Canadian Sow and Pig Counts Still Hazy

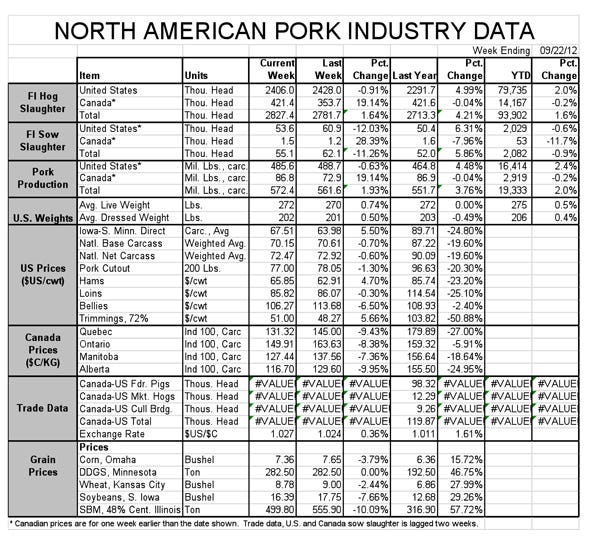

As can be seen from this week’s data table, information regarding imports of hogs and pigs from Canada is still not available from USDA. The Web site for the live animal import report says that the delay is due to technical issues and references for the weeks of Sept. 1 and Sept. 8, adding that the data back to Aug. 18 may be revised.

September 24, 2012

As can be seen from this week’s data table, information regarding imports of hogs and pigs from Canada is still not available from USDA. The Web site for the live animal import report says that the delay is due to technical issues and references for the weeks of Sept. 1 and Sept. 8, adding that the data back to Aug. 18 may be revised.

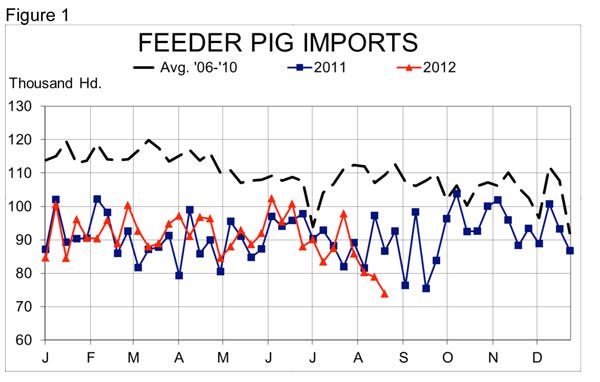

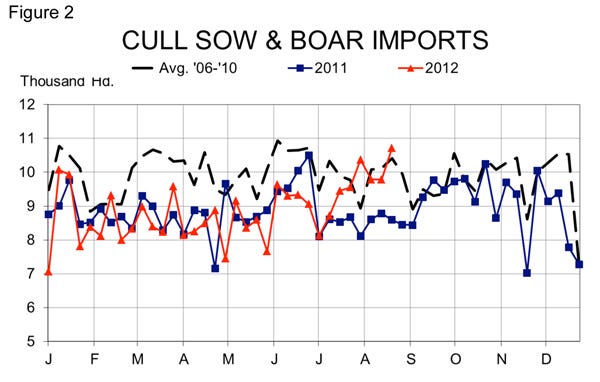

Let’s hope it comes soon. It’s difficult to know what is happening in Canada without these data. The financial news regarding Big Sky and Puratone suggests that things are indeed bad. Figure 1 and 2 shows the last data that are available for imports of feeder/weaned pigs and cull breeding stock from Canada. Readers should note that the last week of data on these charts is for the week of Aug. 24, a week that USDA may believe is in error.

What I fear is that the data look wrong but may, in fact, be pretty close to the truth. The Big Sky and Puratone filings fit with what we have been hearing about Canadian sow herd liquidation. Given Canada’s limited sow slaughter capacity, that should manifest itself in more sows moving south.

