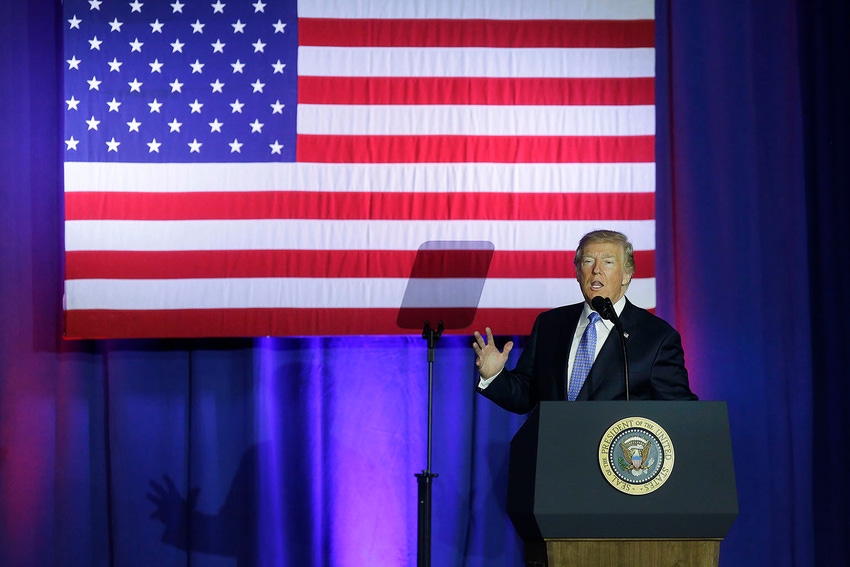

Tax reform effort begins

Legislative Watch: President Trump’s tax reform package unveiled; U.S. and South Korea to discuss KORUS; Farm Bureau Marketbasket Survey finds bacon higher; chief ag negotiator confirmation hearing set.

President Trump and the House and Senate Republican leadership unveiled its much anticipated tax reform package this week which lowers the tax rates for individuals and businesses and repeals the death tax. There remains a number of questions still left unanswered as to what happens to various deductions and how do you pay for the tax reform package which is estimated to cost $2.2 billion.

A number of items are left open for the Congress to deal with that affect farmers. The proposal is silent on the issue of cash accounting and on a stepped-up basis provision for capital gains on inherited property. Congress will have to determine if producers will be able to write off interest expenses.

Highlights of the tax reform proposal include:

• Lowers rates for individuals and families: shrinks the current seven tax brackets into three — 12%, 25% and 35% — with the potential for an additional top rate for the highest-income taxpayers to ensure that the wealthy do not contribute a lower share of taxes paid than they do today.

• Doubles the standard deduction and enhances the child tax credit

• Eliminates loopholes: eliminates various itemized deductions used primarily by the wealthy, but retains tax incentives for home mortgage interest and charitable contributions, as well as tax incentives for work, higher education and retirement security.

• Lowers corporate tax: lowers the corporate tax rate to 20%

• Repeals death tax

• Repeals Alternative Minimum Tax

• New lower tax rate and structure for small businesses: Limits the maximum tax rate for small and family-owned businesses to 25%.

• Expensing of capital investments: allows, for at least five years, businesses to immediately write off (or “expense”) the cost of new investments.

KORUS meeting set

The United States and South Korea will meet on Oct. 4 to begin discussions on changes to the U.S.-Korea Free Trade Agreement. Earlier this month, President Trump sent shock waves through U.S. agriculture when he threatened to withdraw from KORUS. South Korea is a major market for U.S. beef, pork, corn, wheat and soybeans. During his presidential campaign, Trump complained of the KORUS trade deficit primarily due to the importation of Korean automobiles.

The U.S. Trade Representative is looking for changes to KORUS “including possible amendments and modifications to resolve several problems regarding market access in Korea for U.S. exports and, most importantly, to address the significant trade imbalance.”

Marketbasket Survey finds increase in bacon price

The price of bacon is up 19% compared to a year ago to $5.24 per pound according to the American Farm Bureau Federation’s Fall Harvest Marketbasket Survey. Other food items that saw an increase were chicken breast, up 9% to $3.13 per pound; flour, up 7% to $2.37 per five-pound bag; orange juice, up 6% to $3.46 per half-gallon; and vegetable oil, up 5% to $2.52 for a 32-ounce bottle. There are 16 items in the basket of which 12 saw increases and four decreases. The items that saw a decline in price included eggs, down 3% to $1.44 per dozen; bagged salad, down 16% to $2.41 per pound; ground chuck, down 3% to $3.99 per pound; and potatoes, down 2% to $2.68 for a five-pound bag.

The survey was conducted in 25 states by 81 shoppers. AFBF’s next survey will be for a typical Thanksgiving meal.

Confirmation hearing set for chief ag negotiator

The confirmation hearing for Gregg Doud to be the U.S. Trade Representative chief agriculture negotiator is Oct. 5 before the Senate Finance Committee. Doud currently serves as the president of the Commodity Markets Council. Previously he was a senior professional staff member for the Senate Agriculture Committee where he worked on livestock, international trade, food aid and Commodity Futures Trading Commission issues.

Earlier in his career he was the chief economist for the National Cattlemen’s Beef Association. Doud is a native of Kansas and holds both a bachelors and masters from Kansas State University.

Northey and Ibach confirmation hearings set

More USDA nominees are beginning to move through the confirmation process. The Senate Agriculture Committee will consider the nominations of Bill Northey to be undersecretary for Farm and Conservation Programs and Greg Ibach as undersecretary for Marketing and Regulatory Programs this coming Thursday.

Northey is currently Iowa secretary of agriculture and Ibach is Nebraska’s director of agriculture.

About the Author(s)

You May Also Like