Highest hogs prices since 2014

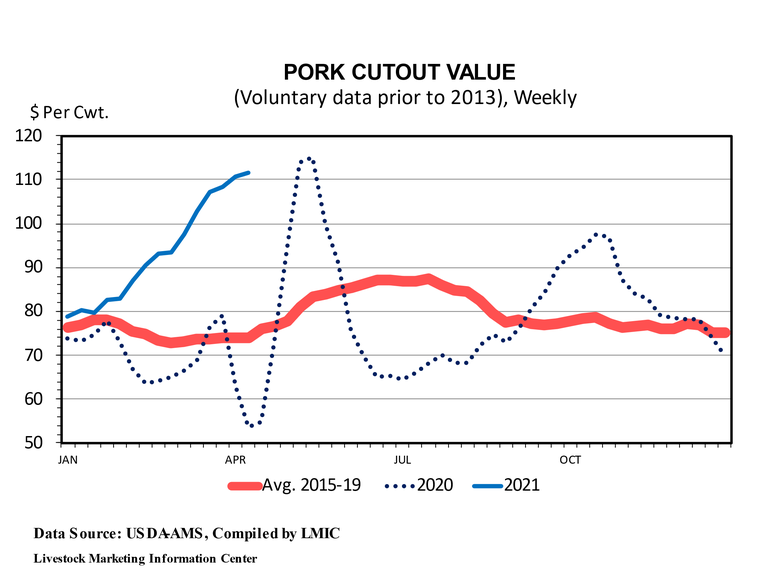

Steep runup in hog prices has been made possible by steep runup in pork cutout value.

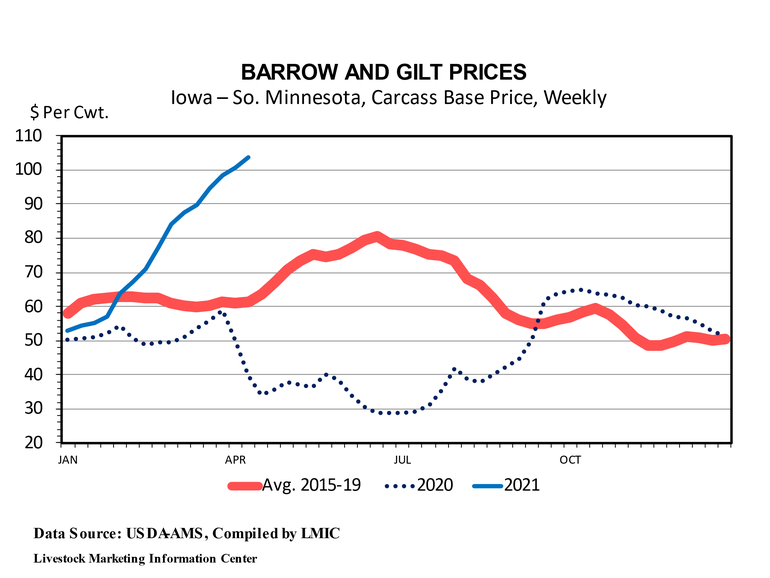

Hog prices have risen for the last 14 weeks and are at the highest level since the porcine epidemic diarrhea virus (PED) outbreak of 2014. It has been a fast price runup. The 2021 national negotiated prior-day purchased carcass prices first exceeded $60 on February 3, first exceeded $70 on February 23, exceeded $80 on March 3, exceeded $90 on March 22 and first exceeded $100 on April 12.

Last week’s national negotiated cash carcass price averaged right at $107/cwt. (I don’t yet have the average for Friday.) That was the highest weekly hog price since the average of $107.66/cwt. for the week ending on August 15, 2014. By the way, the record high negotiated hog price for a week is $129.87/cwt. for the week ending on July 11, 2014 (also during the PED outbreak). Last week’s hog prices were more than triple the $33.89/cwt. average for the same week last year, when COVID-19 among packing plant workers forced plants to drastically reduce slaughter schedules.

Last Friday, the May lean hog futures contract closed at $109.35/cwt. That is the highest close for any hog futures contract since October 14, 2014 when the October contract closed at $109.53/cwt. By the way, the highest close for any lean hog contract came on July 17, 2014 when the July contract closed at $134.01/cwt.

The futures market expects hog prices to trend lower from May to December. On Friday, the May hog futures contract closed $3.63 above the June contract which was $1.19 above July and $3.38 higher than August. The price decline is expected to be sharp this fall with the October lean hog contract currently $15.25 lower than August but $6.55 higher than the December contract. Despite the expected price drop, the futures market is indicating December 2021 hog prices will be $14/cwt. higher than they were in December 2020.

