Where Did All the Hogs Go?

September 17, 2013

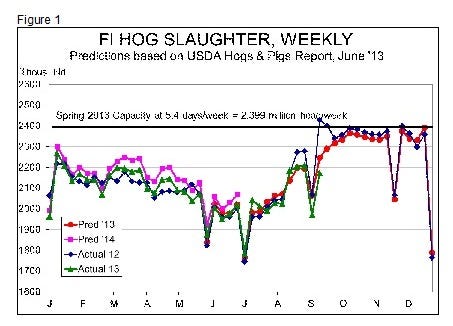

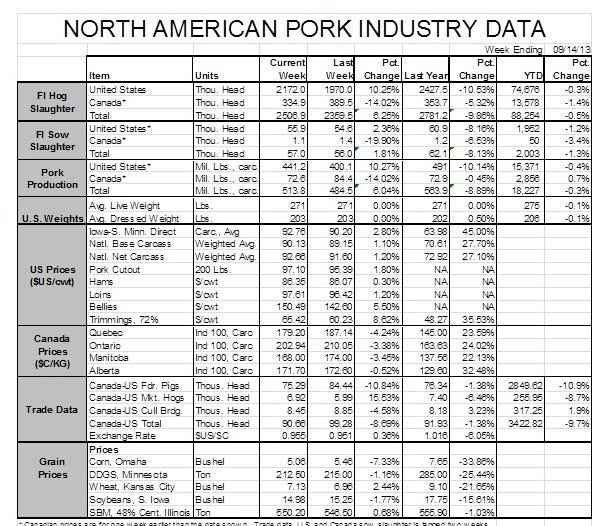

The headline message on Monday’s Daily Livestock Report sponsored by CME Group asked “Where Did All The Hogs Go?” It’s a question likely being asked by a lot of people after last week’s 2.172 million head fell 10.3% short of last year’s level and well-short of even my relatively low forecast for weekly slaughter (Figure 1).

As I’ve pointed out on many occasions, it should be no surprise that hog numbers in August and September this year are far lower than they were one year ago. That has little to do with the number of hogs on farms in the U.S. (or Canada, for that matter) but more to do with the current economic situation being faced by producers relative to what they were facing last year. One year ago, feed costs were growing by the day and producers were in a hurry to get hogs gone. The rush of pigs kept slaughter weights constant at a time that they usually increase and pushed slaughter totals above 2.4 million the first two weeks of September 2012.

The situation is vastly different now. Corn prices are falling quickly as harvest gets started, and they will very likely fall even further according to USDA’s World Agricultural Supply and Demand Estimates (WASDE) report last week. Hog prices have rallied with October futures trading above $90 since Sept. 6 and eclipsing $92 Monday morning, Sept. 16. Neither of those factors will get producers too fired up about moving hogs quickly, especially with cooler temperatures and fresh corn and the higher feed intakes and daily gains they usually drive in autumn months.

Like what you’re reading? Subscribe to the National Hog Farmer Weekly Preview newsletter and get the latest news delivered right to your inbox every week!

And let’s remember that for a hog to move to slaughter producers have to want to sell it and packers have to want to buy it! Now price is the obvious equilibrator of those two actions but there is no guarantee that price will move enough to equalize the total desired quantities in the short run and packer margins have been nothing to write home about.

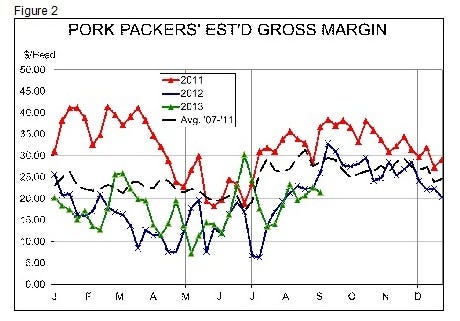

Figure 2 shows my computations of weekly average packer gross margins. By “gross” margin, I mean basically revenues over cost of goods sold with no operating costs deducted. These figures represent the value of the hog carcass plus the value of the by-products, less the value of the hog. No amounts are deducted for plant, labor, energy, transportation, packaging, marketing, etc. costs. My thinking is that those other costs are relatively constant from week to week and thus the changes in this gross margin provide packers’ incentives (or disincentives) to slaughter hogs.

One note: Computing a margin this year that is comparable to years past is not easy since the cutout values now published by USDA using data reported under the mandatory price reporting system for pork are significantly higher than the cutout values that were computed from voluntarily-reported data prior to January. The margins for 2013 in Figure 1 use the FOB plant cutout value less $3.90/cwt., the difference between the FOB plant cutout and the cutout using voluntary data during the January-April overlap of the two series. This isn’t perfect but it is all we have since parallel systems were not maintained for a full year as had been wished by many.

While margins have not been bad this year, they have neither been stellar with the exception of a few weeks in late June and July. All but five weeks this year have been lower than the five-year average gross margin and, as can be seen, virtually every week in 2012 and thus far in 2013 have fallen short of the excellent margins of 2011. Packers aren’t too enthused about killing pigs and had pushed cash prices down by over $10/cwt. since mid-August until last week’s rally which was, quite understandably, driven by a higher pork cutout value.

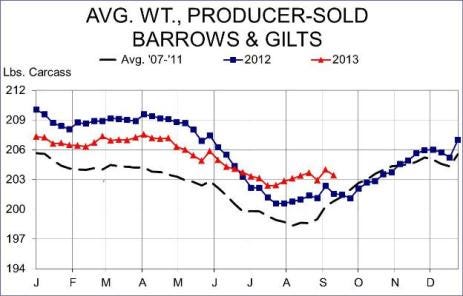

But there is, in my opinion, no evidence to suggest that hogs are backing up on U.S. farms. If anything, weights have risen slower than normal for this time of year (see Figure 3), suggesting that producers are pretty current. A solid week of near-100-degree temperatures in August and some hot days last week have no doubt kept gains in check and weights could increase pretty quickly given this week’s forecasted cooler temperatures.

Figure 3

So did the June report just absolutely miss the 50-119-lb. pig inventory on June 1? Maybe. But, at -0.4% from last year, it had been spot-on accurate when adjusted for last year’s strange slaughter pattern until two weeks ago. The June 1 under-50-lb. inventory was pegged at -1% so perhaps we have gotten into those smaller inventories already? Not out of the question given this year’s generally cooler temperatures. That still doesn’t explain all of the 3 to 4% shortfall of actual slaughter relative to my downward-adjusted forecasts of the past two weeks.

It’s a good thing we are just over a week away from a fresh set of inventory data. As Ron Plain, University of Missouri agricultural economist, always says, “The number-one rule of forecasting is to forecast OFTEN!” And fresh data helps that process a lot!

You might also like:

Pork Repeats Strong Demand Showing

Analyzing How Farm Size Impacts Piglet Survival

You May Also Like