Ag barometer unchanged from August; well below January

Surveyed producers show waning optimism about the future ag economy, though their assessment of current conditions improved from last month.

October 3, 2017

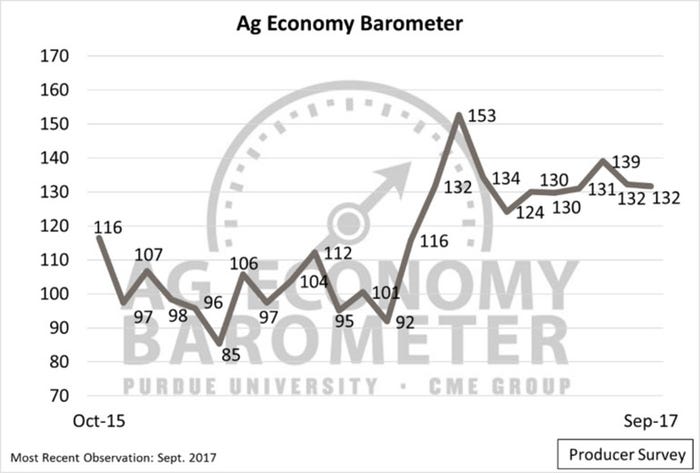

Producers are feeling stable about the ag economy, according to the Purdue University-CME Group monthly Ag Economy Barometer, with September’s reading coming in at 132, the same as it was for August. The reading has lingered between 130 and 139 over the last six months, but is well below the peak of 153 in January.

This monthly measure of agricultural producer sentiment is based on a monthly survey of 400 U.S. producers of corn, soybeans, wheat, cotton, beef cattle, dairy cattle and hogs.

Though the last two months have been stable, the barometer’s two sub-indices, the Index of Current Conditions and Index of Future Expectations, shifted in opposite directions. Surveyed producers’ optimism waned on future expectations, while the index of the current conditions improved from August. Although the decline in the Future Expectations index was modest, it could be an indication that some of the optimism that surfaced among producers in late-2016 and early 2017 is eroding.

The Purdue-CME Group Ag Economy Barometer, October 2015 to September 2017

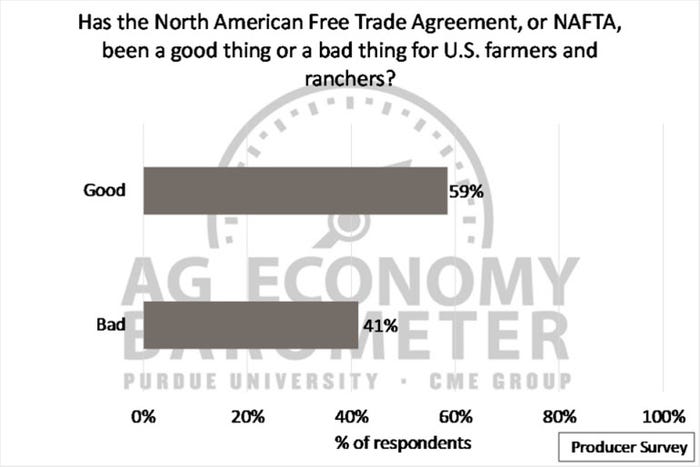

Much has been said and written about the importance of trade to the success of U.S. producers, and surveyed producers were asked if the North American Free Trade Agreement, in particular, was good or bad for the U.S. economy as a whole, and separately if it is good or bad for U.S. farmers and ranchers. Authors of the report say, “In both cases, a larger share reported the agreement was ‘good’ than ‘bad.’ For the U.S. economy, 52% reported ‘good,’ while 48% reported ‘bad.’ With respect to agriculture, 59% of respondents reported the agreement was good for U.S. farmers and ranchers, with 41% reporting it was bad. However, it should be noted that an unusually large percentage of survey participants, 24% in the case of the U.S. economy and 20% in the case of the impact on farmers and ranchers, opted not to answer these two questions. Although it is not possible to ascertain exactly why producers opted not to respond to these two questions, it could reflect a relatively high degree of uncertainty among respondents regarding NAFTA’s impact.”

“Has NAFTA been good or bad for U.S. farmers and ranchers?” September 2017.

In conclusion, report authors say “producers showed signs of being less optimistic about the future than a month earlier whereas their assessment of current conditions improved. One of the sources of optimism among U.S. producers following the fall 2016 elections was an expectation that the U.S. economy would strengthen in the year ahead. However, recent surveys suggest that confidence among agricultural producers that the U.S. economy will continue to expand in the year ahead appears to be waning, which might be contributing to weakness in the Index of Future Expectations.

Click here for the full report.

You May Also Like