Keeping a Lid on Iodine Values

Iodine value pressure points have pushed producers and their nutritionists to learn more about iodine values, what affects them, and what can be done to meet packer restrictions.

February 15, 2012

Pork producers trying to improve margins have turned to alternative feed ingredients, predominantly distiller’s dried grains with soluble (DDGS) — which with relatively high levels of unsaturated fats has pushed iodine values (IV) higher. In turn, packers are scrutinizing carcass fat quality closer, setting IV restrictions and, in some cases, warning producers that exceeding those targets could result in carcass quality penalties.

The iodine value pressure points have pushed producers and their nutritionists to learn more about iodine values, what affects them, and what can be done to meet packer restrictions.

What We Know About IV

Iodine value is not a measure of fat firmness but rather an estimate of fat firmness based on a measure of unsaturated fats, commonly measured through fatty acid analysis. Most vegetable oils are high in unsaturated fats, have higher IV and are more liquid at room temperature. Animal fats are higher in saturated fats, have lower IV and are more solid at room temperature.

The fat in pig carcasses comes from two primary dietary sources — fats and carbohydrates. Carbohydrates (e.g. corn) are converted to fat through something called “de novo synthesis,” which predominantly generates saturated fatty acids. Therefore, the fat the pig creates from carbohydrates is hard. On the other hand, common dietary sources of fat/energy, such as DDGS or bakery byproducts, inhibit de novo synthesis, causing the pig to take on the characteristics of the fats it consumes, thus making its fat softer.

It’s a classic case of “a pig is what he eats.” When a pig eats more unsaturated fats, the form is not changed during the absorption and deposition process. This is not a new phenomenon. Back in the mid-1920s, pork producers and packers in the southern states found pigs fed peanuts high in oil exhibited softer carcass fat with an oily appearance.

The consensus is that high IV levels create processing challenges. Some packers have set IV restrictions, while others are less forthcoming. Some packers have gone so far as recommending that producers not exceed a certain level of DDGS in swine diets or that they withdraw the ethanol byproduct for a specific time period prior to slaughter.

Swine nutritionist Chad Hagen, senior vice president of Value-Added Science & Technologies (VAST), Mason City, IA, feels ingredient restrictions are a simplistic way of looking at the issue, because several factors beyond dietary ingredients affect fat hardness, including:

Genetics: Leaner pigs have softer fat. “In late finishing, there still are some pretty big differences in genetic performance — fatness, growth rate and feed conversion,” he notes. Through VAST’s ongoing terminal sire line evaluations, they have found genotypes perform similarly up to 200-220 lb., but as pigs approach heavier market weights (270-290 lb.), variation in fat firmness begins to surface.

“The differences aren’t as big as they were 20 years ago, but there still are some major differences. From the leanest to the fattest pigs, we still see 2-3% lean percent differences and backfat differences of as much as 0.5 to 0.6 in.,” he says. “It is important to remember that most of this difference happens in late finishing, so that is the period when we have to make corrections — the last six weeks or so before pigs go to market.

“Whenever you have a situation where pigs are inherently fatter, the fat tends to be harder because more of the fat is coming from de novo synthesis; that is, the fat the pig is making himself is hard fat. The fat directly deposited from the dietary ingredients, DDGS for example, is softer fat. Leaner pigs tend to lay down more of that directly deposited fat as a percentage of their total fat, while fatter pigs are making more of their own fat, which tends to be harder.”

Gender: Gilts have softer fat than barrows, partially because they are generally leaner. “If a packer checks a load of gilts weighing 250 lb. and a load of barrows averaging 270 lb., fed the same diet, they will have big differences in IV. The lightweight gilts are leaner and their fat will be softer, while the heavyweight barrows will be fatter, but the fat will be harder. It’s really an inexact science,” Hagen points out.

Sampling is a huge issue. Many producers split-sex feed, so if by chance the packer randomly samples a load of gilts, IV levels may appear to be high, when in reality, the overall population is not.

“Packers need to be sure they are testing a representative sample of a producer’s hogs,” he stresses.

In addition, it is critically important that the producer knows where on the carcass the sample is taken — from the jowl, belly or backfat. “The IV of jowl fat is about four points higher than loin fat (backfat),” he notes. For that reason, it is very difficult to compare IV from one packer to another.

“One packer may have an IV specification of 72, based on a jowl sample, while another packer’s specification may be 68, but the sample is taken at the loin. This is not an apples-to-apples comparison, so it can be confusing,” he adds.

Season: “Most things that make the pig grow slower tend to make the fat softer. Feeding the same diets, we see different IV levels in the summer vs. the winter. When you come into summer, growth rate slows down and the fat begins to get softer. Producers need to account for that,” Hagen says.

Ractopamine (Paylean from Elanco Animal Health): “Paylean tends to make the pigs leaner and, therefore, the fat a bit softer. During Paylean use, pigs are depositing very little fat from de novo synthesis,” he explains. “Paylean is a tremendous product, but like any tool, you really need to know how to manage it.”

