PEDV Hits Canada--What Happens Next?

January 27, 2014

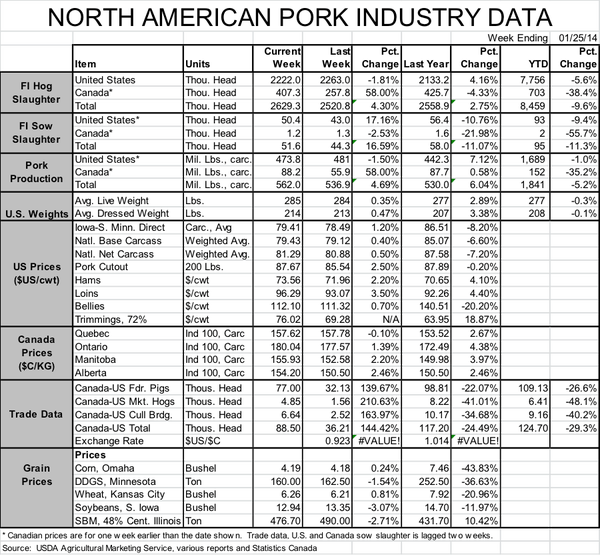

The big news this week is, of course, the discovery of porcine epidemic diarrhea virus (PEDV) in Canada. The virus was confirmed last Thursday to be present in a 500-sow farrow-to-finish operation in Ontario. Canada also reported that two samples from a loading dock at a Quebec slaughter plant had tested positive earlier in the week. Late last week there was no apparent connection between the two incidents but there is talk this morning that they may be related.

How much will this move markets? In my opinion, no more than the discovery of the virus in a 500-sow farm in the U.S. – and possibly not as much since the U.S. market is far more important from a price discovery point of view. That is not to say it is insignificant. It simply doesn’t mean much to markets.

There is a lot of truck traffic between Canadian farms and assembly yards and U.S. farms and packing plants. This was pretty much inevitable, especially considering the truck washing challenges posed by winter weather. It is likely that the Canadians will do a better job of controlling the virus than did we Americans, primarily because they have been able to learn from our experience. I certainly hope they are successful in those efforts.

Like what you’re reading? Subscribe to the National Hog Farmer Weekly Preview newsletter and get the latest news delivered right to your inbox every week!

One important fact is this: Canada has declared the disease “reportable” and will thus generate much more accurate, detailed and meaningful data than have their U.S. counterparts. That’s not saying much, but contrasting what we will know in Canada with what we have known – or NOT known – in the U.S. may prove quite interesting.

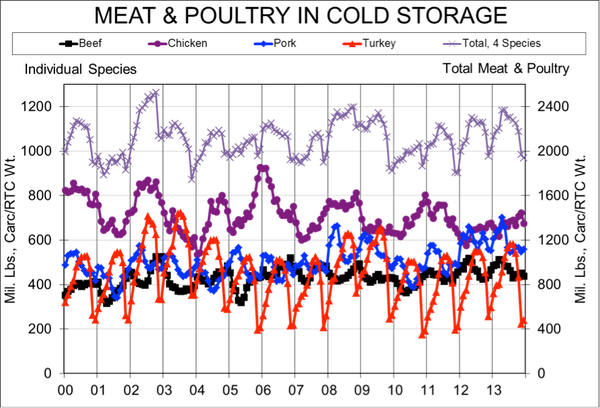

Last week’s Cold Storage Report from USDA indicated that total frozen meat and poultry inventories were at their lowest level in two years on December 31. That’s not to say that the freezers are empty, since we have 1.938 billion pounds of frozen product on hand. But that figure is 4.1% lower than last year, and 1.6% lower than at the end of November. Figure 1 shows the monthly freezer stocks data for the four major species.

The largest year-on-year decline among the four major species was for turkey, whose stocks were nearly 20% smaller than at the end of 2012. Frozen beef stocks were down nearly 6% from one year ago, while chicken stocks were only fractionally (0.4%) lower.

