U.S. Appears to Have Lost WTO MCOOL Battle

August 25, 2014

Remember, you heard it here first! Well, maybe not first but you have been hearing it here for a long time: The United States would lose again – and ultimately – with the World Trade Organization (WTO) on mandatory country-of-origin labeling (MCOOL). That is the word that has appeared in a number of published accounts the past few days. I have been able to corroborate those reports with my own sources.

The WTO has circulated to the affected countries its finding that last November’s revised MCOOL rules still violate WTO regulation. Those findings will be made public this fall. We hear that will occur in September. At that time, the United States will have yet another opportunity to appeal a WTO decision, potentially dragging out this fiasco even further.

Canada has already announced a detailed list of U.S. products that it will target for retaliatory tariffs should the ultimate decision be that MCOOL is a trade violation. On that list are U.S. pork and beef and a number of other agricultural and non-agricultural products whose inclusion has had the desired effect of waking up other trade groups to this issue. In addition, the list has been targeted at a number of key legislators’ home districts. There’s apparently nothing like potential trade sanctions to get non-agricultural businesses and politicians interested in food.

I could not locate a retaliation list from Mexico, but news reports have stated for some time that Mexican authorities have indeed compiled one. The Mexicans know how to play this game and will almost undoubtedly do the same kind of strategic targeting that the Canadians have done.

So where do we go from here? I have said since the earliest days of MCOOL debate back in 2003 that this program would eventually be found to violate our free trade commitments. A further appeal of this ruling will be, I believe, as futile as past appeals so it is time to take action. I’m pretty confident that the action the U.S. Department of Agriculture (USDA) will choose, however, will be to appeal and thus buy more time.

But what are the options when that appeal fails? I suppose the USDA could try yet another rule but after two attempts to both enforce the law and satisfy the WTO, the USDA doesn’t likely have any new rabbits in its hat. That means that the program must simply be suspended or that Congress will have to change the law in a manner that will allow WTO-compliant rules to be written. A day of decision is drawing nigh.

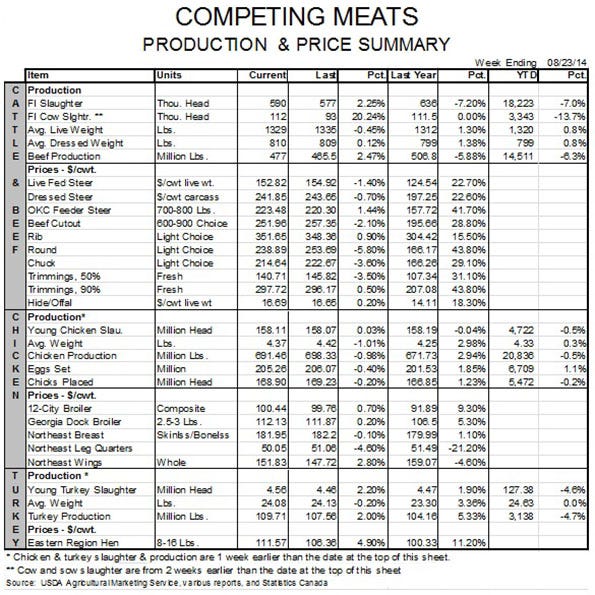

Should all of that fail, Mexico and Canada will be free to impose retaliatory tariffs. Canada and Mexico were our second and third largest markets, respectively, for beef cuts in 2013. They were third and second, respectively, in the U.S. pork export market rankings. Mexico is our largest market for pork variety meats and is challenging Japan virtually every month to become the largest pork muscle cut market. Year-to-date, Mexico trails Japan by a mere 1.4% in total pork muscle cut exports.

Should they be imposed, Mexico’s tariffs will hurt much more than will Canada’s. That conclusion results from Canada’s position as a net exporter of both beef and pork. As such, any reduction of imports from the United States will be offset by more Canadian product remaining at home. Neither Canadian prices nor consumption will change. U.S. suppliers will be able to capture the international markets left short by reduced Canadian exports thus having little or no impact on prices in the United States.

Mexico, though, is not an exporter and any reduction in imports from the United States will drive prices upward there, reducing the quantity demanded. Mexico may turn to other suppliers for part of that “shortage” but will not likely be able to backfill at anywhere near the same price as the foregone U.S. product. The amount of the price increase in Mexico and the resulting reduction in imports from the United States will depend on the size of the tariff imposed – something we know nothing about at this time. Should a 10% tariff similar to that imposed in the trucking dispute be imposed, I believe the impact on U.S. pork prices will be 2% to 3%.

It’s unfortunate we have had to go down this road when it was so clear a decade ago that we would end up in this place. I only hope that the decision-makers in Washington will finally face up to the damage they are about to force on U.S. livestock and meat producers.

About the Author(s)

You May Also Like