Will Demand Hold Firm?

December 1, 2014

News regarding the impact of our two most serious disease challenges continues to be favorable as the calendar turns to Christmas. The entire industry had entered the fall of 2014 with two concerns. First, that porcine epidemic diarrhea virus (PEDV) would explode again when temperatures fell. Second, that porcine reproductive and respiratory syndrome virus (PRRS), which has been remarkably quiet last winter, would rear its ugly head in spades this year as fewer herds would have infection-induced immunities. While virtually no one thought PEDV would be as bad this year as last, it was feared that the combination of PEDV and PRRS might take a heavy toll on pig numbers this winter. They may still do that, but the data so far is encouraging indeed. Encouraging for pork supplies that is.

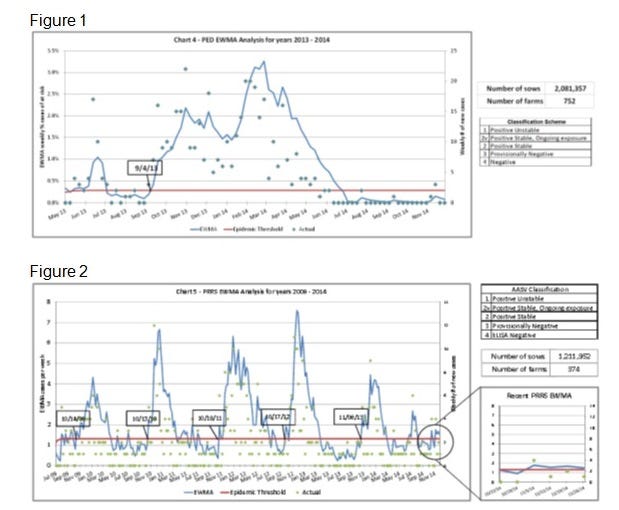

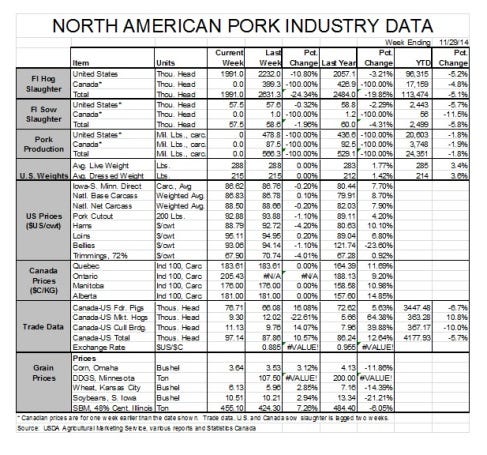

Figures 1 and 2 come from the University of Minnesota’s Swine Health Monitoring project (the entire report can be found at http://www.cvm.umn.edu/ sdec/SwineDiseases/pedv/index.htm) and represent the numbers of reported cases among the sow herds owned by the cooperating production systems. It is easy to see why we are encouraged at this point.

Figure 1 is for PEDV and shows that very few sow herds have seen positive test results since early summer. The week of November 14 provided a bit of a scare with three herds turning up positive, to the past two weeks has seen that count return to zero. Readers should note that these data do get revised. The original value for November 14 was one. But the chart is encouraging indeed, especially since it covers roughly 2.1 million sows.

Figure 2 may be even more encouraging. It shows the same kinds of data for PRRS breaks. The sample here is smaller (1.2 million sows) but the results are similar. In fact, this year’s PRRS totals are staying much lower even than one year ago when the mid-winter peak in case numbers was about half that of 2012-2013. Actual cases went above the computed epidemic threshold one week later than it did last year, and up to three to five weeks later than in years prior to that. But as can be seen in the detail, those case numbers have stayed relatively flat, an unusual occurrence by historical standards.

What does this mean? First, that pig losses during the summer and fall months have not been nearly as large as they were last year. That suggests that winter and spring slaughter could be much more “normal” relative to the size of the breeding herd. I have increased by Q1-2015 slaughter forecast to 27.54 million, up 1.5% from 2014 in light of these data. It is too early to tell whether PRRS losses will be lower as well, but we have to consider that possibility. If they are, I don’t think the impact on supplies will be seen before April.

Second, these data spell price pressure. Futures markets have lagged the levels I had forecast in early October all fall, perhaps in anticipation that these pig losses would indeed be lower. It looks like “the market” may have gotten this one right. That doesn’t mean a price disaster is in the offing but it does say they will be lower than previously expected.

So will demand hold firm? No one knows that answer for sure but a few items support a “yes” answer at this time. First, retail prices remain strong. They did decline by 1.6% in October, but the average price of $4.15 per retail pound was still the 3rd highest such price in history. The decline was driven, at least in part, by per-capita availability/disappearance/consumption that was 1.9% larger than one year ago.

Consumer attitudes remain positive even though the two widely followed indexes of consumer thinking diverged some in October. The Conference Board’s Consumer Confidence Index declined by 5.8 points in November after a large 8.5-point gain in October. The October index of 94.5 was the highest since mid-2006, and this index is pretty volatile so the November decline is not a big reason for concern. The University of Michigan/Thompson Reuters Index of Consumer Sentiment gained 1.9 points in November to reach 88.8, also a post-recession high. The index was 75.1 just one year ago.

Finally, consumers have more dollars to spend. Real per capita disposable income has risen, on average, 1.6% this year. This figure represents personal income per person after taxes. In addition to this growth, gasoline prices have fallen sharply and are likely due to fall further given last week’s announcement that OPEC will not reduce crude oil output. The OPEC move is clearly a test of North American shale oil production to see just how competitive it will be. This is a market share battle and consumers will be the winners. Gasoline prices have fallen by $0.87/gallon since June. If that decline persists for an entire year, it would leave $113 billion, nearly $350 per person, in the pockets of U.S. consumers. That can be a big boost for the economy in general. Meat and pork won’t get it all but they will get a portion of it.

You May Also Like