Pork inventories grew by 2% during December and finished the year 1% larger than one year earlier. The monthly gain was a bit of surprise as stocks frequently decline during December as holiday product moves to retail outlets and holiday-driven slaughter slowdowns reduce output and thus freezer inflow. I’m not too concerned about the increases since December production, based on weekly data for the four weeks that ended December 28 was 3.7% higher than one year ago. December 2013 had one more slaughter day than did December 2012 and that extra day is included in the data cited above. One day added to nineteen would have boosted “slaughter time” by 5.3% so production on an equal day basis was actually a bit lower this year.

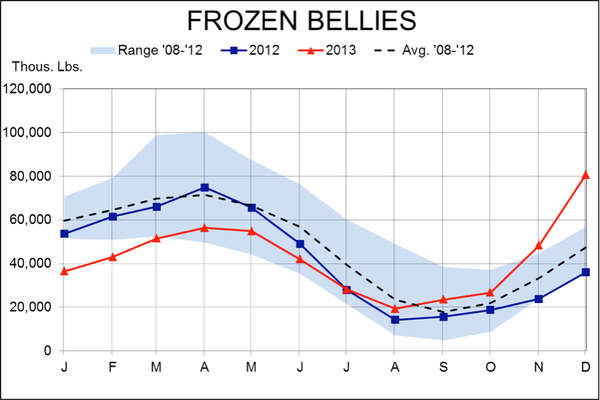

The only cut to show a large year-on-year swing was bellies (see chart above), whose inventory grew to 80.556 million pounds, up 123% from one year ago and up 67% from last month. That’s the highest level since May 2005 and comes on the heels of a record run for bellies prices in 2012. This does not mean bacon and bellies demand has tanked! It does imply that bacon may have been priced out of some usage and off of some consumers’ shoping lists. And what happens then? Prices fall and inventories grow – just as they have done for bellies – and the product once again becomes attractive, pushing prices higher and drawing down inventories. I’m not worried about bellies. Bacon still makes almost anything taste better and that fact has not changed one bit!

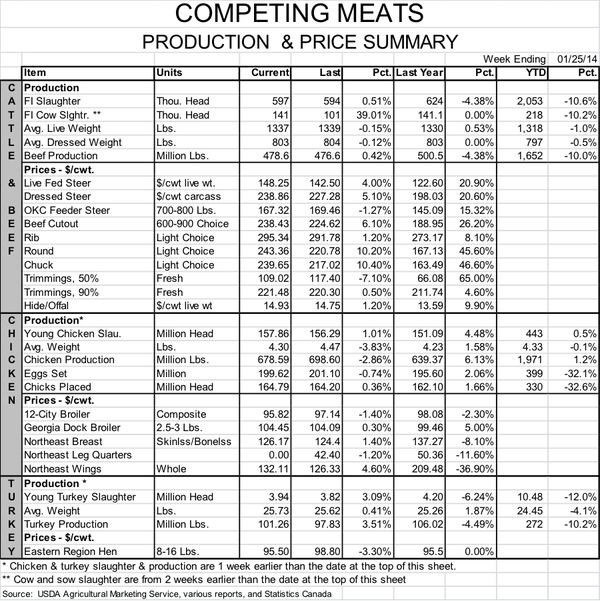

Finally, last week’s Cattle On Feed report was generally neutral. Slightly higher placements will provide some respite for beef consumers come summer but the die is already cast for this spring: HIGH PRICES. We doubt that the market can maintain cutout values in excess of $230/cwt. just as it couldn’t keep bellies at $180. Some buyers will back off of beef. But they will likely eat some other sort of animal protein, thus strengthening pork, chicken and turkey demand.

I still see tight beef supplies for the foreseeable future, especially with better pasture conditions and a full-blown expansion of the beef cow herd underway.

You might also like:

It’s All About PEDV in Pork Producer Circles

Propane Shortage Challenges Pork Producers

You May Also Like