Feed Costs Down, Futures Follow

Friday’s World Agricultural Supply and Demand Estimates (WASDE) from USDA contained enough good supply news for grains and soybeans to set those markets into a tailspin.

February 11, 2013

Friday’s World Agricultural Supply and Demand Estimates (WASDE) from USDA contained enough good supply news for grains and soybeans to set those markets into a tailspin. The changes weren’t large, but they were large enough that when combined with some skepticism about demand and more interesting happenings in equity markets, they caused a big drop for soybeans and a modest drop for corn.

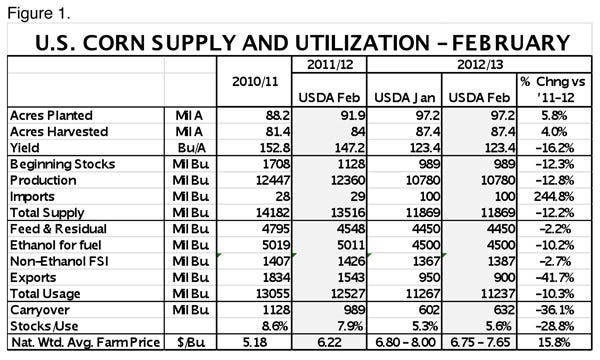

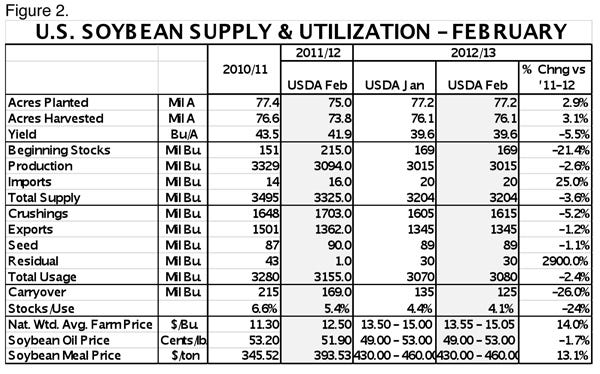

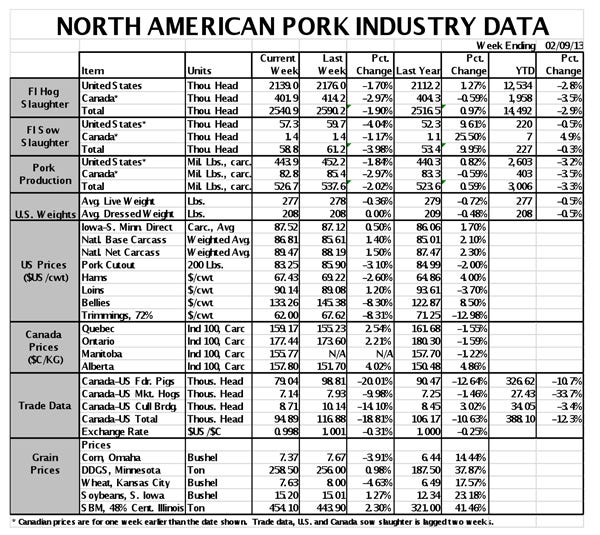

USDA added 30 million bushels to projected year-end corn stocks and actually reduced its forecast of year-end soybean inventories by 10 million bushels. See Figures 1 and 2 for February supply-utilization tables.

After the large change to feed/residual corn usage last month, USDA left the figure unchanged at 4.45 billion bushels on Friday. Lower exports (down 50 million bushels) were the key driver for the corn change while higher crushings accounted for all of the change in soybean stocks. The 5.6% year-end stocks-to-use ratio for corn is still the second-lowest on record, the lowest recorded in ’95-’96. The projected 4.1% year-end stocks-to-use ratio for soybeans is the lowest ever and the projected 125 million bushels in bins at the end of August will be the lowest total since 1976 – a time when, I would argue, the soybean industry was still in a primary development phase in the United States.

South American Crops

Of course, there is the matter of South American crops for which, in some cases, harvest has begun. USDA reduced its estimates of Argentinean production of soybeans and corn, but both figures came in higher than analysts had expected. Both Argentinian crops are expected to be nearly 30% larger than last year with 27 million metric tonnes (MMT) of corn and 53 MMT of soybeans anticipated. Those figures compare to average pre-report trade estimates of 26.4 and 52.9 MMT, respectively.

