Corn Crop Jitters Complicate Market Forecasts

July 9, 2012

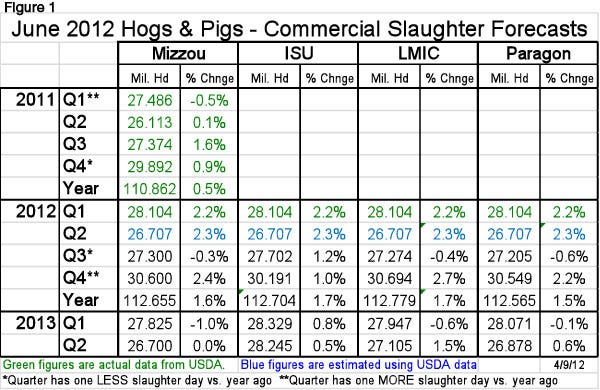

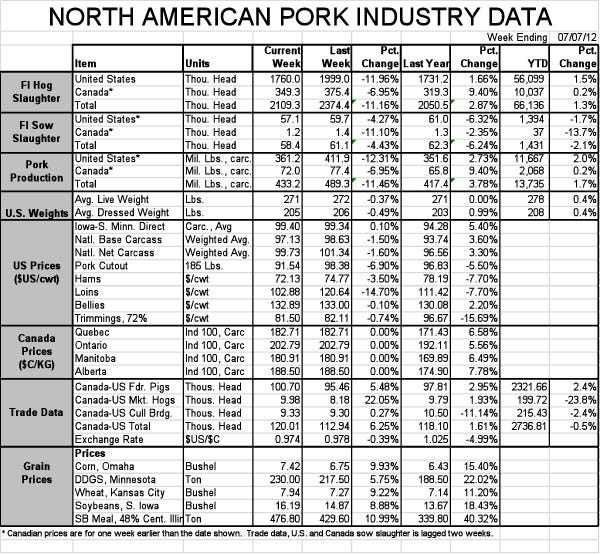

Summaries of analysts’ forecasts for slaughter and price based on the June Hogs and Pigs Report appear in Figures 1 and 2. Take note of the different price series forecast by the various analysts. Look at the line for 2011 to get a sense for the normal difference between the price series and adjust others accordingly to make an apples-to-apples comparison across forecasts. I include forecasts only through the first half of next year, since that is the farthest out that data in the March report will cover.

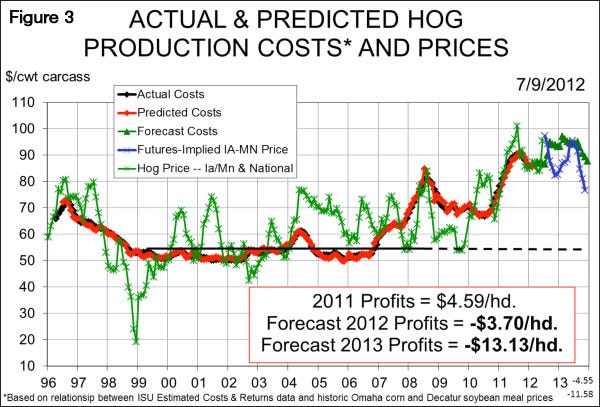

The biggest problem with the forecasts in Figure 2 is that they are low relative to what now appears to be a record year for production. Estimated monthly costs, based on Chicago Mercantile Exchange (CME) corn and soybean meal futures, mid-morning on Monday, are above $90/cwt., carcass, for every month through October 2013 and April and August are currently above $95/cwt. Even near-record hog prices can’t manage to produce black ink for hog sellers in that situation.

It may be worse. Corn futures are up another 32 to 38 cents/bu. and soybean meal is up another $10 to $15/ton this morning (Monday), and there is precious little rain in the forecast for this week. Temperatures have dropped significantly in Iowa and much of the Midwest, but the damage may have already been done. Whether that gets reflected in Wednesday’s Crop Production and World Supply and Demand Estimates (WASDE) reports remains to be seen. Pre-report average estimates are for a corn yield of 154.1 bu./acre and a soybean yield of 42.3 bu./acre. The corn estimate is understandably sharply lower than USDA’s 166 bu./acre June estimate. Soybeans are only 1.6 bu./acre lower than the June estimate, underscoring that all is not lost for many acres – yet.