Hagen recommends feeding Paylean at 4.5 gram/ton for a minimum of three weeks and a maximum of five weeks, with a target of 28 days. “Some producers start it before they ‘top off’ a barn, some after. It depends on how long it takes to empty a barn. Last summer, we did a lot of step-up work with Paylean. Feed costs were very high. Market prices were very high. Space was short. Producers were struggling to hit market weights, which is very costly when you have pig prices as high as they were.

“If nothing else, the step-up program allows producers to feed Paylean for a longer period of time and maintain a response. Say you can get 6-7 lb. more carcass weight by feeding Paylean for 28 days at 4.5 grams. If we step up from 4.5 grams to 6.75 grams/ton or 9 grams/ton, we can feed it another two weeks and get another couple of pounds of carcass weight. That doesn’t always work economically, but last summer it did, mainly because of the very high market prices,” he says.

“If you have slower-growing pigs, they will likely have slightly higher IV; then you add Paylean, which will push IV slightly higher, but we believe that even with the IV restrictions, the use of Paylean is a worthwhile investment.”

Formulating Diets

Understanding the various factors affecting IV readings, VAST nutritionists have turned to a dietary formulation tool called iodine value product (IVP), which is a measure of the fat/oil in a feed ingredient used to estimate the IV of the carcass fat. (IVP = the percent of fat in an ingredient x the IV of that fat source x 10%).

“When we formulate diets, we can set a maximum IVP that will help a producer hit the packer’s IV specification,” Hagen explains. But other variables (sex, gender, etc.) affect IVP, too, so IVP serves as a roadmap to achieve a producer’s targeted IV.

If a producer is selling 270-lb. pigs with an IV of 75 and the packer’s specs are an IV of 72, Hagen first checks to see how much unsaturated fat is in the diet. “The gap between where he is and where he needs to be helps set diet specifications that will move him to the IV target,” he says.

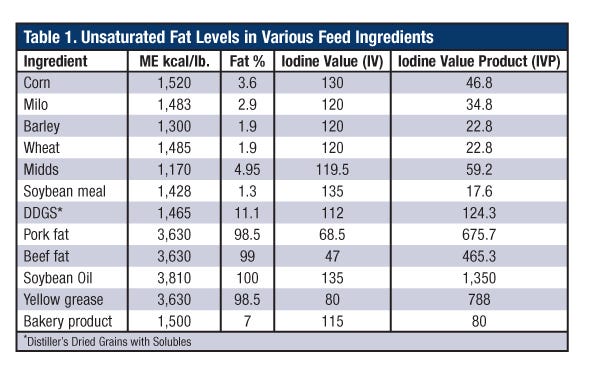

VAST nutritionist Wayne Cast uses Table 1 to illustrate the unsaturated fat levels in various feed ingredients. Some DDGS are 6-7% fat, others are 10-11%. “Monitoring fat levels in your ingredients is an important part of formulating IVP,” he emphasizes. “Whether your corn is 3.3% fat or 3.6% fat will also have a significant effect on your diet formulation. It is also important to confirm the iodine value of the fat in dietary ingredients because there are substantial differences in sources of bakery products, feed-grade fat, meat and bone meal and DDGS.”

Using the IVP formula, corn with 3.6% fat and IV of 130, the simple calculation is 3.6 x 130 = 4.68 x 10% = 46.8 IVP.

For easy calculation, if corn represents 10% of the diet, it would add 4.68 points to the diet’s IVP. If DDGS represents 10% of the diet, it would add 12.4 points to the diet. A rule of thumb would be that 10% DDGS would increase carcass IV 2-3 points

To formulate a diet using IVP, Cast uses three nutrients to set up each ingredient — fat %, IV and IVP. If you plug in the values for fat and IV, the equation will calculate the IVP. “The equation saves you from having to hand-calculate IVP each time the fat level changes in an ingredient. When you formulate for IVP, you will discover that 3% yellow grease, 3.7% pork fat or 30% DDGS will produce similar IVP values,” he relates.

“When a producer sets a maximum IVP in the diet, the least-cost formulation will pick from the most economical ingredients to make the diet and meet the nutrient specs without going over the IVP. In general, it restricts DDGS,” Hagen explains.

“It’s a moving target. Last summer, the savings of each 100 lb. of DDGS was close to $5/ton; we went through a period last fall where it was worth less than $1/ton. Today (mid-January), it’s worth about $3/ton. If you figure three grow-finish pigs will eat a ton of feed, then each 100 lb. of DDGS in a diet is worth about $1/pig. If you feed DDGS aggressively, say 500-700 lb./ton in finishing vs. feeding to hit an IV restriction, you’re talking about cutting back roughly 300 lb. of DDGS throughout that growth period, on average. So, to hit the IV restrictions that are out there now, on average, you’re looking at $3-5/pig, based largely on how much DDGS you can use,” Hagen notes.

