Hog Slaughter Up, but Weights Coming Down

The driving force behind recent weakness in cash hog and pork markets is not hard to find – larger supplies. Federally inspected (FI) hog slaughter exceeded year-ago levels by over 6% for the third straight week.

September 4, 2012

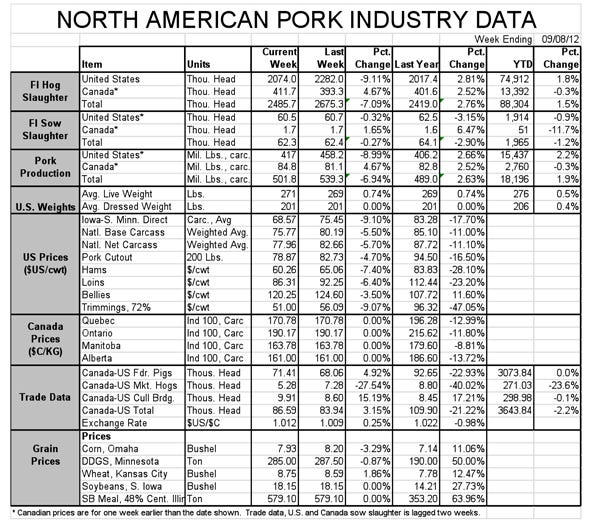

The driving force behind recent weakness in cash hog and pork markets is not hard to find – larger supplies. Federally inspected (FI) hog slaughter exceeded year-ago levels by over 6% for the third straight week. FI slaughter last week was 7.6% higher than one year ago. Hog prices were 11-12% lower than in 2011, while the cutout value was down almost 15%. Those relationships are all pretty reasonable with a relatively steady hog demand function.

But there was good news last week. The average weight of barrows and gilts sold to packers subject to mandatory price reporting dropped by 0.51 lb. from the week before. Last week’s 200.9-lb. carcass average is still 0.3% larger than one year ago, but the important point is that it dropped vs. the previous week.

Big numbers and lower weights support the hypothesis that a concerted effort to reduce hog weights was underway. That effort finally out-weighed the impact of cooler weather and weights finally dropped. But the effort to reduce weights may end up pushing about 450,000 more hogs through slaughter plants by Oct. 1 than was predicted by the June Hogs and Pigs report. If all of those are taken from Q4 slaughter, that will mean 1.5% fewer pigs and the possibility of lighter hogs than we would have seen this fall. Both would be a shot in the arm for product and hog values.

Tough Quarter Ahead

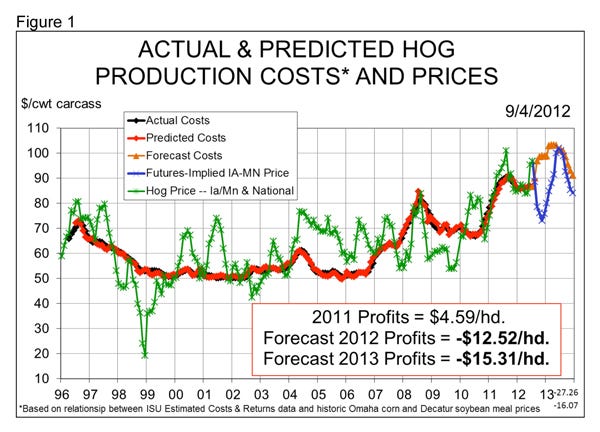

A curative is needed somewhere. As Figure 1 shows, the profit outlook for the next 16 months is bleak, with the worst of it coming this fall. The “lost spring” for hog prices and the recent selloff in Lean Hogs futures has been the lowest this year, averaging about $12.50/head. But things will be very bad for un-hedged hogs sold in October through December with losses amounting to over $45/head. The average cost for market hogs in 2013, according to my model, now stands at $99.41/cwt., carcass.

What can be done? Ontario George Morris Centre's Kevin Grier and Alberta Pork Specialist Ron Geitz recently wrote: “As far as hedging grain goes, it’s too late. The horse is out of the barn and is in the next county. Don’t compound your problems, as some major U.S. meat companies did in 2008, by locking in high-priced grain for an extended period.”

The key words in that statement are “extended period.” There may not be much choice to locking in some pretty high-priced grain for the next 3-4 months. But time offers opportunities for many things to happen. Some are bad, but some are also good. Markets do respond. While it is difficult to see how they might respond favorably in this instance, a locked-in price removes any possibility of change. I know you are in dire straits at $100/cwt. cost of production. Will you be that much worse off at $105/cwt. if there is a possibility of being better off? The answer to that question likely lies in your balance sheet and your banking relationship. Examine both carefully as you make decisions.

