PEDV Outbreaks Are Not Linked to Low Slaughter Levels

October 28, 2013

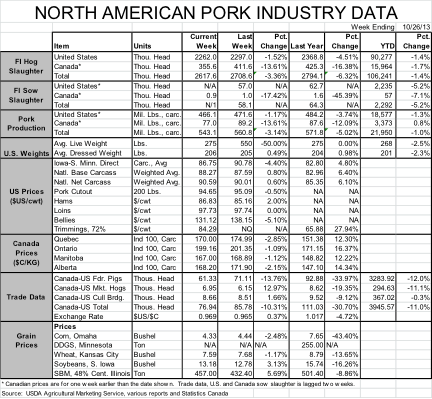

Two issues are dominating the news in the pork industry this week: the spread of porcine epidemic diarrhea (PED) virus and the low levels of hog slaughter since Sept. 1.

The key to realize about these two issues is that at present they are not related. The timing simply does not match. The earliest known case of PED virus in the United States was April 15. There are a number of producers and packer employees who are claiming that PED virus was in the United States and active in many herds well before April 15, and is thus responsible for the current short hog numbers.

I do not know where those conclusions are coming from. But I know from a number of legitimate, knowledgeable sources in the veterinary medicine community that the diagnostic labs went back and retested samples dating back to last fall (November, I believe) and found no PED virus-positive samples before that April 15 case. There may be black helicopters, the lunar landings may indeed have been faked and the Tri-Partite Commission may actually run the world, but I do not believe that PED virus was active in the United States before April 15. The scientific evidence simply does not support any other conclusion. And ours is an industry based on science, correct?

But PED virus is spreading and impacting more and more sows. North Carolina continues to see more cases – about 100 for the five weeks that ended Oct. 13. News circulated last week of some breaks at several large sow farms in Iowa.

Futures markets have been sharply higher since last Wednesday as piglet losses mount. I still do not expect to see any PED virus-driven supply reductions until December since losses did not become significant until July. But the losses in North Carolina beginning in September and now those in Iowa will begin impacting numbers even more in March and beyond.

Explaining the Slaughter Shortfall

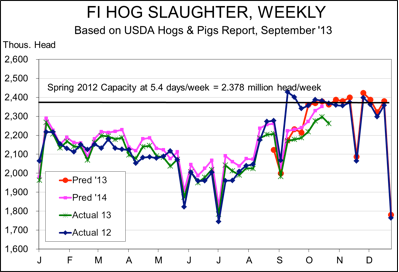

So what is causing the current shortfall in numbers? Before we answer that, let’s consider the magnitude of the shortfall. Figure 1 shows weekly federally-inspected slaughter. The red line is my forecast of weekly slaughter numbers based on the September Hogs and Pigs report. Note that it is far below the level of last year, something we all expected. But actual slaughter (the green line) is far lower than even those forecasts. In fact, slaughter since Sept. 1has been 6.2% lower than last year and 2.9% lower than the forecast levels. That 2.9% is 520,000 fewer hogs than I had expected.

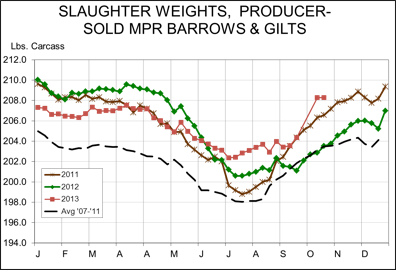

Why is this happening? My original idea was that hot weather in August and stretching a very short corn crop over 14 months (the normal 12 plus one month due to last year’s early harvest and one month due to this year’s late harvest) had caused hogs to slow down and thus reduce slaughter. And weights from mid-July forward (see Figure 2) bear that out. They didn’t go down but they didn’t go up as they normally do. See the black dashed line in Figure 2. It is the average for the past five years – what I would say is probably normal.

But look at what has happened since USDA market reporters returned to work! The first of those two observations represents just one day but last week’s observation is for a whole week. The 208.8 for both of those periods represents a return to rapid growth rates as cool weather and fresh corn work their magic.

So will more hogs come to town soon? Likely – when prices begin to fall. Why get in a hurry now if one earns 90 cents per pound – and maybe more – for another week’s growth? But if price begin to fall, I suspect slaughter will rise.

I’m not completely confident that my hypothesis will be correct since the magnitude of the shortfalls is so large. But I still think it is the most plausible explanation other than “The USDA missed it.” Both are likely true to some degree. The more legitimate of the two will be determined by hog numbers over the next few weeks.

Miss a Golden Opportunity?

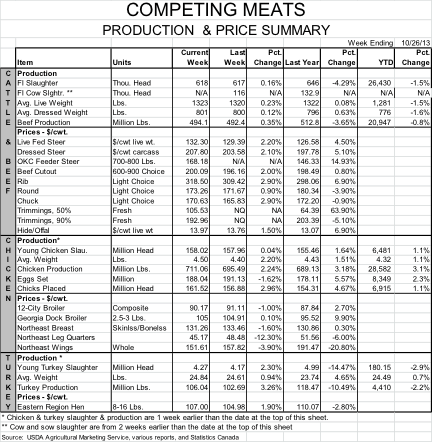

My growing fear is that the U.S. pork industry is going to miss a golden strategic opportunity. It had appeared that pork would have a definite price advantage on beef. In addition, pork cooked to 145 degrees with a three- minute rest could compete favorably against steaks and other products. But will all of this negate that opportunity by driving hog and pork prices higher? It will to some degree. The question is how much and, again, we won’t know that for a while.

About the Author(s)

You May Also Like