The estimates of Brazil’s corn and soybean crops increased – a reflection of generally better weather conditions there. USDA expects Brazil to harvest 72.5 MMT of corn and 83.5 MMT of soybeans. Those estimates were also larger than the average pre-report trade figures. If the soybean crop meets expectations, it will mark the first time that Brazil has harvested more soybeans than the United States. The 83.5 MMT is equal to 3.067 billion bushels.

The reaction was swift and continues in futures markets today. Nearby soybeans are now down over 50 cents from Thursday’s close and new crop down beans are over 60 cents lower. Nearby soybean meal is down $22/ton and new crop meal is over $21 lower as of mid-morning on Monday.

The slide for corn futures actually began on Wednesday as traders squared positions going into the report. New corn had fallen about 25 cents/bu. by mid-morning Monday. Nearby March corn was down the same amount vs. one week ago.

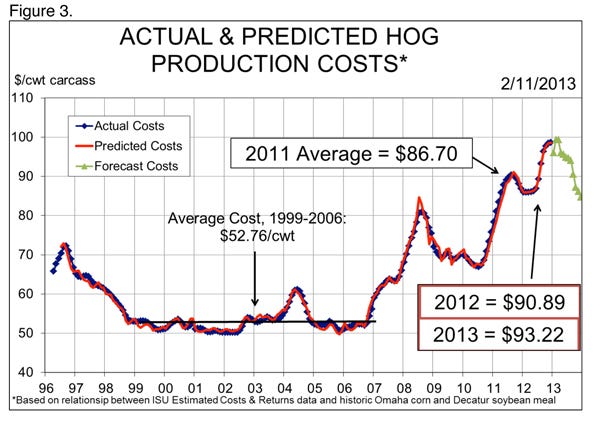

Declines for corn and soybean meal futures have pushed projected 2013 breakeven costs down by about $4/cwt., carcass. The annual estimate as of Monday was $93.22/cwt. (Figure 3).

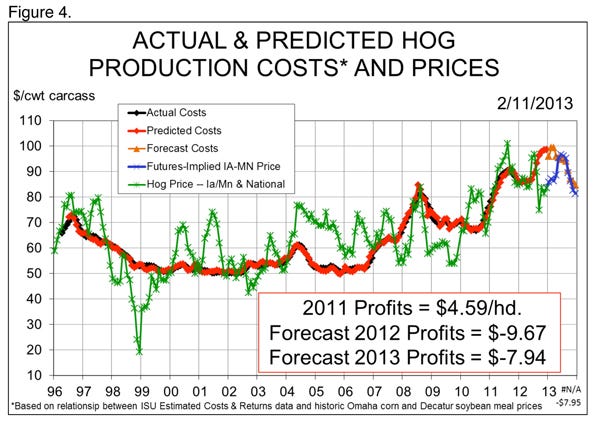

The bad news, of course, is that rapidly falling lean hogs futures have more than offset the lower cost projections and have driven projected 2013 profits for average Iowa farrow-to-finish operations to -$7.94/head (Figure 4). That is an improvement from 2012, but the losses would still represent another major drain on producers’ equity should they actually come to pass. Only June, July and August sales would record profits, according to prices on Monday, Feb. 11.

Export Expectations

The situation with Russia has been a major reason for the negativity in hog markets, but there’s another negative: It’s February. January is never great coming off the big slaughter runs of the fall. February is never great because there is really nothing helping demand. It’s not that prices collapse in February. It’s just that they very seldom do anything positive. The loss of shipments to Russia leaves the market with nothing to fall back on.

We still expect summer hogs to trade in the mid- to upper-$90s with a few hogs hitting $100/cwt., carcass. Those price levels in June, July and August would mean futures markets have to rally some – not a lot—over the next few months. Such a move is not at all unusual as long as cash markets see their normal seasonal rise. I do not see the Russian situation as being negative enough to prevent that. Russia took a little over 1.2% of last year’s U.S. pork production. A normal price impact would put prices 2.5 to 3% lower than we had previously expected, provided the Russian snit over ractopamine continues.

I won’t hazard to guess on that one. The point is that this is not Japan or Mexico or Canada or China. It is Russia. While every export market and consumer is important, dealing with Russia has always involved episodes such as these. They’ll show us who is boss and eventually discover that ractopamine isn’t so bad after all. It may be a while, but my guess is they’ll find that sellers will demand a premium for ractopamine-free pork – as they should since it costs more. And the Russians have just never been too big on premium-priced product of any sort. In truth, they still can’t afford to be.

About the Author(s)

You May Also Like