USDA Cold Storage Report Analysis and Anticipating the Hogs and Pigs Report

March 24, 2014

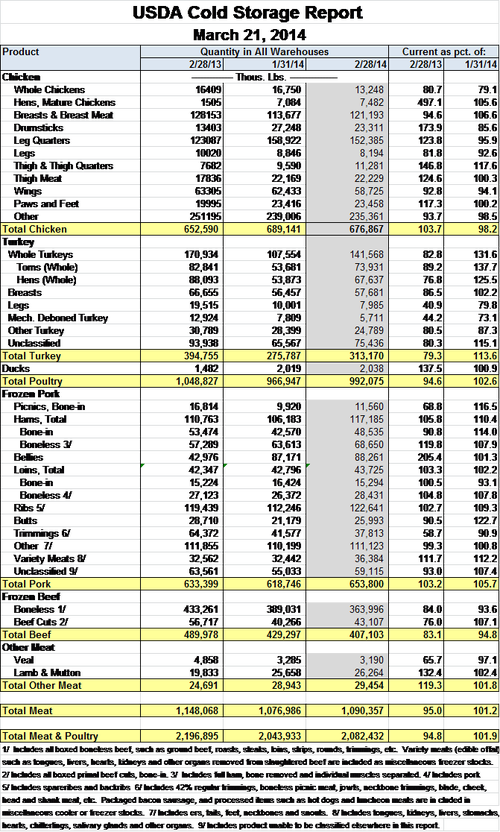

Friday’s Cold Storage report from the United States Department of Agriculture (USDA) showed record-large February pork stocks that I still think are generally bullish, since they do not reflect the big month-on-month buildup that many in the trade expected. Given Monday morning’s softness in CME Group Lean Hog futures, that may have been a mis-reading of what the trade expected on my part. The data from the USDA Cold Storage Report is shown in the table that appears later in this article.

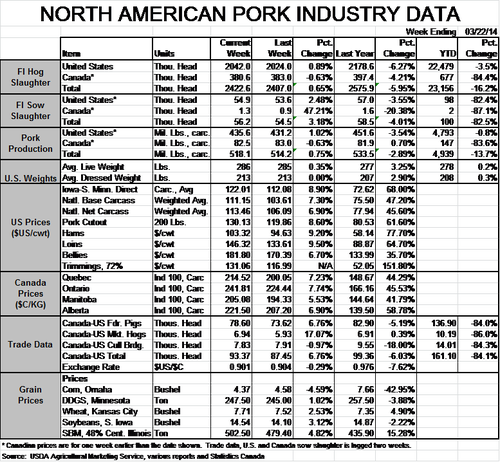

The amount of pork in freezers on Feb. 28, 2014, was 3.2% higher than last year, and 5.7% higher than one month earlier. Widespread talk of “stockpiling” had, I thought, put expectations for this report higher than those values would indicate. However, today’s futures suggest that observers had it right: Any stockpiling has occurred in March, not back in February. We expect freezer numbers to be even larger at the end of March as packers and end users set some product aside for the rainy days they expect this summer.

Virtually every category of pork product saw increases in stocks versus January. Butts led the way in percentage terms at +22.7%. There were10.4% more hams in storage on March 1. Loin stocks were only 2.2% higher, while bellies stocks grew by only 1.3% in January, but remain more than twice as large as one year ago. The recent explosion in cut prices and the cutout value suggest that many more users are following belly users’ lead in preparing for summer.

Like what you’re reading? Subscribe to the National Hog Farmer Weekly Preview newsletter and get the latest news delivered right to your inbox every week!

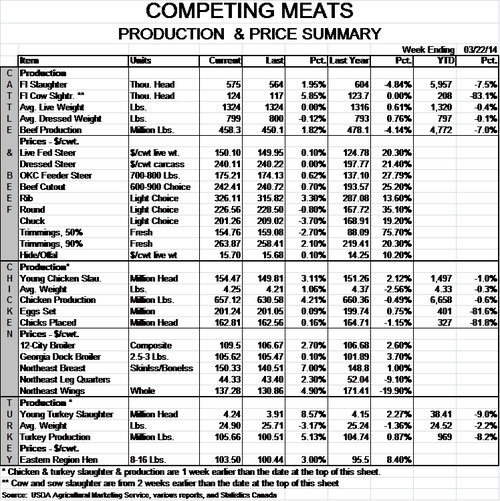

Beef inventories were sharply lower as the industry tries to get through current short supplies and frozen beef owners decide the time is right to sell. A slight year-on-year increase in chicken supplies left total meat and poultry inventories 5.2% smaller than last year on Feb. 28.

Friday’s Cattle on Feed Report indicates that more fed cattle should be available this summer. Placements were a surprising 14% higher than last year. That compares to analysts’ average pre-report estimate of +9.1% and puts feedlot inventories nearest their year-earlier level that they have been since August 2012. The report suggests no help for short-term supplies, but does point to lower prices in mid- to late-summer, a fact that the futures market has, in our mind, pretty well already incorporated.

The more important implication for Friday’s Cattle on Feed Report, though, is that the drawdown in feeder numbers will leave stocks critical again in late summer and fall, and point to another “cattle hole” in early 2015. The supply of cattle outside of feedlots was historically low on Jan. 1, down 2.7% from the already low level of Jan. 1, 2013. Placing more now leaves less of an already tight supply for placement later on.

The entire meat and poultry complex will now turn its attention to Friday’s quarterly Hogs and Pigs Report. I don’t know that we’ve anticipated – or needed(!) – a report this much since late 2007 when circorvirus vaccines came out or, perhaps the summer of 1998 when rapid expansion was confirmed and many of us began worrying about the wreck that indeed came that fall.

The numbers to focus on this week will be the Dec.-Feb. pig crop, the two lightest market hog inventories, and the monthly farrowing, pig crop and litter size estimates. My estimates of these losses are now well known but what will USDA say based on its tried-and-true sampling and computational methods? Will those methods capture an event of this magnitude? We’ll know on Friday afternoon. One input of note: Rabobank released its quarterly hog situation report last week, and its supply numbers were even gloomier than mine. Rabobank has September slaughter (which I haven’t taken a shot at yet) over 20% lower than last year!

A question for the longer term is whether the breeding herd is growing. In spite of lower sow slaughter and unprecedented prospects for future profits, I doubt that it is. In fact, a herd stable with the December level will be down 1.4% from last March. I think that is pretty likely given how much attention producers have had to pay to fighting porcine epidemic diarrhea virus (PEDV), and how much money they have spent on things like farm biosecurity, truck washing, etc. Add in some difficulty in locating replacement gilts and some understandable, “Why would I want more sows when I’m having so much fun with the ones I have now?!” sentiment, and it is difficult to see how the herd will increase by much if at all.

You might also like:

High Hog Prices Come with Complicated Consequences and a Positive Export Picture

You May Also Like