Tight marketing margins cause for hog price jump

This desirable situation is not likely to last much longer. As we move out of summer, hog slaughter will increase which is likely to cause the retail pork price to decrease and allow marketing margins to increase.

The average live price for 51-52% lean hogs during June was $60.61 per hundredweight, up $10.15 from the month before, up $2.19 from June 2016, and the highest average hog price for any month since December 2014.

Why such a high hog price? An increase in retail pork prices helped, but mostly the jump in hog prices was due to tighter margins between the producers and consumers.

The average retail price of pork was $3.756 per pound in June. That was up 2.8 cents from May, but down 1.4 cents from June 2016.

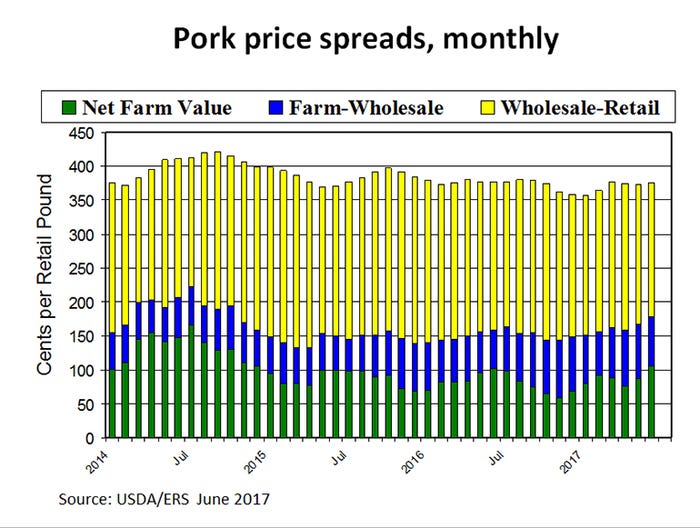

The June farm-wholesale price spread was the lowest since February. The wholesale-retail spread was the lowest since July 2014. The combined farm-retail price spread shrunk in June to the lowest level since May 2015. Because of these tight margins, the farmers’ share of retail pork value in June (28.1%) was the highest since October 2014.

In summary, compared to a month earlier the retail price of a pound of pork in June was up 2.8 cents, the wholesale-retail spread was down 7.4 cents, and the farm-wholesale spread was down 7.5 cents for a total improvement for hog producers of 17.7 cents per retail pound of pork. This combination drove the $10.15 per hundredweight increase in live hog prices compared to the month before.

This desirable situation is not likely to last much longer. As we move out of summer, hog slaughter will increase which is likely to cause the retail pork price to decrease and allow marketing margins to increase.

Typically, the farm-wholesale price spread (i.e. packer margin) goes up when hog slaughter increases and shrinks when hog slaughter declines. Average daily hog slaughter typically bottoms in July. The wholesale-retail price spread also tends to go up and down with pork production.

On the positive side, the farm-wholesale price spread should consistently drop below the year-ago level during the fall and winter of 2017 as the new slaughter plants in Coldwater, Mich., and Sioux City, Iowa, come on line.

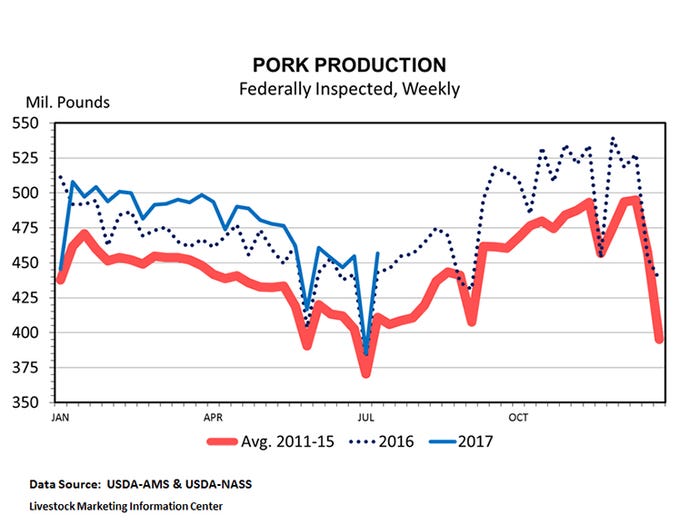

Pork production has been above year-ago every week this year except for two. Year-to-date, weekly pork production is up 2.9% and weekly hog slaughter is up 3.4%. Slaughter weights are down 0.5%.