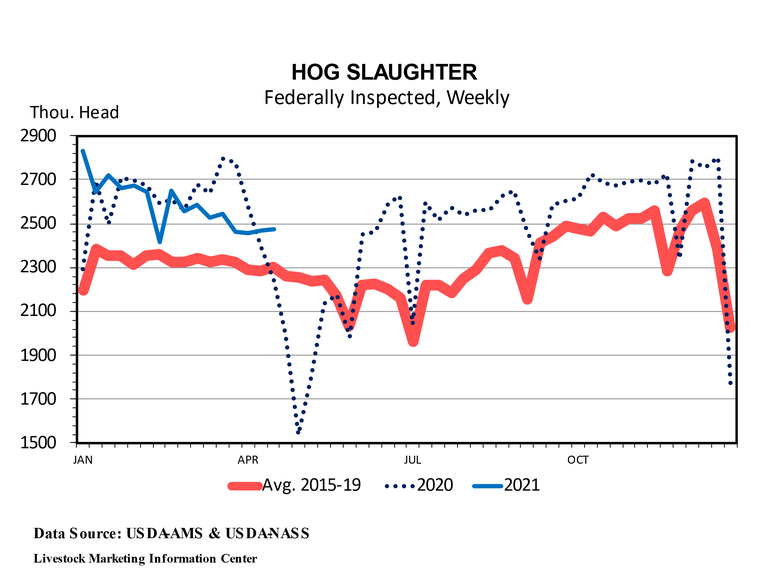

As expected, hog slaughter during the last three weeks has been well above the year-ago level, not due to a surplus of hogs this year but due to COVID problems a year ago. The next four weeks also should see slaughter far above year-ago, with slaughter during the upcoming week to be roughly 60% higher year-over-year.

As a general rule, in 2020 weekly hog slaughter totaled 2.5 million head or more for non-holiday weeks, except during the period in April and May when COVID-19 among plant workers forced reduced slaughter operations. The weeks ending on April 25, May 2 and May 9 each had slaughter under 2 million head with the week of May 2 totaling only 1.54 million head. During the seven weeks from April 7 through May 23, 2020 federally inspected hog slaughter was 2,314,064 head below the level indicated by the March 2020 “Hogs and Pigs” report. Some of these missing hogs were slaughtered later in the spring and summer while some were euthanized.

The steep runup in hog prices has been made possible by a steep runup in pork cutout value. Pork cutout value started 2021 at $77.77/cwt. Cutout began April at $108.86/cwt. Last Friday the value was $111.94/cwt. That compares to a year ago when the pork cutout was only $77.48/cwt.

The runup in the pork cutout value has been slower than the hog price runup, as evidenced by a narrowing in the cutout-to-hog price spread. The pork cutout to carcass hog price spread averaged $23.62/cwt. in January-February, $13.12/cwt in March, $9.79/cwt thus far in April, and $6.90/cwt. last week. If this narrowing continues, packers will be reluctant to push hog prices much higher.

The year-over-year increase in both hog prices and pork cutout value has been made possible by an increase in the retail price of pork. The average price of pork in grocery stores during March was $4.165 per pound. That was 1.2 cents higher than in February and 31.9 cents higher than in March 2020.

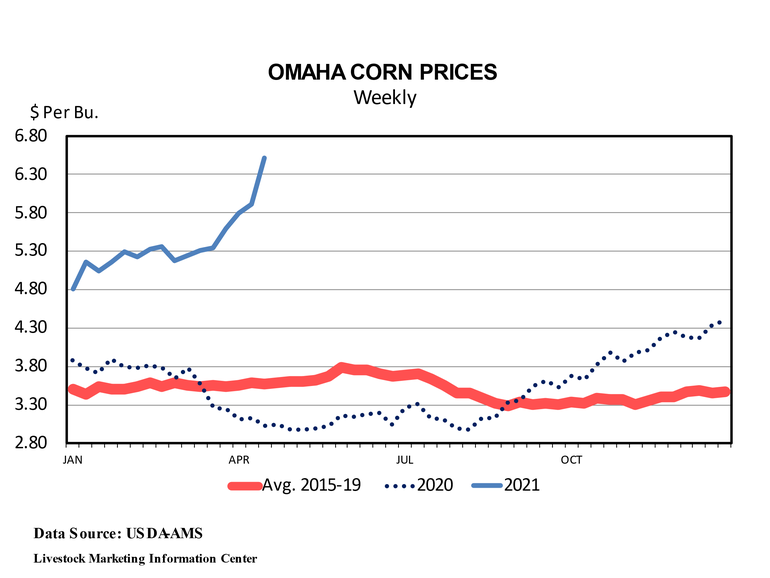

Corn prices have also increased rapidly this year with recent cash prices double the year-ago levels. The May corn futures contract closed last Friday at $6.555 per bushel. That compares to $4.48 at the start of 2021 and $3.16 for the May 2020 contract at this time last year.

The price of corn is the single most important cost component in livestock and poultry production. Rising corn prices will squeeze the profit margins of meat producers. U.S. red meat and poultry production is expected to increase only 0.5% this year. That would be the smallest increase since 2014.

This afternoon USDA/NASS will release the weekly crop progress report. On Thursday afternoon, the annual “Meat Animal Production Distribution and Income” report comes out.

Source: Ron Plain, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset. The opinions of this writer are not necessarily those of Farm Progress/Informa.

About the Author(s)

You May Also Like