Feed Costs Continue to Plague Producers’ Chances for Profits

Will this winter ever end? Many in the upper Midwest and eastern Cornbelt areas are asking that question as temperatures fall and snow continues to fly.

March 25, 2013

Will this winter ever end? Many in the upper Midwest and eastern Cornbelt areas are asking that question as temperatures fall and snow continues to fly. About the only thing pork producers are more weary about is the ongoing bad news in the markets.

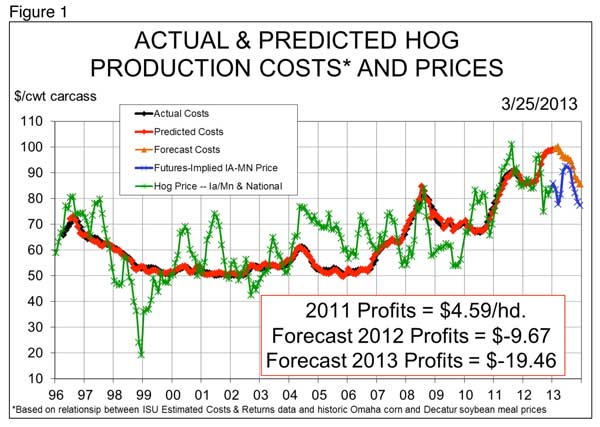

As of Monday morning, my profit model based on historical estimated costs and returns from Iowa State University shows losses of nearly $20/head for average Iowa farrow-to-finish operations this year. Figure 1 shows estimated costs and hog prices on a carcass weight basis.

While it is true that costs are the big driver in these losses, the cost situation has actually gotten better of late, with corn and soybean meal prices falling more-or-less constantly. But those lower input prices will not significantly impact the costs of hogs going to market until summer. In fact, my model shows costs of over $99/cwt. for hogs sold in January and February, with costs of roughly $98/cwt. for March and April shipments. Based on Monday’s corn and soybean meal futures, costs are not expected to drop below $90 until August.

Could those change? Of course, but I fear that if anything they will rise between now and July. Corn and soybean carryout stocks are still forecast to be near record lows and there will be places where both are hard to find this summer. I certainly hope I’m wrong, but I could easily see costs rising this summer for those who have not already priced their feed ingredients or, better yet, secured the physical supplies they need through the end of the marketing year. Don’t get caught without the feed ingredients you need.

Like what you're reading? Subscribe to the National Hog Farmer Weekly Preview newsletter and get the latest news delivered right to your inbox every Monday!

On the contrary, a good growing season could easily result in fourth quarter costs near $80/cwt. It is difficult to believe that near $80/cwt. costs are a good thing but this is the new world. A breakeven level of $80/cwt., carcass, would be the lowest since early in 2011. USDA’s forecast of $4.80/bu. average farm price for corn could get us to that level, especially if soybean meal prices fall commensurately.

The big negative this spring has been cash hogs and Lean Hogs futures. Barring some unforeseen circumstance, I still believe we will see a seasonal rally in hog prices that will most likely carry the futures complex higher. Over the past five years, the national negotiated net weighted average price has increased by $12/cwt. from April 1 to its peak in mid-May. That peak is then, on average, matched again in late June and nearly matched in early August. The largest late-March to mid-May cash hog rally since mandatory price reporting began in 2002 was in 2008 when they rose by $19.38. That rally was spurred on by the beginning of our first great export surge to China.

Should the average rally occur this year, it will only take prices into the low $90s, well below the $100 or so that I had expected. Winter and spring disappointment could set the stage for a larger-than-normal rally, but it appears that anything above the mid-$90s would be somewhat of a surprise. Wouldn’t it be nice to have a positive surprise for a change?

Pork in Cold Storage Update

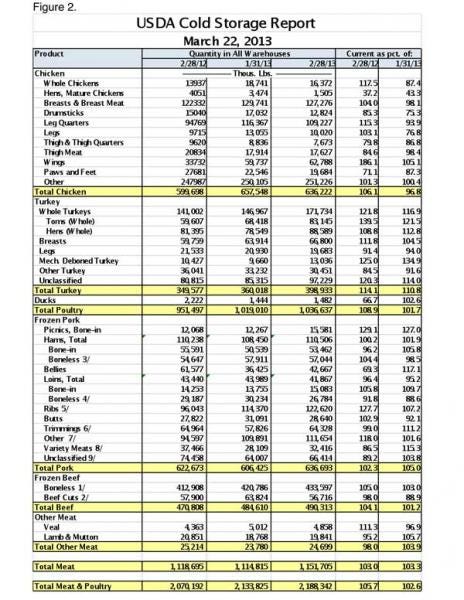

Friday’s Cold Storage report was not as bearish for pork as I had feared. Total stocks of frozen pork were 5% higher than at the end of January and 2.3% higher than at the end of February 2012. The data for pork and all other meat/poultry species as of Feb. 28 appear in Figure 2.

The encouraging part of the report is that the difficulties for pork lie primarily in two cuts – ribs and “other.” The growth is really nothing new, especially for ribs, which have been piling up in storage since early last summer. Feb. 28 rib stocks were up 28% from last year, while “other” pork in freezers was up 18%. Bellies stocks increased by 17% during the month but that growth was from very low levels at the end of January. Feb. 28 bellies inventories were nearly 30% lower than last year. With fewer hogs and summertime BLT demand just ahead, we think bellies will remain strong. Now, if Mexican buyers will just step in and buy some cheap hams after Easter!

The negative part of Friday’s Cold Storage report is poultry. Turkey supplies led all increases at +49.4 million pounds or 14.1% vs. one year ago. Chicken wasn’t far behind at +36.5 million pounds or a 6.1% increase. Add them together and the two poultry species accounted for over 70% of the year-on-year gain in freezer inventories – just as chicken companies become poised to grow.

We expect to see some slowdowns for turkey, but we would be surprised if the chicken companies back off unless crop weather challenges develop. In spite of their “reasoned” approaches to growth in recent years, the mantra of the chicken guys is still pretty much “damn the torpedoes!” or, perhaps more accurately, “The damn torpedoes won’t hit me!” Barring a reversal of feed price expectations, look for more chicken as the companies charge ahead.

You might also like:

Margin Management is Especially Critical in Volatile Times

Amendment Helps Avoid Meat & Poultry Inspector Furloughs

New Pork Checkoff Videos Shine Spotlight on Real Pork Producers

About the Author(s)

You May Also Like