Sow Slaughter Slows

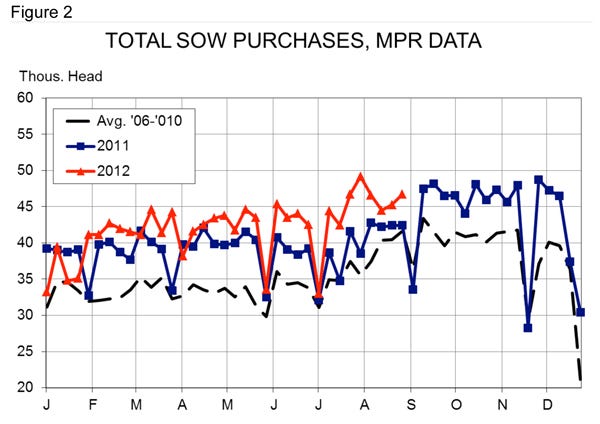

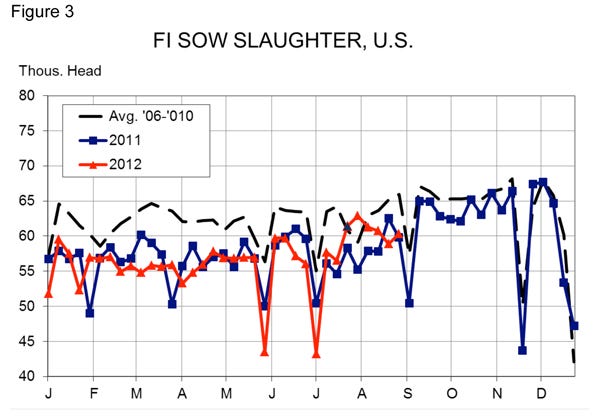

It appears that U.S. producers are taking a break from any panic regarding downsizing the sow herd. Last week’s sow purchase data from the mandatory price reporting system indicated a slight increase from the previous week, but nothing suggests a flood of sows (Figure 2). But remember, the year-on-year comparisons of this purchase data look much worse than the year-on-year comparisons of actual slaughter data (Figure 3), since a new entity is apparently reporting this year.

Last week’s purchase data suggest that actual sow slaughter, which we will not know for another two weeks, will be just barely (0.3%) larger than one year ago. I think producers are holding onto sows that will farrow December through February litters. Pigs from those litters will be sold against June through August futures – all of which were at or near $100/cwt., carcass, on Friday. Breakeven isn’t great but it allows one to live to fight another day!

Then There’s Ethanol

Most readers of Weekly Preview know my opinion of U.S. ethanol policy and our need to, at least now after billions of aid, allow the ethanol industry to compete and behave according to market forces. Last week, Grier, who is cut from the same cloth, wrote in the George Morris Centre’s Pork Mark Review: “In the spirit of the Olympics, in a remarkable display of logical gymnastics, the Grain Farmers of Ontario issued a press release that actually said, ‘Relaxing or eliminating Canadian mandates [for ethanol inclusion] to control the price of grain . . . will not allow the marketplace to function independently.’ You don’t see rhetorical cartwheels, back rolls and forward extensions like that every day.” It looks like the Canadians are again competing well with us Yanks on this one.

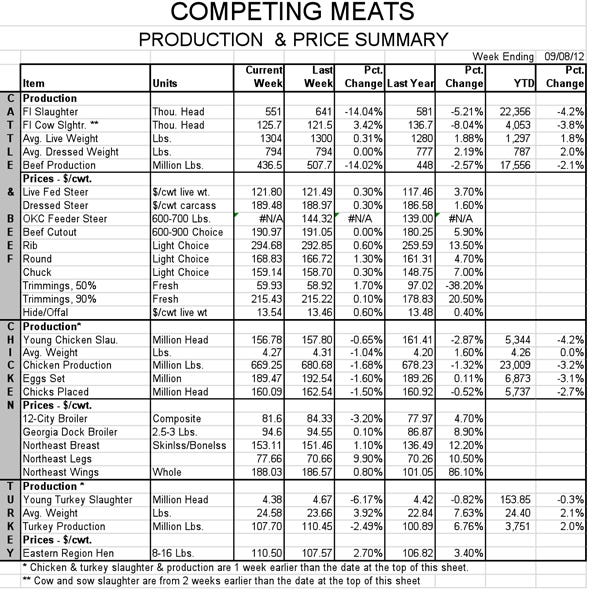

Sorry for the “not available” (N/A) in the trade data cells in today’s North American Pork Industry Data table. Something has gone haywire again in the APHIS-AMS reporting system for these data. I hope the situation will be rectified quickly.

About the Author(s)

You May Also Like