Don't Put All Your 'Eggs' in One Basket

October 13, 2014

The old poultry-based admonition “Don’t put all your eggs in one basket” works for three reasons. The first is the well-known fragility of eggs. Second is the minimal protection afforded by a basket and third, of course, is the notorious undependability of basket carriers. It is not hard to see corollaries of all three in today’s hog and pork markets.

But let’s first take inventory of the situation producers and the industry face.

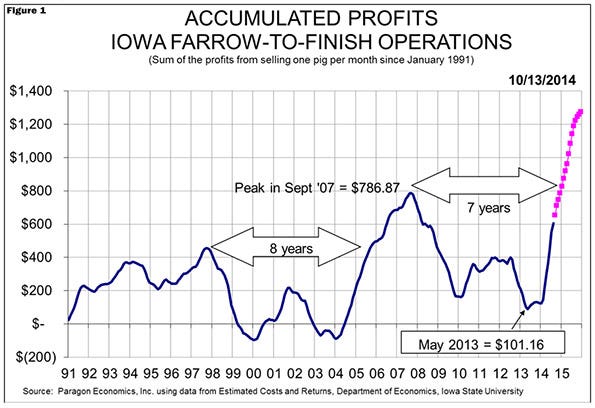

Producers who have bought cash grain and sold cash hogs have had their best year ever. Ones who hedged hogs last winter haven’t done so well but have enjoyed a very, very profitable year nonetheless. Those cash-to-cash producers modelled by the Iowa State University Estimated Costs and Returns series have recouped almost three quarters of the “biofuels years” losses and will, according to current CME Group Lean Hogs, Corn and Soybean Meal futures, collect the rest of those losses by year’s end (See Figure 1). Next year could well carry this measure of profits accumulated by selling one pig per month to a level over 60% higher than the September 2007 peak.

The best corn and soybean crops ever in the United States and a much different world supply-demand situation for both items has put projected costs of production at their lowest level since 2007. CME Group futures as of Oct. 13 indicate breakeven costs of just over $67 per hundredweight carcass in 2015. That figure is 18% and 30% lower than the costs of the past two years, respectively.

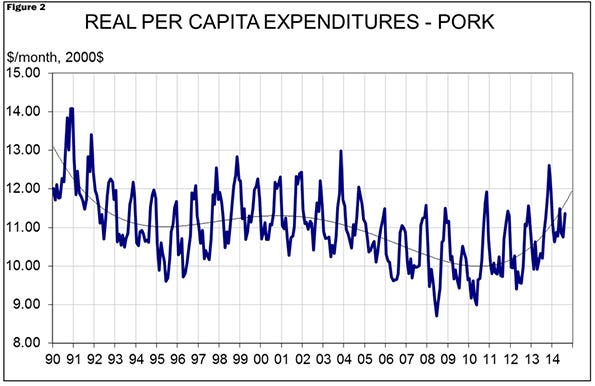

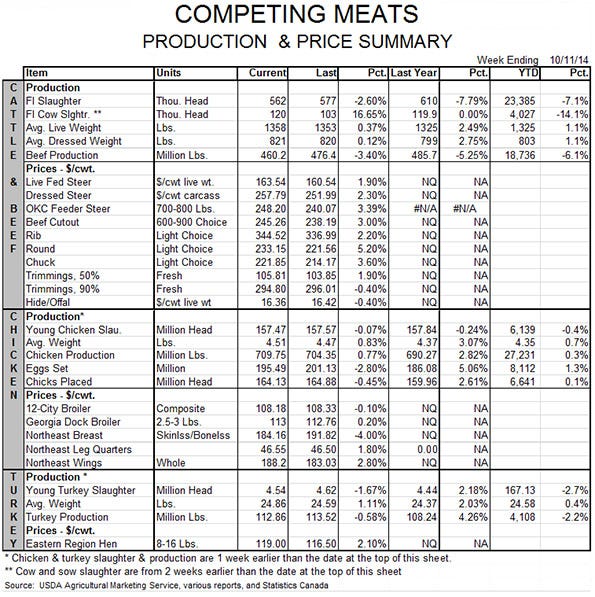

Pork demand is stronger than it has been since 2002 – even before the Atkins Diet period of 2003-04. Further, it would take only a few dollars per month in real per capita expenditures (RPCE is a measure of consumer-level demand) to push pork demand to its highest level since the early 1990s. (See Figure 2.) Record-high beef prices have been – and will continue to be – a factor in this resurgence as have higher-than-expected chicken prices and some positive impacts of the economic recovery. But the big driver appears to be consumer preferences changed by new-found a) interest in and concern over dietary protein and b) confidence that saturated fats are not just a heart attack waiting to happen.

