USDA’s Believe It or Not: Do you believe the reports?

Do you believe the USDA or not? If you do, there is no need to worry about inputs getting away from you in a pronounced manner; we have plenty of corn and beans across the nation and across the globe.

August 14, 2017

Those of you old enough to remember the series from the early �’80s (or have been to the upside-down house at Wisconsin Dells or other themed locations) know that the premise of the Ripley’s Believe It or Not attraction was to present material so wild that you had to question whether or not it was authentic. Proof that the dinosaurs went extinct because they smoked too many Pall Malls? True. Proof that Elvis is still alive? Also true. Proof that zombies really exist? Of course. I happen to know that the bearded lady was real, she was my Great Aunt Alice and you did not want to get close to her when you were a timid 5-year-old kid.

My point with this introduction is that the USDA gave us some reports last week that the reader must discern whether you Believe It or Not. Caution: for this piece to resonate you must choose one side of the ledger or the other. You are either a believer or a skeptic. All in or nothing. Deal?

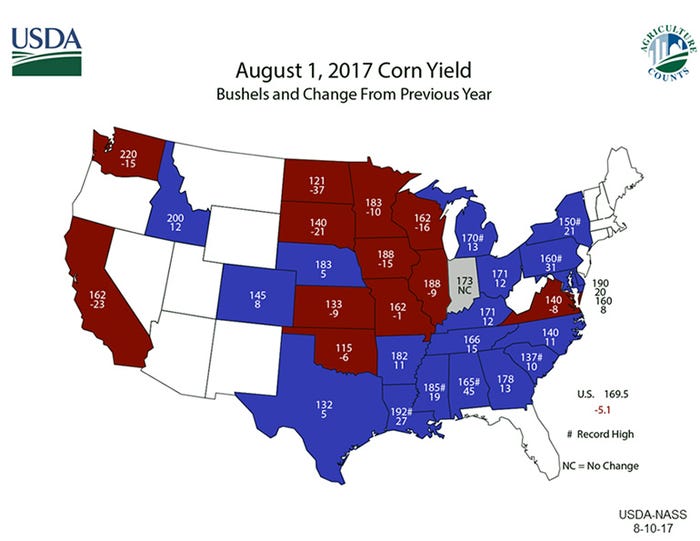

Let’s start with the grain report. Both corn and soybean yields were higher than the top side of the analysts’ guesses coming into the report. To say the collective was fooled is an understatement. Corn at 169.5 bushels per acre, down less than 1 bushel per acre from the July numbers? After we just went through the second driest June on record and the ninth driest July? That just does not make sense … or does it? The drought monitor is showing deepening regions of dryness across the heart of the Midwest. Did the USDA miss the boat?

Take a look at the math and the map. Iowa down 15 bushels per acre from last year feels about right. Illinois down 9, Minnesota down 10, South Dakota down a whopping 21. All of those seem sane. How can you possibly have anything approaching a trend-line yield when you put up a clinker in the heart of corn country? Well, take a peek at the blue areas of the map. Arkansas up 11, Louisiana up 27, Alabama up a whopping 45 bushels to the acre.

These are regions we normally associate with college football scandals, not record corn yields. But the math works. The regions peripheral to the Corn Belt have performed so well that it impacts the national yield. Maybe those of us in the Great State of Iowa are not so special after all? Cyclone fans are painfully aware of our insignificance on the football field; do we have to bow to the SEC in the farm field, too? That hurts.

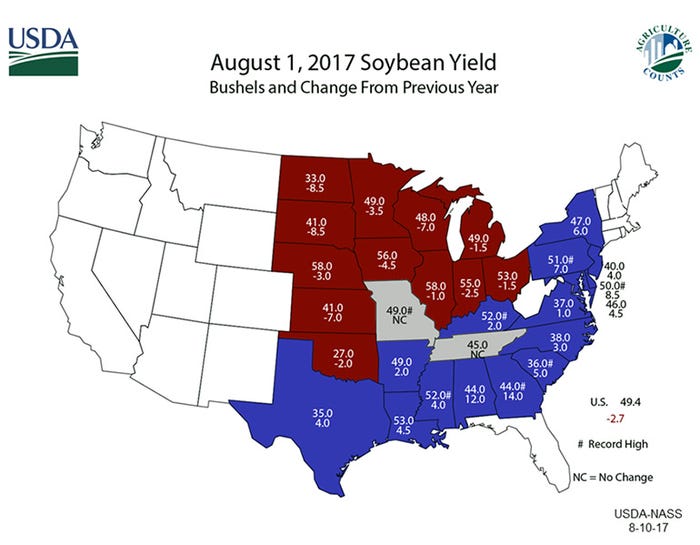

Beans tell a similar story. The compromise in the Midwest was compensated for by the same regions on the map that are carrying corn. Midwestern farmers have already made room in the soy production arena for Brazil and Argentina to muscle their way into the supply picture; do we have to accommodate the Crimson Tide as well? Yes, this year we do.

