Pork industry data: Stable building costs, shifting interest rates

Are we building enough spaces to keep up with genetic improvement and more pigs marketed per sow?

February 21, 2024

By Dusty Compart, Compeer Financial

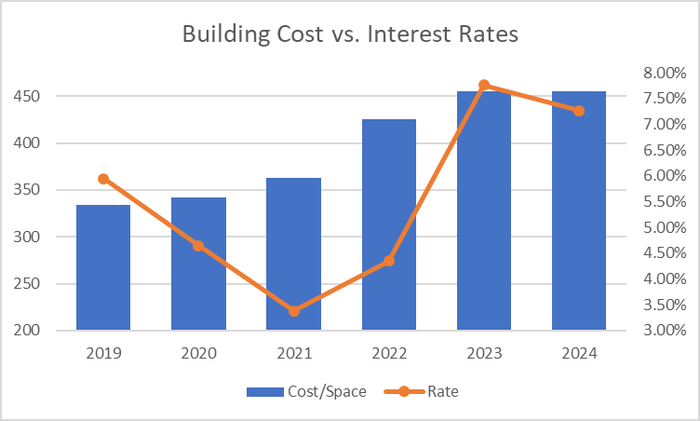

Over the past three years, we’ve compiled a comprehensive dataset on building costs and interest rates, which are critical considerations for pork producers. In the current high inflation environment, it is clear that heightened building costs are becoming the new normal. Additionally, while interest rates have historically been manageable, they have risen noticeably from levels familiar to us not too long ago.

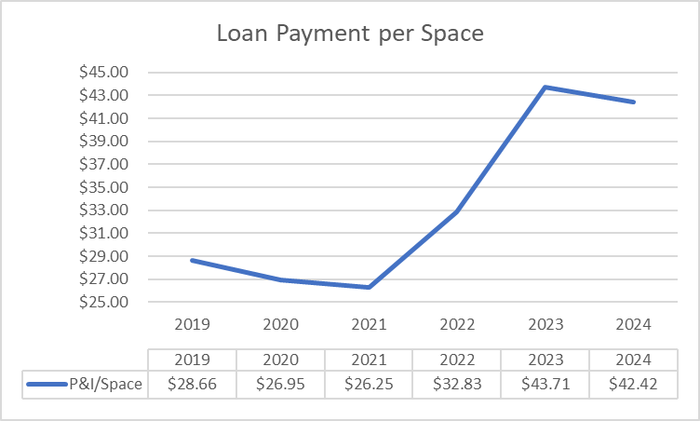

Last year at this time, we discussed a long-term trend regarding building costs and interest rates. As we revisit the topic now, armed with updated data reflecting 2023 actuals and 2024 projections, we observe a stabilization in building costs and a slight pullback in interest rates. The graphs below illustrate this trend, focusing on a standard 2,400-head wean-to-finish barn under the following assumptions:

15-year term loan

85% loan financing

Solid borrower credit

Southern Minnesota and Northern Iowa cost averages

Costs include all aspects except land

Rates may vary based on specific loan pricing, products, young farmer program qualifications and terms

The interest rates were recorded in early to mid-January of each respective year and are based on above-average borrower credit. Overall building costs for the site can change based on your equipment package, material quality and other factors, but the trend captures what producers have been experiencing across the countryside.

Compeer Financial

Compeer Financial

U.S. Inflation Calculator

There are a few key points to consider when analyzing this data:

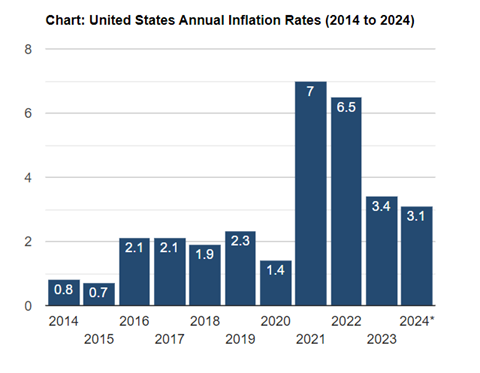

Since 2020, overall building costs have surged by approximately 30%. This escalation became particularly pronounced after the onset of the pandemic and has since stabilized over the past two years. While unsurprising, it’s noteworthy that the rise in building costs mirrors the general inflation rate data in the U.S. (chart above)

Throughout 2020 and 2021, interest rates experienced a decline, offsetting the surge in building costs. However, present conditions reveal increased borrowing costs, with certain rate products currently hovering around the 7% range. Consequently, we’ve witnessed a significant increase in principal and interest per pig space from 2021 to 2023, with a slight decrease observed in 2024. To maintain the same loan payment per space as in 2022, a down payment of approximately 30% is now required – a marked increase compared to the 15% capitalization rate utilized in the 2022 scenario.

In addition, two important questions deserve some thought:

Are we building enough spaces to offset the ones that have been decommissioned or are needed to keep up with genetic improvement and more pigs marketed per sow? While we don’t have a definitive answer for this challenge, it’s a trend worth monitoring closely, and it will be interesting to see how it all unfolds.

The average age of pork producers is on the rise. Many producers who built barns during our industry’s growth phase are now approaching retirement. While this might initially seem like a hurdle, it also presents an opportunity to transition these assets to younger producers. Although these assets may require reinvestment, they can offer a newer producer a facility with potentially more attractive cash flow.

It’s important to highlight the positive aspects of constructing new grow-finish hog barns. Firstly, the manure value derived from these operations can significantly enhance cropping operations. Secondly, hog barns have traditionally maintained their values as equity builders. Moreover, the income generated from this investment can be effectively managed through depreciation.

We remain in a dynamic and challenging period. However, challenges often present opportunities. When making borrowing decisions, producers should thoroughly evaluate each opportunity, considering all angles to gain the necessary insights into how it will impact and enhance their farm business both now and in the future.

Compart is a swine lending specialist with Compeer Financial. For more insights from him and the Compeer Swine Team, visit their website.

You May Also Like