Hog Market Goes Higher Than Justified by Supply

September 2, 2014

In early May I was asked “Why has the hog market fallen so much?” My answer was “Because it went way too high in the first place.” The same question was posed to me two weeks ago, and guess what? My answer was the same. I also pointed out in April and July that the hog market had gone higher than was justified by actual – and, I think, even the anticipated! – supply levels.

The roller-coaster pork and hog markets of 2014 are, to me, a classic example of what happens when a market is starved for accurate information. There is plenty of information out there and some of it has proven to be pretty accurate. But the ignorance of and fear caused by a new disease, an apparent new demand paradigm and the resulting range of estimates for key variables has left market participants groping for a price equilibrium that appears to be quite elusive.

Producers selling hogs and packers buying hogs are locked-in to the reality of hog numbers and cut values on a given day. While there is some doubt about those numbers, it is small. Packers, for instance, have most of tomorrow’s supply booked and know pretty much what those hogs will cost and how much the product will be worth. Producers know how many hogs they have to sell and, for the few they actually negotiate, do so with some idea of packer needs.

But the futures market is a free-for-all that is free to all in terms of access. Any one that wants to put money on the line in the belief that they know where the market is headed is free to do so. That money carries their vote on the future regardless of the factual underpinnings of their expectation. This openness is the futures market’s strength in that it brings every piece of information that is in the market to bear in discovering prices. It is also its weakness in that it creates – especially in times of uncertainty – turmoil that can take prices both lower and higher than they should go. This year has been a case in point.

But we’re again on the “Be Happy” side of the bright little tune as it relates to Lean Hogs futures. After crashing by roughly $28 and $20/cwt. carcass since early July, the October and December contracts, respectively, have gained $10 and $8 since Aug. 21. I think part of that bounce is a simple correction. Sellers piled on when sky-high prices broke. Buyers stepped in when they once again smelled a bargain.

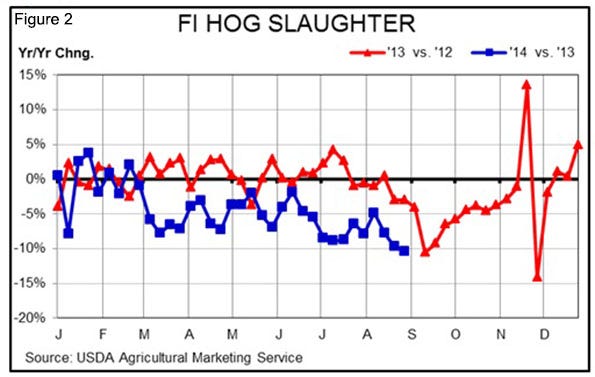

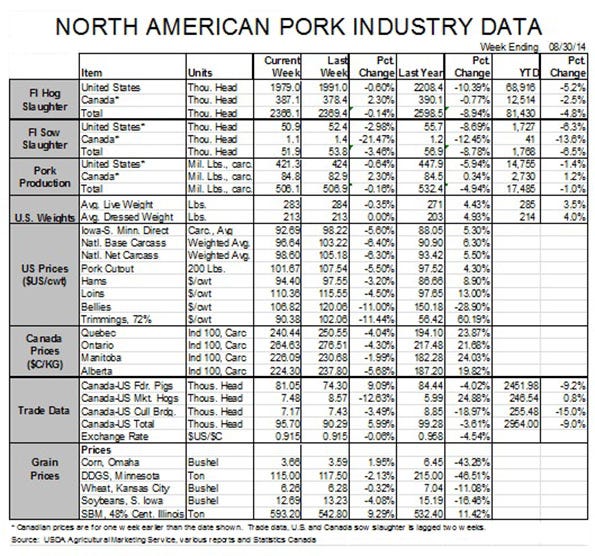

There is more than psychology at work here. Those dramatic year-on-year slaughter totals that I warned you about back in March are at hand. Last week’s total was only 1.979 million head, 10.4% lower than one year ago. Figure 1 shows weekly slaughter totals. Figure 2, which shows year-on-year percentage declines for those weekly totals, is probably more informative. As can be seen, last week’s year-on-year change is the largest we have seen yet. Could we see more 10%-plus shortfalls?

Examination of Figure 2 would, on first blush, suggest that continuation of these kinds of year-on-year changes are unlikely. Last year’s total for Labor Day week was just 1.983 million head – a number that was nearly 5% lower than the year before. And slaughter the week that ended Sept. 14, 2013, was 10% lower than in 2012. If we keep up this minus-10% pace, this week’s slaughter will be 15% smaller than two years ago and next week’s will be down 20% from two years ago. One-fifth fewer hogs than just two years ago? Can that be?

The 20% next week might be tough but the minus-15% two-year decline for this week is likely. Last Friday’s HG-201 report from the U.S. Department of Agriculture (USDA) said that packers had booked 1.167 million hogs for delivery this week. One year ago, the same report (also for Labor Day week) said 1.457 million head. These data aren’t precise but that is a 20% decline in bookings for the week.

The only reason I doubt the 20% two-year decline for next week is that last year’s year-on-year decline was itself 10% and was likely caused by what my friend Dow McVean refers to as “the creeping liquidation of 2012” when feed prices started to take their toll. The “creeping” part refers to liquidation that was scattered and small for individual operations; likely too small for the USDA to effectively pick up. It never showed up until September and October 2013 when we saw sharp year-on-year slaughter cuts.

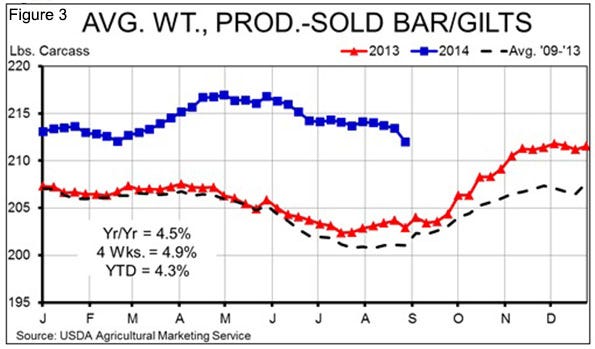

McVean now expects a “creeping expansion of 2013” to begin to offset some of the porcine epidemic diarrhea virus (PEDV) losses this year and leave slaughter numbers closer to year-ago levels than they have been in recent weeks. That is definitely possible but I’m going to wait and see on this one. The average weight of producer-sold barrows and gilts for last week through Thursday was 212.0, down 1.4 pounds from the previous week. As can be seen in Figure 3, that is by far the largest decline for hog weights this year and comes at a time when weights usually increase. It looks like folks had to work hard to come up with last week’s pretty paltry number of pigs, suggesting that any “creeping expansion” may still have been over-run by the huge PEDV losses implied by February and March case accession data.

It appears the futures market is now betting on that. Will it get oversold or overbought again? Probably. But it is again heading in producers’ favor. Grain and hog futures still imply average profits of $36.10 per head for 2015. If you haven’t locked-in those profits – the third highest annual average ever according to my model – then this rally may be another great chance.

Just how many do you think you are going to get?

About the Author(s)

You May Also Like