Here's how fast USDA sees pork industry growing

USDA is predicting increasing U.S. pork production over the next decade while pork prices decline over the next two years.

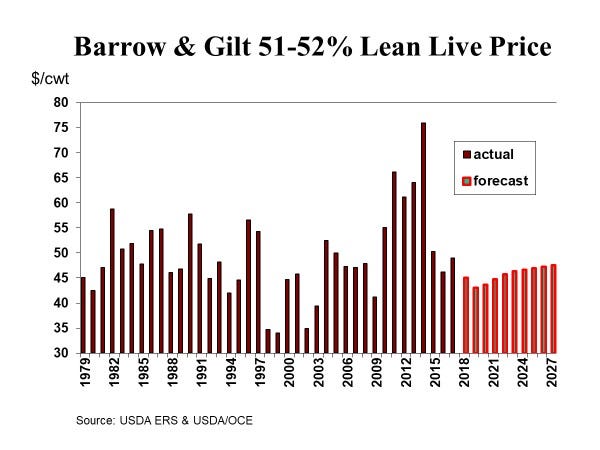

Last week’s retail meat price report said grocery store prices for pork averaged $3.75/lb. in January, up 1 cent from December and up 18 cents from January 2017. The farm-retail pork price spread narrowed by 9.7 cents in January with both a tighter wholesale-retail spread and a tighter packer spread than the month before. Tighter marketing margins helped hog prices. The 51-52% lean hog price average was $50.40/cwt in January which was up $5.93 from December and up $4.80 year-over-year.

Last week’s federally inspected hog slaughter totaled 2.384 million head. That was down 0.2% from the week before, but up 1.2% from the same week last year. Since the first of December, hog slaughter has been 0.7% higher than indicated by the December market hog inventory. Higher-than-expected hog slaughter is not good for hog prices. Last week was a tough one for hog prices. Friday’s prices were nearly $5/cwt lower than seven days earlier.

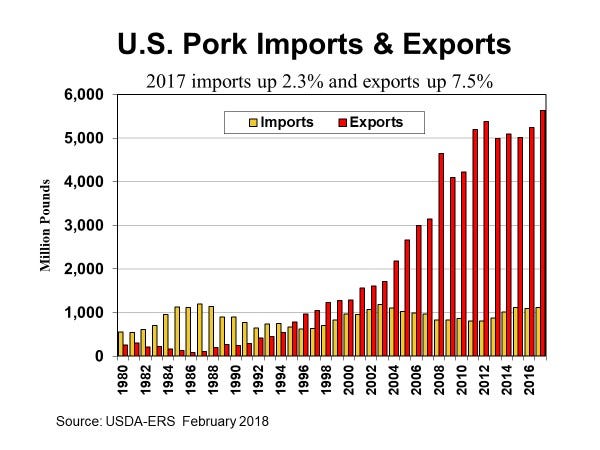

The U.S. exported a record 5.632 billion pounds of pork in 2017, up 7.5% compared to 2016 and 4.6% more than the old record set in 2012. The growth in exports was largely due to increased purchases by Mexico with South Korea and Columbia also registering large increases. Of 2017 U.S. pork exports, 32.1% went to Mexico, 21.8% to Japan, 9.4% to Canada, 9.3% to South Korea and 27.4% someplace else. The only big decline in pork exports was in shipments to mainland China. Pork exports equaled 22% of U.S. production. USDA is predicting a new pork export record in 2018.

U.S. pork imports totaled 1.116 billion pounds in 2017, up 2.3% from 2016 and the most since 2003. Our top two foreign suppliers largely offset each other’s change. Pork imports from Canada in 2017 were down by 63 million pounds, but imports from Poland were up by 65 million pounds. Pork imports equaled 4.4% of last year’s U.S. production. USDA is predicting a modest decline in pork imports during 2018.

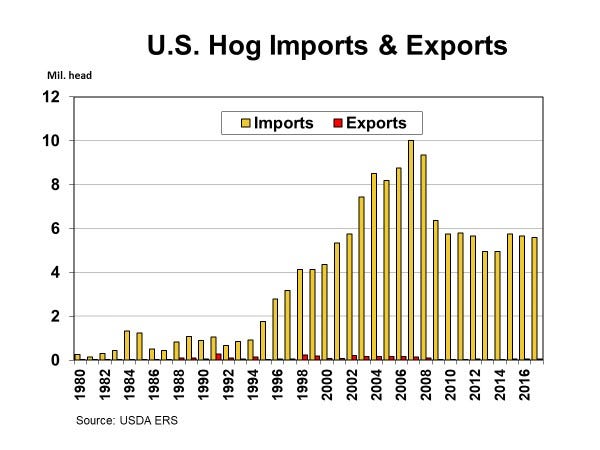

The United States imported 5.6 million live hogs last year. Twenty head came from the United Kingdom and 61 head were imported from France. The rest came from Canada. Roughly 85% of the imports from Canada were weaner/feeder pigs coming south to take advantage of lower feed costs.

