher demand for goods. That should especially hold true for a higher-cost good like pork, right? Well, it doesn’t. I have tried about every income variable you can think of (GDP, Per cap disposable income, household income, you name it) and can’t find one that is a significant and positive predictor of pork prices. Maybe I’m modeling wrong, but I can’t find it.

The good part of that is that any slowdown in the economy or government payments may not drag pork demand much. I think they will impact beef due to its high cost and chicken due to its high exposure in restaurants, but the data tell me they won’t hurt pork.

We’ll see if this demand surge lasts. If it does, very strong prices could be in the cards. If it doesn’t, things could get much softer in 2022. f

About the Author(s)

You May Also Like