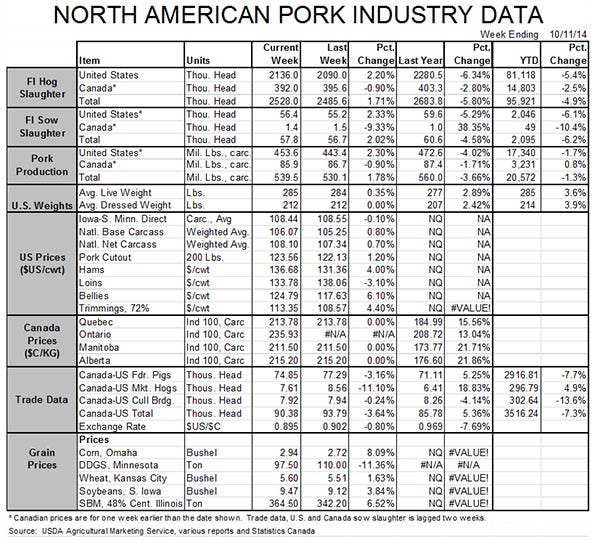

An export market that has been soft but still good. How can that be? Consider the challenges we have seen with Russia (politics and ractopamine – or probably just politics) and China (ractopamine – OK, politics) and the general price level of U.S. product. And yet, exports year-to-date are up 3.6% in carcass weight and the value of those exports is up 17%. Byproduct exports are lower by 24%, but their value is up by nearly 12%. August was pretty ugly due to a sudden glut of European Union (EU) pork in the wake of Russian retaliatory sanctions and a U.S. dollar that has gained roughly 7% versus the CME Group’s Dollar Index since July 1. The export market’s performance in light of these factors has been remarkable and these factors will not last forever.

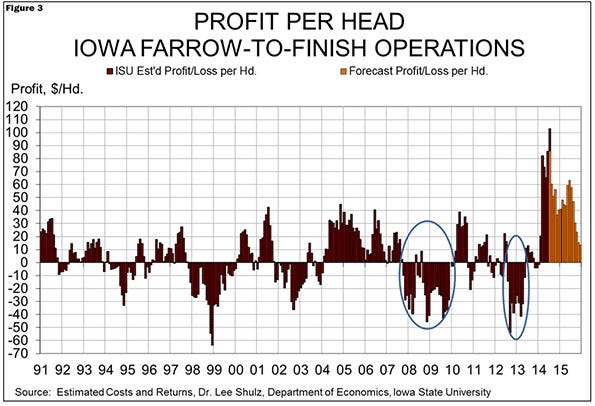

So how does this relate to the eggs in a basket admonition? Hog production profits are about as fragile as avian ovas. It doesn’t take much to shatter them utterly and it doesn’t take an intentional act to get it done. Reference: Headlines regarding “Swine Flu”! Or how about “Drought: Worst Since the Dust Bowl”. While the bars for this year and next in Figure 3 look great, it doesn’t take a lot of analytical power to see that history is littered with downturns that wipe out several good years pretty quickly.

Second, just what basket are you putting this year’s crop of eggs/profits in? Farmers in general, and hog producers in particular, have usually answered the question of “What will you do with your profits?” with “More of what made me those profits!” It is understandable. You are successful doing what you do. You now have the resources to do more of what you have been successful doing. You have a competitive advantage so you think you will capitalize on it. You know bad times will result but you can weather them and be stronger on the other side. And so thinks everyone else; even the companies/producers that won’t survive.

Now I can’t stop this from happening. And I can’t ask any of you to agree to do so, either, since that would violate our antitrust laws and what’s good for the goose (Microsoft, packing companies, lysine manufacturers, e.g.) is good for the gander (producers). But I can ask you to think about potentially better baskets for the eggs you are harvesting. Diversification was once a touted farm management strategy. It was killed, of course, when the gains to specialization became so large that diversified producers earned so much lower returns in every enterprise that they could not make a living. But diversification beyond agriculture may make more sense now than ever.

There are thousands of opportunities to invest in other businesses and industries. I realize that doing so may be something new and challenging and scary. I feel the same way. Economics and markets – not mutual funds – are what I do. Even though my work, just like yours, is “related” to those things, the details are frequently foreign. Overcoming our ignorance, natural skepticism and fear is not easy. Doing so is not a sign of disloyalty or an indication that you lack confidence in your industry.

A different basket or basket carrier may be warranted. These “eggs” have been a long time coming.

About the Author(s)

You May Also Like