Both year-to-date hog slaughter and pork production are record high for this time of year. Preliminary data indicated June commercial hog slaughter was a record 9.87 million head, up 3.2% from last June. Despite record production, thus far in 2017 hog prices have averaged 2.4% higher and pork cutout is up 6.0% compared to the same weeks last year.

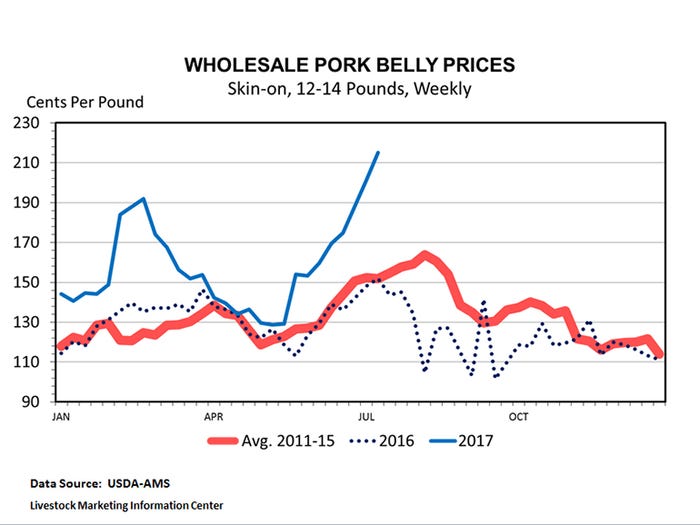

The higher cutout values are due in large part to record belly prices. Wholesale prices for the pork belly primal have been above the year-ago level each week since April. Pork belly prices have been record high in July exceeding $2 per pound for the first time ever.

Since bellies are, more or less, a constant share of the hog carcass, record pork production also means record belly production. So, the record belly prices are not due to a shortage of bellies; they are demand driven.

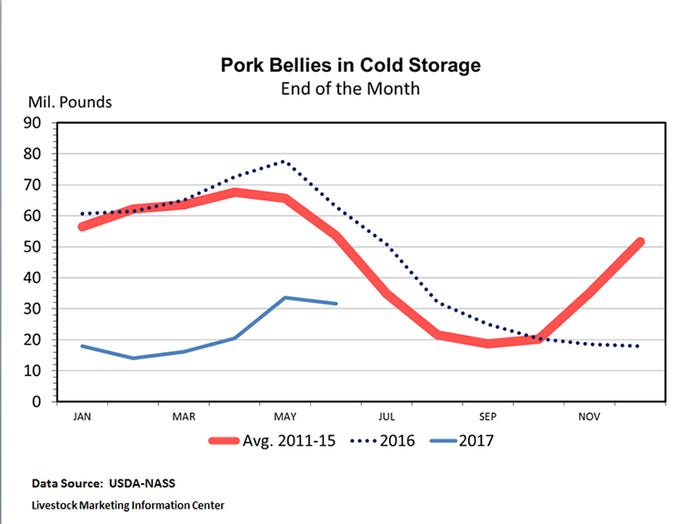

Pork belly prices are usually the lowest during the winter and highest in late-summer (bacon-lettuce-tomato season). This price pattern is so consistent that bellies are typically moved into cold storage in November-April when prices are low and pulled out in June-August when prices are high. This year few bellies were put in cold storage during the winter causing summer supplies to be tight.

The inflation rate is slowing. The Consumer Price Index for June was up 1.6% year-over-year. In May, the CPI was up 1.9%. In each of the first four months of the year the CPI was up 2.2% or more compared to 12 months earlier. Slowing inflation may reflect slower growth in the U.S. economy. If so, that is likely to mean softening domestic demand for meat.

Fortunately, export demand for U.S. pork continues to be strong. Pork exports have been above the year-ago level for each of the last 13 months. May pork exports equaled 24.56% of production, the largest share since March 2014. Mexico, South Korea and Japan account for 86% of the January-May increase in U.S. pork exports. Pork imports were down 3.4% during the first five months of the year.

About the Author(s)

You May Also Like