Don't Lose Sight of the Real Prize: Profits

August 18, 2014

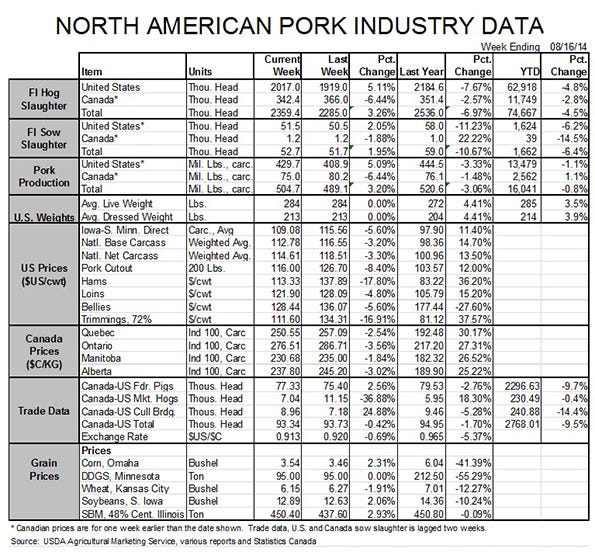

Well, so much for a solidifying of the cash hog market I expected one week ago. After another $7 decline for the negotiated weighted average net price last week, I’m still wondering where things are headed. Relative to prices earlier in the year and the strength exhibited by retail prices this year, this adjustment seems large enough. Lean Hogs futures are mixed in Monday trading and appear to have solidified a bit since last Thursday’s lows.

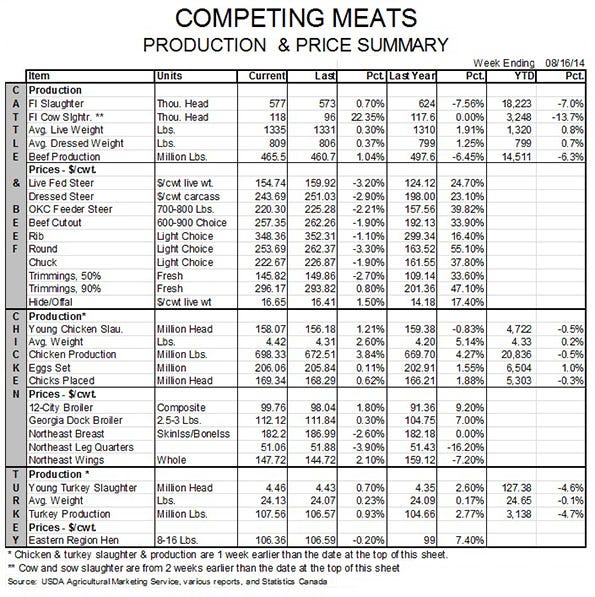

There is still ample uncertainty regarding hog prices, especially as chicken output shows some signs of life in the form of higher egg sets since mid-July. Higher sets have not led to higher chick placements and, eventually, output on many occasions over the past year but this problem, too, would find a solution eventually, right?

In all of the smoke and ruins of the hog and cattle markets over the past few weeks, let’s not lose sight of the real prize: Profits. In a message to clients last week, the principals at Commodity Ingredient Hedging (CIH) in Chicago emphasized that potential profits for the next 16 months are still among the best on record. And I agree completely.

I still feel that the futures market decline is somewhat overdone and that suggests that better profit opportunities may yet be available. But the situation reminds me of the old adage about gift horses and the often-offered advice of Professor Grimes: Maybe you should sell part of them and hope you’re wrong.

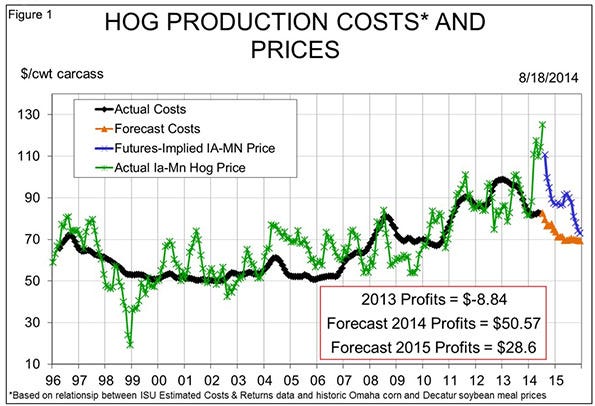

As can be seen in Figure 1, profits for this year will be far and away a record and stand as of Monday morning at around $50 per head in my model based on the parameters of Iowa State University’s (ISU) Estimated Costs and Returns for average Iowa farrow-to-finish operations. Experience tells us that the best producers will be around $60 in these computations that assume cash buying of feed ingredients and cash sales of hogs. Those same calculations for next year say $28.42 for average producers and imply somewhere in the upper-$30s per head for the lowest cost operations.

Looking at the historical data from the ISU series is interesting relative to the current situation for the U.S. pork industry. The second and third highest profit years in the ISU series were witnessed in 1978 ($36.33/head) and 1975 ($34.53/head). It is no accident that those two years followed the 1973 run-up in corn prices that drove herd reductions and then sharply higher hog prices in the mid- to late-$70s. Sound familiar?

The warning is that two years after that record profit year, the first losses in the ISU series were recorded. ISU shows losses of $4.20/head in 1980 and $4.61/head in 1981. “Oh, those weren’t bad!” you might say ‑ until you consider that those were the two largest losing years for Iowa producers until 1994 when the issue of packing capacity first reared its ugly head. ISU’s estimates only go back to 1974 but the reputation of hogs at that time as “mortgage lifters” did not get earned by having very many losing years prior to 1974.

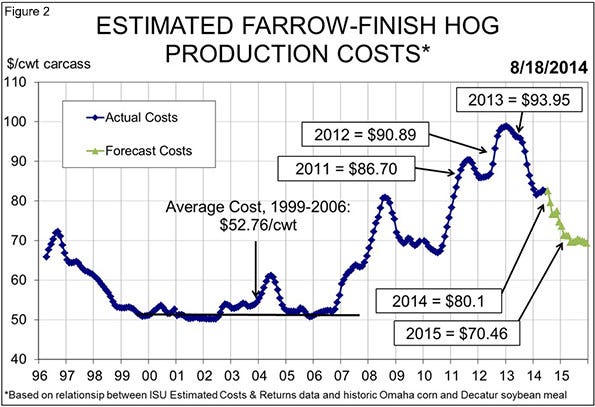

Costs for the rest of this year and 2015 are down sharply (see Figure 2) and may go lower yet. Corn, soybean and soybean meal futures have solidified over the past few weeks and new crop corn prices have actually risen since Aug. 1. Some concern about late-season dryness and susceptibility of both crops to an early drought are probably the key factors in that rally.

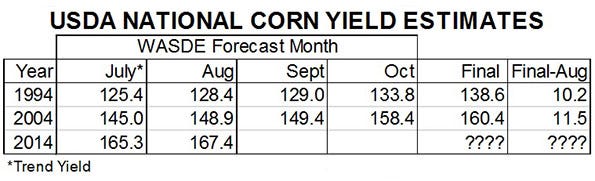

But consider what happened in two previous big-crop years, 1994 and 2004. As can be seen in the table below, what appeared to be good crops relative to the trend yield in August turned into terrific crops by the time their final estimates had been made the following January. The same kind of increase could take the national average yield to near 180 bu./acre this year. We don’t think there is anything to the numerology of the years (1994, 2004, and now 2014) or, necessarily, that the past years’ increases will happen again. But it is certainly possible, meaning feed costs could fall even further.

About the Author(s)

You May Also Like