The United States exported 59,469 live hogs in 2017 with 47% going to Mexico, 10% to China, 5% to Canada and 38% someplace else.

Hog imports in 2018 are expected to be between 5 million and 6 million head again.

Each February USDA updates their 10-year forecast of agricultural production, prices and trade. Agricultural production is impacted greatly by weather and disease. International relations have a big impact on trade. The timing of these potential market disruptions is impossible to predict. Therefore, USDA’s long-term forecasts show much less variability than will reality. Take corn for example. USDA is forecasting corn prices will slowly increase from $3.20 per bushel for the current marketing year to $3.60 for the 2027-28 marketing year. This is a price forecast that leaves plenty of room for growth in the livestock industry. But, the odds are high that sometime in the coming decade a summer drought will wither corn production and boost prices. Since USDA is unable to predict when the drought will occur, their corn forecast is smoother than actual year-to-year change is likely to be.

USDA is predicting hog prices will decline 8.1% this year and then 5.9% in 2019. After 2019 they are forecasting a slow but steady price increase.

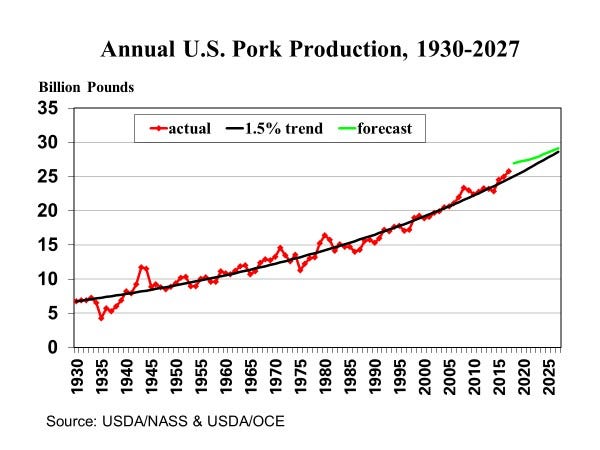

USDA’s long-term forecast has U.S. pork production increasing each year for the next decade, but at a much slower pace than in recent years. As the chart below shows, the long-term trend for U.S. pork growth has been 1.5% per year. Production is currently above that trend but is expected to narrow the gap over the coming decade.

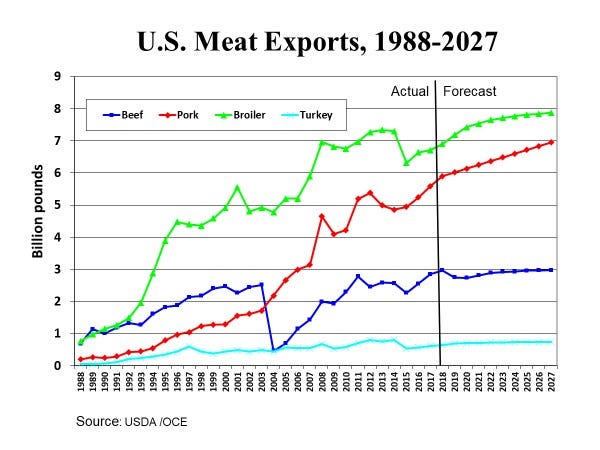

USDA is optimistic that U.S. meat exports will post large increases over the coming decade, especially pork and poultry. Compared to last year, USDA’s meat export forecasts for 2027 show a 24.5% increase for pork, a 17.4% increase in boiler exports, a 19.9% increase for turkey, but only a 4.2% increase for beef exports. USDA expects U.S. pork imports to hold steady.

On Thursday afternoon of this coming week, USDA-NASS will release both the monthly Cold Storage report and the monthly Livestock Slaughter report. The amount of pork in cold storage was up 3.2% at the end of December following 22 consecutive months of being below the year-ago level. I’m guessing the Jan. 31 stocks of frozen pork will also be a little higher than last year.

Preliminary data indicates January hog slaughter was up 5.9%, due largely to one extra slaughter day than in January 2017. Daily hog slaughter in January appears to have been up a fraction over 1% compared to a year ago.

The February Cattle on Feed report will be released on Friday afternoon.

About the Author(s)

You May Also Like