COVID-19 impact on wean-to-finish groups

Longer days on feed, higher mortalities and heavier weights resulted from processing challenges.

July 7, 2021

In the previous three-monthly articles, MetaFarms analyzed and wrote about how nursery, finishing, and marketing aspects were impacted by the COVID-19 virus and the subsequent packing plant closures in 2020. As many packing plants closed for human safety concerns the backlog of market hogs quickly began to accumulate. Producers scrambled to find alternate options to market their pigs, slow down pig growth and maximize barn utilization. In this month’s article, analysis will be done on the impact of the events on single-stocked wean-to-finish groups.

W2F closed group analysis was performed utilizing the MetaFarms Ag Platform with specific focus on the United States (U.S.) customers only. In the calendar year 2020, the US MetaFarms customers had slightly more than 3,300 closeouts (3,367) with total pigs started over 8,000,000. Characteristics of a single-stocked W2F group would be a starting average weight around 12 pounds with an ending average weight out of 285 pounds. Pigs are normally on feed for around 160 days, have an average daily gain (ADG) of a 1.60 and have a feed efficiency (FCR) of 2.60. As previously stated, W2F groups are generally on feed for 160 days, or a little over five months. Groups starting in August 2019 would not close out until January or February 2020 whereas groups starting in January 2020 would close out in June or July 2020.

First, it is important to understand what makes up a single-stocked W2F group. When determining what a single-stocked group is, MetaFarms looks at percentage of animals transferred out of a group. W2F groups that transferred (pigs moved from one active group to another active group) more than 10%, of the pigs started, are removed from the benchmarking analysis. Removing these groups allows the remaining groups to be compared by performance and costs on a more “apples-to-apples” perspective.

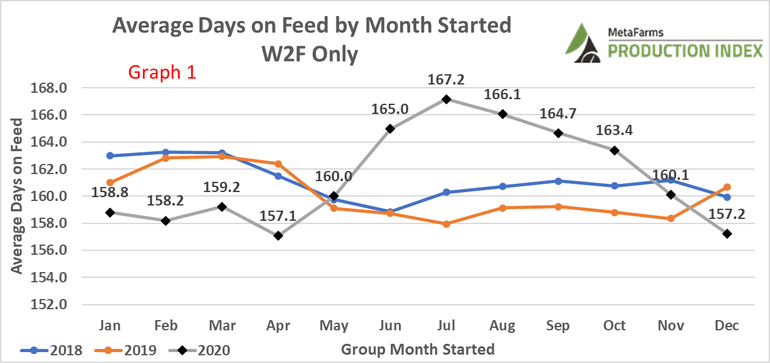

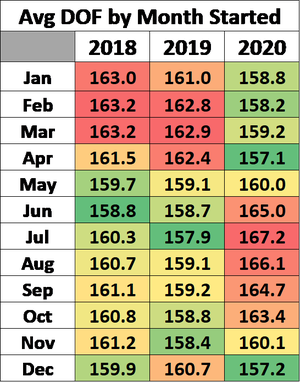

On April 7, 2020, the first packing plant temporarily closed, whereas on April 23, 2020, nearly 25% of the packing capacity was unavailable for pork producers. Graph 1 shows the monthly differences in average days on feed (Avg DOF) between 2018 to 2020 for W2F groups based on their group start date. Data shows an additional 5-10 days on feed for those groups started back in August/September 2019 which were on schedule to be marketed amid plant closures in April/May 2020. The data also shows that groups started in June and July 2020 (which would closed out in the later parts of 2020) had their feed diets modified for slower growth to adhere to unknown packing plant availability.

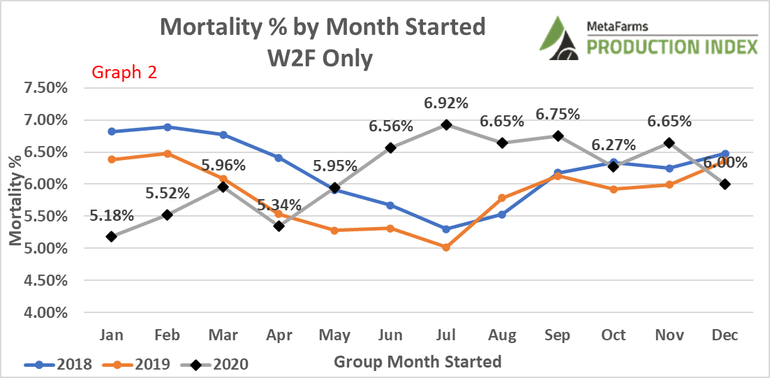

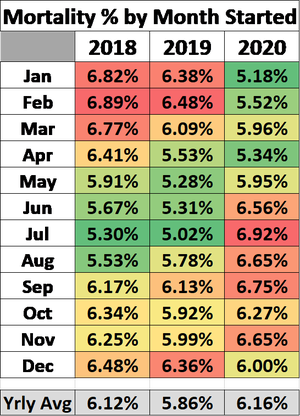

Pork producers constantly focus on ways to keep pigs healthy, which, in turn, lowers mortalities. In the future, when looking back at 2020, the higher-than-normal mortality rates cannot be blamed as much as PEDV, flu, mycoplasma, and even PRRS. The main culprit was the COVID-19 virus and the impact that it had in the pork industry.