Before I move off of my grain thoughts, there was something else I found interesting in the soy balance tables — demand. The USDA says we have more exports on the horizon which will soak up a large portion of the production increase (relative to our expectations) and keep things from getting too sloppy. Wide soybean meal basis at the processor combined with a lower board price makes for an attractive flat price, in my opinion.

On the livestock front there were not too many notable changes. Pork production us up a whopping 7% over the last two years and the export market has, thankfully, obliged in taking the product. Even with exports dialed up to projected record levels in 2018, the USDA is showing an average price of the year at $64 carcass. A quick peek at the 2018 futures string averages right at $70 — this represents somewhere in the $12-15 per pig range in discrepancy for the year. The USDA is telling you one thing, the CME is telling you another.

It is at this juncture where I ask you to commit. Do you believe the USDA or not? If you do, there is no need to worry about inputs getting away from you in a pronounced manner; we have plenty of corn and beans across the nation and across the globe. You do have to pay attention to the revenue side of your business as the same Washington, D.C., folk who blessed you with favorable grain values are telling you your hogs are going to be worth less than current board values in the coming year. You better do something about the hogs if you are in this camp.

If you do not believe the USDA, you are forced to consider the recent drop in grain values a gift from the heavens and you should buy with both hands. Conversely, you must assume they are equally inaccurate about the clearing price of meat and the CME will prove them wrong, we will eventually see revisions from the USDA that push projected prices higher.

Here is the bottom line: no matter which camp you choose — the believers or the non-believers — you have to initiate action. Believers on the revenue side, non-believers on the input side. Make sense?

Next topic.

As all of us attempt to handicap the impact of the two new plants (and the Prestage facility) to the market, we must realize that none of us have all the answers but here are my best-guesses to what lies ahead.

• The spread between the cutout and the cash hogs narrows. This is a good thing in the big picture for the hog producer and is an important consideration when discussing the timeframe of any new agreements.

• The new plants can run first shifts without the acute fear of lack of labor. The best pipeline for the new facilities: the second shift workers at current plants. We are just back from the Coldwater open house. The place is clean, bright and roomy. Working in a plant is not a job I would like, the guy working second shift on the ham line in an older facility would think the new plant is the greatest thing ever.

• Both new plants will be slower than we think in getting operational. This will not be a surprise to them; it will be to anyone anticipating a much quicker ramp up. Both plants are slated to increase capacity slowly with full operations in February. This will lead to some gyrations in the market. I anticipate the October contract will be volatile as we weigh and measure the hog supply relative to shackle space.

• The 602 will not collapse once August is off the board. We have good demand. Our “fears” are overblown. Bacon will carry the cutout and I anticipate a gentle slope into the fall.

• No plants will close to accommodate the new facilities. Large or small.

• The Prestage plant changes everything. The introduction of this player into the hog market will make a bigger splash in the pond than Conventional Wisdom currently anticipates. I see nothing but good as a result of this new plant slated for operation in early 2019. You may have read the recent blurb from Ron Prestage as he was voicing his concern regarding the North American Free Trade Agreement and indicating “they may not be at the point of no return.” I respect Ron’s opinion, but firmly believe the family is committed to the project. Here is a picture of the facility taken from 4,500 feet on Saturday morning. Looks like things are rolling along to me. What do you think?

Conclusions

No falling asleep at the wheel, the bus is rolling. Lots of change on the horizon with the new plants starting in a couple of weeks. Crop tours will slog through the fields and — if history is any lesson — will claim the USDA is way off base … which will eventually transcend into yield values that come eerily close to government projections. Our run of profitability that was kick-started with the porcine epidemic diarrhea year of 2014 looks to continue with favorable margins availed through 2018.

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals

About the Author(s)

You May Also Like