“When a producer tells us his packer is concerned about the IV in his pigs, this is the procedure we go through. You have to do it case by case; you can’t broad-brush it because of the genetic variation for growth rate and differences in market weights. Pigs that grow faster generally put down more de novo synthesized fat, so they have harder fat,” he reminds.

How to Reduce IV

“There are at least two ways to hit an IV requirement. One is to feed a low level of DDGS all the way through finishing; the other is to feed higher levels of DDGS early in the grow-finish period, then reduce or withdraw it late in the finishing period. Each week with zero DDGS will take IV down 0.5 to 0.7 points,” he explains, “depending on the genetics, how fast pigs are growing, etc. If you are going full bore with DDGS, six weeks with zero DDGS in late finishing would reduce IV 3-5 points and allow you to meet the IV restriction. Both approaches work. Economics will drive which approach to take,” Hagen says.

One of the detriments of feeding high-fiber ingredients such as DDGS or wheat midds is some carcass yield drag. This is caused by larger hind gut adapting to higher fiber levels and more intestinal content at slaughter. “That’s why the approach we typically take when we’re trying to meet an IV restriction is we feed high levels of DDGS early, and then we back them down late. This gives us the withdrawal advantage and we avoid some of the yield drag,” he explains.

DDGS with Less Oil

Ethanol plants spinning off 2-3% more oil from the DDGS byproduct is becoming more common. The practice lowers DDGS value as a feed ingredient in swine diets. To track these differences, VAST has built a database on product from about 150 ethanol plants. Called ILLUMINATE, samples are analyzed weekly to update the database. Over 3,000 samples were processed in 2011.

“ILLUMINATE allows us to put a relative value on product from each of those plants, ranking them from lowest value to highest,” Hagen says. “In January, there was about $90/ton value difference, lowest to highest. The main drivers of value are energy, then digestible amino acids and available phosphorus.

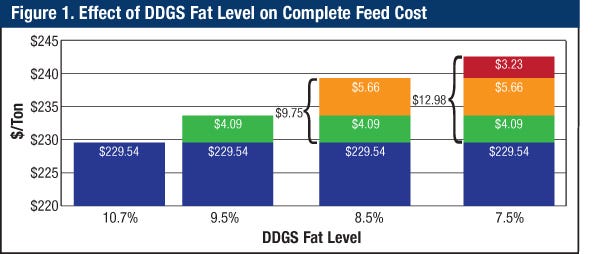

In December 2011, VAST Technical Services Director Rob Musser estimated that each 1% reduction in DDGS fat content increases the cost of a finisher diet $3 to $6 (Figure 1). On a per- ton basis, lowering DDGS fat content from 10.7% to 9.5%, a 1.2% reduction, increases diet cost $4.09/ton. By averaging nutrient profiles of DDGS from 10 ethanol plants, Musser formulated a finishing diet (1,530 kcal/lb. metabolizable energy [ME], 0.91% TID lysine) using 30% DDGS. Prices included were corn, $5.84/bu.; 46% soybean meal, $267.20/ton; DDGS, $175/ton; and fat, $0.435/lb. “It is important to remember that the incremental value of energy changes based on diet constraints and DDGS inclusion rates,” Musser notes.

In his example, with 30% DDGS inclusion rate, he explains, “the shadow price, which represents the price at which adding the first few pounds reduces diet cost for 7.5% fat DDGS was $50/ton less than that of the 10.7% fat DDGS.”

Currently, 82 of the 150 plants in the ILLUMINATE database are removing more oil from DDGS. Hagen likens the DDGS value differences from one ethanol plant to another to the performance differences between farms. “Comparing ethanol plants is like comparing farms — one is extremely well designed and operated while the other is old and decrepit and doesn’t work very well. Those are the extremes and there is everything in between.”

Hagen estimates plants can remove about 3% oil, which in a ton of DDGS is 60 lb. Valued at 50 cents/lb., that’s skimming off $30/ton in value. “When you pull out the fat, other lower-energy components, like fiber, go up. We see substantial differences in fiber from source to source. In our work, when you roll all of these factors together, the value difference is closer to $50/ton,” he says.

Add to that, every batch of DDGS is different because it is a biological process. Therefore, the database analysis also tracks nutrient variability within each plant over time. One factor that is tracked is residual starch in DDGS.

“A good plant wants residual starch levels to be low because their objective is to change starch into alcohol,” he explains. In some plants, residual starch is just 3%, while another may be 14%. There’s a huge difference in the quality of fermentation they can achieve. It’s like feed conversion in pigs. We try to turn feed into pork as efficiently as possible. The ethanol plant wants to get as much ethanol as they can from their input of corn. Residual starch is their measure of feed conversion. So, it’s not good distillers vs. bad distillers. It’s getting the right distillers in the right place,” he explains.

You May Also Like