Graph 2 shows a three-year monthly mortality rate for single-stocked W2F groups based on the start date. As a reminder, those groups closed out in November 2020 would have started in May or June timeframe. Graph 2 shows how the April 2020 plant closures, and thus backlog of market hogs, started off a steady uptick in mortality rates. 2020 had started off with four straight months lower than the previous two years, but after the year was all said and done, the yearly W2F mortality rate finished off with an average of 6.16, 0.30% higher than 2019 (5.1% change). Comparing July 2020 to July 2019 alone saw a nearly 2% increase (1.90% or 37.8% change).

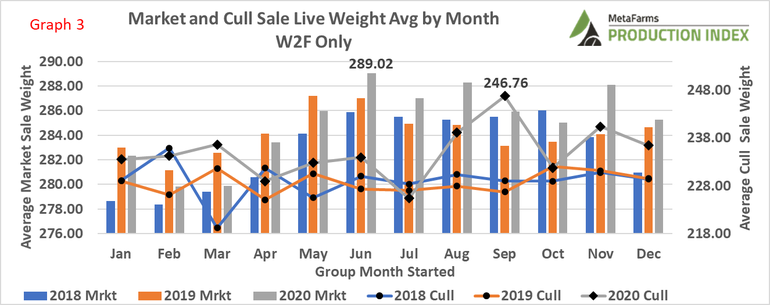

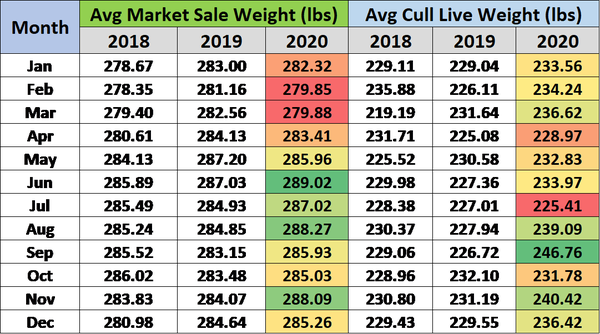

With packing plants temporarily closing, along with other packing plants reducing their daily capacity limits, pork producers had no choice but to slow or even stop market loads. Mainly producers implemented need feed diets changes to slow down the growth of the pigs to buy time for shackle spaces to open. As much as we would have all loved to have the pigs hold steady on their current weights, pigs are not able to utilize programs like Weight Watchers, so the pigs continued to add on pounds. Graph 3 shows a 3-year monthly comparison between 2018 to 2020 for two metrics, average market sale weight and average cull sale weight.

As was noted on Graph 1, pigs were held on feed for longer, so it should not be surprising that 2020 market live weights continued to trend upwards, surpassed previous years starting in June, and eventually tapered back to previous years in September. 2020 cull sale weights were noticeably higher in August and September, with September being the highest monthly average over the entire three years. September 2020 average of 246.76 pounds was 21.35 pounds heavier than July 2020 (9.5% change). One thing that can be said about this increase in market weight average is that pork producers decided to hold onto their heavier weight pigs and sell lighter weight pigs to buy time and pig space.

Raising a newly born three-pound pig to 285 pounds in just a mere six months is nothing short of amazing. In that short period of time, some production areas give producers quicker feedback on production practices or medication, for example. Other areas can take longer to get feedback, and not just any feedback, but feedback that has adequate amount of data points with the accuracy needed to make sound data driven decisions. Many pork producers may look back at 2020 as a year that threw curveball after curveball. Some may have struck out, but for most, 2020 can be looked at as perhaps one of the biggest obstacles one has ever faced.

Take a moment to look back at 2020 and remember those within your company that stepped up when tough decisions had to be made, whether it was keeping pigs longer than expected or scrambling to move pigs around to open pig space for incoming pigs. Big decisions had to be made, and the impact was felt not only the pigs but also the bottom line. Ask yourself if you could do it all over again, and if so, how you would do things differently?

MetaFarms Analytic Insights were used to provide the context and trends for this article. If you would like to see an analysis of how COVID-19 impacted your wean-to-finish performance, or if you have suggestions on production areas to write articles about, please e-mail or call us. If you have questions or comments about these columns, or if you have a specific performance measurement that you would like us to write about, please contact Bradley Eckberg at or Ron Ketchem.

Source: Bradley Eckberg, MetaFarms, who are solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset. The opinions of this writer are not necessarily those of Farm Progress/Informa.

You May Also Like