Pork demand strength and prices

Strong consumer pork demand driving pork prices higher.

Pork demand has been growing stronger every month and has been phenomenal so far this year. Consumer demand for pork products has helped drive cutout prices higher. There is a lot of talk about short live hog supplies in the industry. But the real issue is stronger pork demand from the consumer, which has been driving pork prices higher in the U.S.

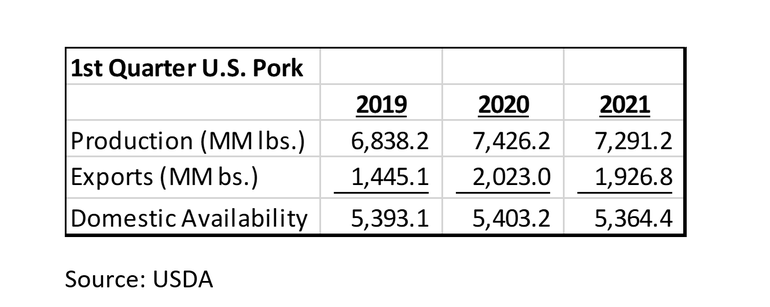

Pork production in the U.S. increased from 2019 to 2020 in the first quarter of the year. Much of this was the high harvest levels before plants shut down due to COVID. Under more normal conditions (if normal exists), harvest levels in 2021 were down from 2020, but production in 2021 was 6.6% higher than 2019—plentiful production in the first quarter. When comparing 2021 to 2019 again, exports were 33.3% higher in 2021 due to continued strong exports to China.

For the quarter, domestic availability was within 0.5% of 2019. No significant change in available pork supplies in the U.S. Price data from USDA shows retail pork prices were up 10.6% in the two-year period. While there are some problems with the retail scanner data, it would show strong prices for retail pork. The problems include not a true “pork expenditure,” which is hard to collect on a broad basis. Also, the fact that foodservice data is not collected, and much of the product goes through non-retail channels.

Drivers of the improvement in domestic pork demand likely have much to do with all the stimulus money pumped into the U.S. economy. It will be hard to quantify, but seems reasonable that as disposable income increases, foodservice and retail meat demand would benefit. We hear a lot about inflation and the term “commodity super-cycle” more regularly. Time will tell in that regard, but global (insert China) demand for commodities is real and driving our costs of meat production higher. And so far, strong prices are offsetting the costs.

Source: Kent Bang, Compeer Financial, who are solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset. The opinions of this writer are not necessarily those of Farm Progress/Informa.

About the Author(s)

You May Also Like