Everything is relative in economics; $7/bu. corn is high but okay with $105 cwt., carcass, hogs; $65/cwt., carcass, hogs is awful with $7 corn, but it worked fine when corn was $2.00/bu.

Ethanol Economics

The same applies to the ethanol business. The problem is that economic agents are not free to fully react to changing relative prices in the ethanol sector. And we may, unfortunately, see the full and potentially awful impact of such restrictions if dry conditions continue.

I have felt a bit like a voice in the wilderness the past two years, warning that under a specific set of circumstances, the Renewable Fuels Standard (RFS) could still be a nightmare for poultry and livestock producers. The reason I’ve felt alone is that actual conditions have not been very close to those specific circumstances under which the RFS becomes a problem. Such is no longer the case.

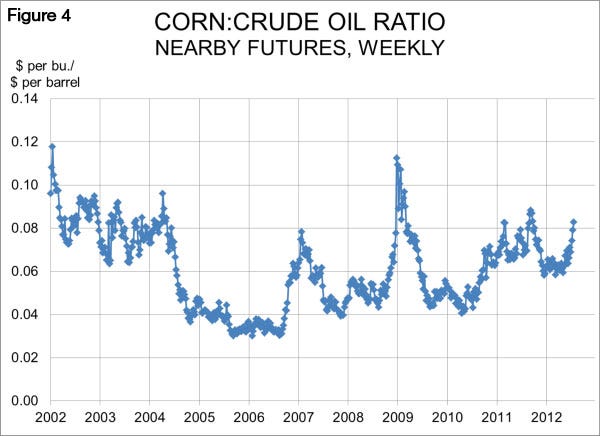

The circumstances of which I have warned are simple – relatively cheap oil and dry conditions that cause corn prices to explode. Dry conditions are here in spades and cheap oil is here relative to the past two years. The result is a corn-to-crude price ratio that is nearly as high as at any time since early 2008 (Figure 4). And the scary part to me is that the corn portion of this computation may not go down while crude oil is threatening some key support in the range of $75/barrel. The ratio could very easily go to 0.9 or above and stay there for a while.

Last year, ethanol distillers did their thing because it paid. In fact, ethanol output has exceeded the RFS mandated levels in each of the past four years and did so by over 10% in both 2010 and 2011. Corn-crude ratios generally below 0.7 (except for last August’s run to 0.85 when corn prices started to rise), low natural gas prices and federal tax credits kept producers in the black through the end of 2011.

But this year sans federal tax credits has been a different story even with corn-crude ratios at 0.6. Things are getting very ouchy for ethanol plants with ratios at 0.8 and will likely get ouchier as corn prices rise and oil prices potentially fall lower due to lagging world economic conditions.

That situation would, under a free market, force more ethanol plants to shut down, thereby putting a cap on corn prices and leaving more corn available to other users. But 2013 usage of corn-based ethanol can, by law, fall to no less than 13.8 billion gallons. That will require 4.93 billion bushels, just 7.0 million less than USDA now projects for the 2012-13 crop year – regardless of the price relationships!

Two factors will help. First, rough years of “excess” ethanol output have generated a large number of credits called renewable identification numbers (RINs). Those will be used to fulfill a portion of this year’s RFS, allowing some blenders to use less and, thus, the ethanol production sector to produce less. Second, the potential losses of using high-priced ethanol might drive some ethanol blenders to pay the fines imposed for falling short of the RFS instead of blending the ethanol.

Some relief from the RFS may soon be needed. There is a provision in the energy law that allows the Environmental Protection Agency (EPA) administrator to set it aside, but I don’t hold much hope of that happening. I simply doubt that the EPA administrator cares much about livestock and poultry producers.

The Renewable Fuel Flexibility Act, proposed by Rep. Robert Goodlatte, has yet to see the light of day in Congress. It would set aside a rising portion of the RFS as projected year-end stocks-to-usage ratios decline. Let’s hope someone pays attention soon.

About the Author(s)

You May Also Like