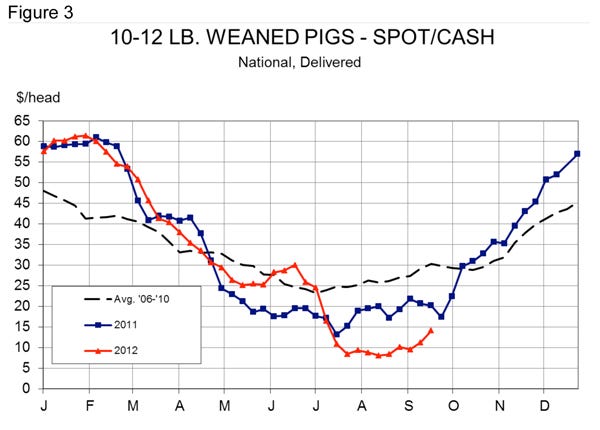

More alarming, the drop in feeder/weaned pig imports fits with reports that weaned pigs are being euthanized as they have so little value that prices will not exceed transport costs. Figure 3 shows the weighted average of the spot market weaned pig prices in the United States. The “low” of the price ranges since mid-July has never been above $8/head and was quoted at $1 the week of July 20.

Serious Sow Culling Yet to Come

The pain is certainly not limited to Canada. As of Monday morning, my hog return model, which is based on the Iowa State University Estimated Costs and Returns parameters, indicates that average Iowa farrow-to-finish operations will lose just over $11.43/head next year. That figure is actually a significant improvement over recent weeks due to last week’s sell-off in corn and soybean meal futures and the rally in Lean Hogs futures. But it still represents a significant drain on producers’ equity, which had not been replenished much since the losses of 2008 and 2009.

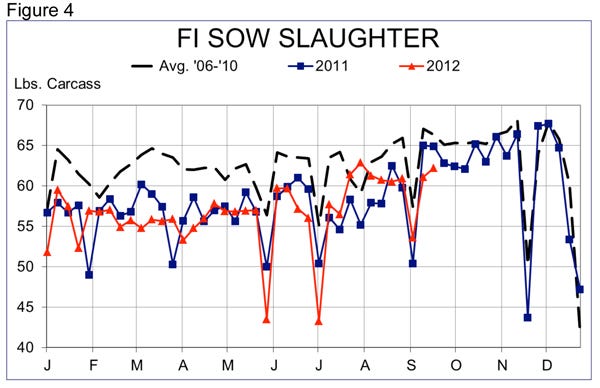

According to USDA data, however, U.S. producers are not yet sending large numbers of sows to slaughter. As Figure 4 shows, slaughter data through Sept. 7 and sow purchase data through Sept. 21 indicate that U.S. sow slaughter is still lower than one year ago. And those figures include any additional sows being exported by Canadian producers.

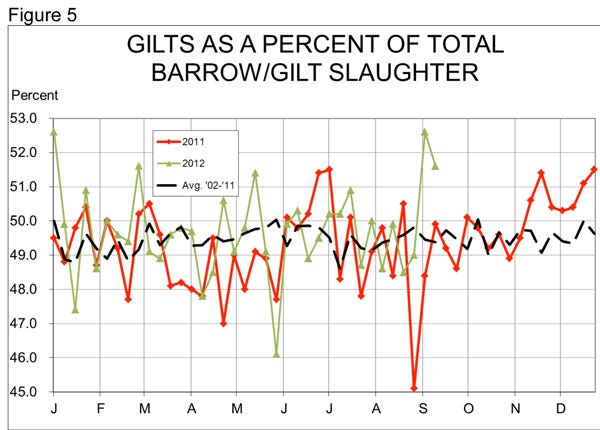

The University of Missouri’s gilt data, however, tell a different story (Figure 5). The percentage of gilts in the slaughter mix jumped sharply the week of Sept. 8; so sharply, in fact, that I was concerned that the observation may be an outlier due to the sampling technique. That is not a criticism of the technique, just a statement of fact about the errors that can occur. Last week’s 51.6% figure, though, seems to validate the prior week’s 52.6% and suggests that producers are not holding as many gilts back -- a very logical reaction to the current outlook.

This still fits with my suspicion that the real sow herd reductions are yet to come. Gilts that would be sold now instead of being retained would not have been bred for another month or two. So extra gilts in today’s slaughter is a reduction in planned matings 1-2 months down the road, a time period that would produce pigs that would be sold after next summer’s expected strong hog prices.

This Friday’s USDA Hogs & Pigs report will shed a bit of light on the breeding herd situation, but I still expect the Sept. 1 number to be at or above one year ago. The real cuts are still to come and it will take some miraculous happenings to prevent them at this point.

About the Author(s)

You May Also Like