Hog price rebound factors supplies

April 13, 2015

Lean Hogs futures continued their long, slow climb out of their deep hole last week and, at least for those contracts through August, are higher again on Monday. In fact, summer contracts are bumping $80 today, making my rather bullish price forecasts from two weeks ago look a little less crazy. I need all the help I can get.

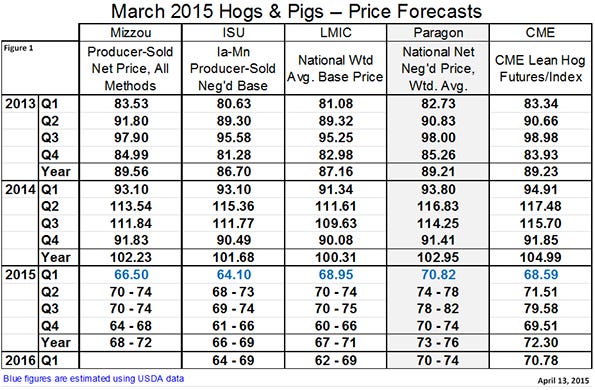

Figure 1 shows my price forecasts and those of three other noted analysts based on the March Hogs and Pigs report. Note that this table includes the forecasts of Lee Schulz at Iowa State University. The CME column at the far right has quarterly average prices of CME Lean Hogs futures as of mid-session on Monday. May and June futures still have to rally by $4-$6 to get the second quarter average into my range since April futures will expire on Wednesday. Today’s $63.23 is still almost $2.50 higher than today’s CME Lean Hog Index of $60.74 so this April contract could fall a bit yet.

The antidote for that, of course, would be some strength in the cash hog market and we are seeing that here on Monday. While the national morning purchases swine report (LM HG-202) provided no information today due to confidentiality restrictions, the afternoon report shows the base price $2.06 higher than on Friday. That’s one of the better days that cash hogs have had all year.

While we think producers should allow the futures market some time to run higher, my big caution right now is “Don’t get greedy!”

We’ve seen all too well how sensitive this market is this past spring. Should futures get to or exceed the top sides of my second quarter through fourth quarter price ranges, I would be booking some hogs and would move to book a high percentage at the first sign of a top. All of those prices will be profitable and it’s tough to go broke locking in profits.

So what is providing this strength? I think it is simply the passing of time and the waning of that pile of negative factors that we were dealing with just a few weeks ago.

Lent is over so many observant Christians will be back to eating meat seven days a week. One day off meant 14% fewer chances to eat meat!

Exports are picking up. Altin Kalo of Steiner Consulting Group noted in Monday’s Daily Livestock Report that “Weekly exports are pointing to robust sales in March and early April.” That is good news indeed and fits with our long-held opinion that progress would be made on clearing backed up shipments, helping pork exports rebound from their abysmal levels of January and February. We still don’t think exports will grow dramatically this year due to the strong dollar but those first two months were not, we think, indicative of the strength of export demand.

Spring has sprung! Major League baseball is off and running, and another young buck has made mincemeat of Augusta National. Hot dogs are being hawked. Millions of grills are being fired up. Memorial Day celebrations are only six weeks away.

Finally, we suspect that some featuring is finally hitting the retail level. USDA’s reported retail prices are still very high, but that series doesn’t pick up featuring well at all. It simply has no way to capture the larger volumes that move at feature prices. Retail margins have been huge since last fall and the main thing that eventually buys us is attention. It takes longer than we ever think it should before it finally happens. Further, when it does, those still-high retail prices provide room for wholesale prices – and thus hog prices – to rebound. And I know producers could use a good rebound.

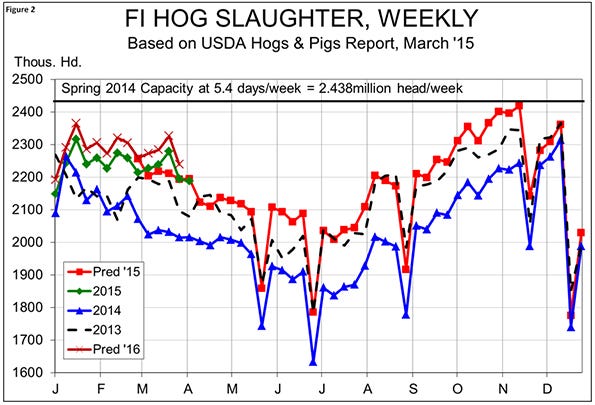

Meanwhile the supply side rolls merrily on. Last week’s FI slaughter totaled 2.188 million head, 8.6% larger than one year ago (See Figure 2). And it gets worse. The appropriate comparison for last week (i.e.: the week after Easter which usually sees some reductions in Monday operations) is to the week that ended April 26, 2014. That comparison says +9.9%.

The good news is that last week’s hog numbers were, for the second straight week, almost precisely the level expected from the March report. The slaughter will remain large but getting back in line with expectations will put packers in a better pricing position on wholesale cuts.

About the Author(s)

You May Also Like