Feed Costs Trim Cattle on Feed, Probably Sow Herds

Anyone who thinks higher feed costs don’t have much impact on livestock and poultry should look at Friday’s Cattle On Feed report carefully.

October 22, 2012

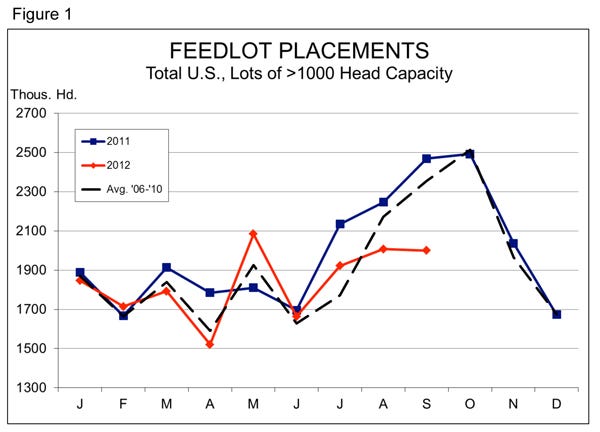

Anyone who thinks higher feed costs don’t have much impact on livestock and poultry should look at Friday’s Cattle On Feed report carefully. While feed costs are not the only driver of a 19.6% year-on-year reduction in feedlot placements, they are, in my opinion, the primary driver. It is true that the simple availability of feeder cattle is an issue, too, but it was the feed cost hikes of 2008 and 2009 that set this “shortage” in motion.

This is the third straight month of double-digit declines for placements into lots with capacities of 1,000 head and more (Figure 1). It’s not likely to be the last. That means that fed cattle numbers are going to get very tight indeed come late January and the situation will continue for the foreseeable future. This year’s projected calf crop of 34.5 million head is 2.3% larger than last year’s crop from which most current placements are being drawn.

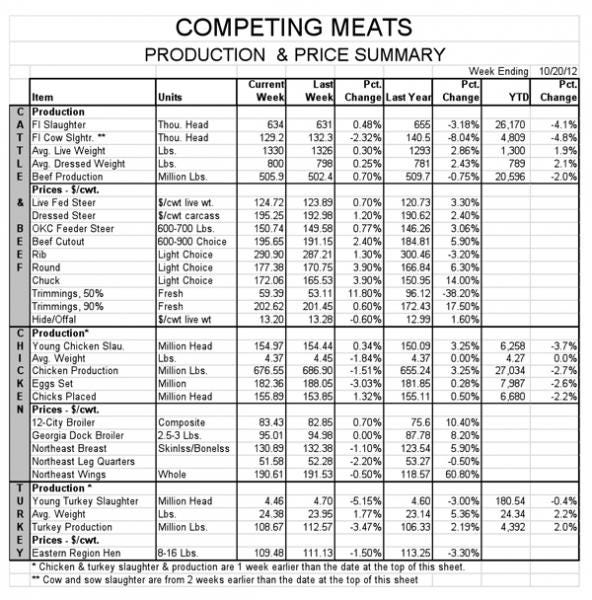

All of this, of course, should be positive for pork demand in 2013. The quantity of a product demanded by consumers depends on several things: the price of the product (negative relationship), the price of competitor products (positive relationship), the price of complementary products (negative relationship), consumer incomes (positive relationship), consumer tastes and preferences (can be positive or negative).

As Weekly Preview readers know, producers determine the quantity of product offered to consumers some 10-11 months in advance of it becoming available when they make decisions about breeding sows. Therefore, the actual dependent variable in our industry is the price – first at retail and then derived back to wholesale and producer-packer levels. But the relationships described above still hold – higher beef and chicken prices mean higher pork prices, ceteris paribus. Ceteris paribus is Latin for “all other things being equal” or, to the cynical among you, “a fantasy world that only exists in the minds of economists.”

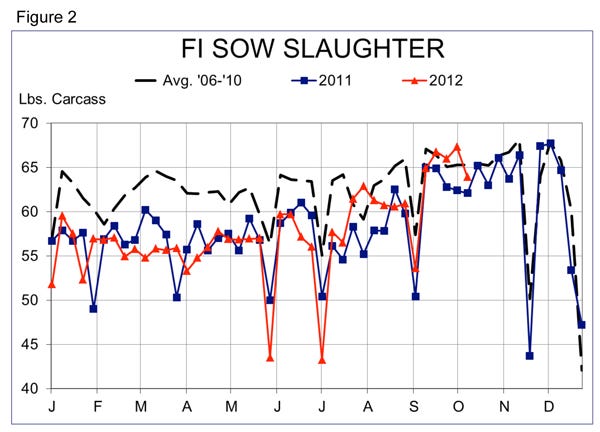

And what decisions are being made about hog supplies 10 months from now? It appears that sow slaughter has increased once more – a bit earlier than I had expected. Figure 2 shows that sow slaughter has exceeded year-ago levels for the four weeks that ended Oct. 5. Last week’s purchase data is not all in yet, but data through Thursday shows 5.9% higher numbers than one week earlier. If that difference carries through with Friday’s data, last week will see sow slaughter of about 67,800, the highest level we’ve seen in 2012.

Now higher sow slaughter is no surprise in the fall. But these levels are high enough to imply sow liquidation. Matching the average weekly slaughter runs over the past five years means the sow herd is being liquidated. The reason is that the sow herd is now smaller and an equal number of animals represent a larger percentage of the herd.

I still think this all revolves around expected margins next year. My costs and returns model, based on the Iowa State University parameters, now shows positive margins of roughly $5 to $10/head for May through August 2013. They show losses of $6.95/head for September and $9.01/head for October. Sows now being bred will farrow in late February. Those pigs, in general, will go to market in late August and September and be priced against the October futures contract. Producers likely think now is the time to cull sows and that action at this time fits well with the surge of gilt slaughter we saw last month.

How high will sow slaughter go? I suspect it will not pass 70,000/week by much, if it gets there at all. But it could stay in the 67,000 to 70,000/week range through late November, before holiday-shortened hours begin to reduce weekly runs. I look for the December sow herd to be 1 to 1.5% lower than last year and the March herd to be another 1 to 1.5% lower.

How does the closure of Odom’s Tennessee Pride sow plant in Little Rock, AR, affect this? Not a bit. ConAgra Foods will move the slaughter and processing that had been done in Arkansas to the Abbyland Foods plant in Wisconsin. Abbyland is a “strategic partner” of ConAgra Foods. That’s a fancy term for co-packer. Our sources tell us that the plant in Wisconsin can absorb the numbers from Arkansas. And even if they can’t match all of Odom’s 1,000-head-per-day capacity, there remains plenty of space to process sows. I estimate that the sector can handle over 80,000 sows/week, working only four days per week.

About the Author(s)

You May Also Like